35 Years of S&P 500 Index Options Trading at Cboe

Founded in 1973 as the first US listed options exchange, Cboe Global Markets further revolutionised the financial world 10 years later with the introduction of options on broad-based stock indexes, S&P 500 Index options (SPXSM). Over the next 35 years, Cboe’s SPX options grew from a modest beginning to the most actively traded index option in the US.

Despite less-than-impressive early volumes – a mere 350 contracts traded on the first day, 1 July 1983 – it was clear to industry participants that options on the S&P 500 Index would eventually prove their utility. “Traditionally, the S&P 500 is the index that portfolio managers follow. They are comfortable with it, maybe even more so than the Dow,” then Cboe Chairman and CEO Walter Auch, said at the time. “The S&P 500 will suit the institutions.”

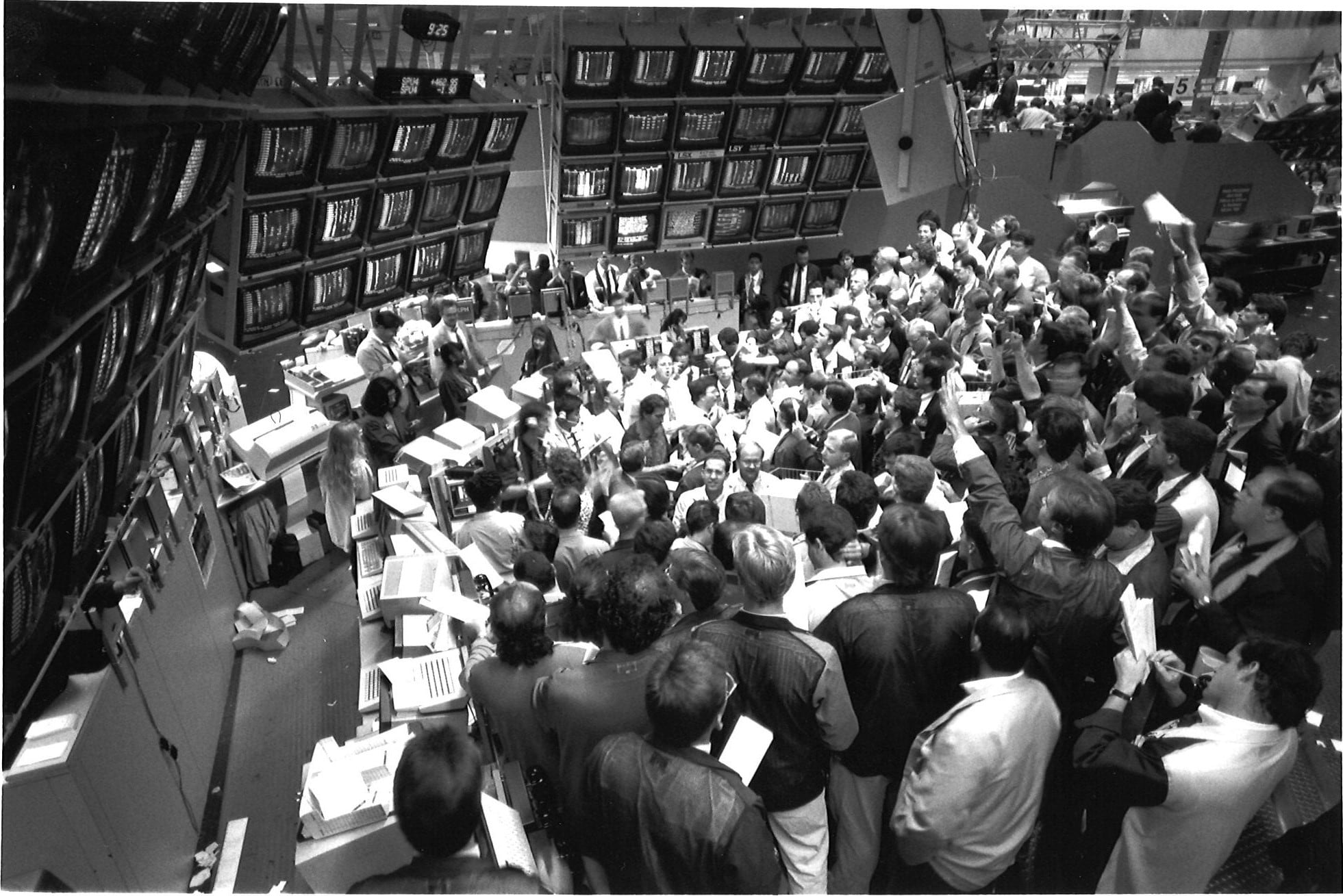

Cboe offered options on both the S&P 100 (OEX®) and 500 (SPX) indexes (and still does), and in the first few years, it was the OEX that was seen as the leading proxy for the US market, receiving the bulk of the options volume. Trading in SPX options built steadily in the ensuing years, but it was the crash of 1987 that caused investors to turn to SPX options.

“The shift in volume into SPX started after 1987 and really gained ground in 1991 to 1992,” said Bill Speth, Cboe Vice President, Research, and a former trader in Cboe’s OEX Index options pit. “European-style exercises in SPX options gained favour by then and it seemed more difficult for institutional firms to get large trades executed in OEX.” Additionally, the S&P 500 became more widely accepted by investors as the leading indicator of the broad US stock market.

By 1994, annual average daily volume for SPX options topped 100,000 contracts for the first time, but the creation of Weeklys in 2005 - another Cboe innovation - propelled SPX options trading even higher. Weeklys, which are short-term options contracts that enable investors to implement targeted buying, selling or spreading strategies around specific news, such as economic data and earnings announcements, would prove popular with retail investors. 2017 was a 10th consecutive year of record volume for SPX Weeklys options.

Some three decades after their launch, SPX options trading hit an all-time high in 2017 with total volume of 292 million contracts. Through the first six months of this year, average daily volume was ahead of last year’s record pace by 15.8 percent. In February 2018, SPX options set new all-time single day and monthly volume records with 3.2 million contracts (on 9 February) and 34.6 million contracts traded, respectively.

“The growth we’ve seen since launch and the recent records in SPX trading underscore investors’ recognition of the incredible utility of S&P 500 Index options,” said Ed Tilly, Cboe Chairman and CEO. “Cboe’s SPX options are a globally important contract, used by investors both domestically and internationally looking to trade, hedge or gain exposure to US equities.”

Through the years, Cboe has expanded its suite of S&P 500 Index products. Innovations such as Weeklys, a mini contract and global trading hours broadened the utility of SPX options and provided investors with different ways to efficiently execute risk management, hedging, asset allocation and income generation strategies.

The year 2018 has been a milestone year for Cboe as it marks its 45th anniversary, the 25th anniversary of Cboe’s creation of the Cboe Volatility Index® (VIX® Index) and the 35th anniversary of options on broad-based indexes, including SPX. There’s been a lot to celebrate this year… and Cboe looks forward to more to come.

Learn more about Cboe’s SPX options at www.cboe.com/SPX.

Cboe®, OEX®, Cboe Volatility Index® and VIX® are registered trademarks and Cboe Global MarketsSM and SPXSM are service marks of Cboe Exchange, Inc. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC. Any products that have the an S&P Index or Indexes as their underlying interest are not sponsored, endorsed, sold or promoted by S&P ("Standard & Poor's") or Cboe and neither Standard & Poor's nor Cboe make any representations or recommendations concerning the advisability of investing in products that have S&P indexes as their underlying interests.