Why Do Most Markets Trade Continuously Rather Than in Auctions?

Nearly all modern securities markets have evolved to trade on a continuous basis, whereby incoming orders are matched to resting orders as soon as they are received by the exchange. Most market observers believe that this type of continuous trading generates deeper liquidity, lower bid-ask spreads and more accurate pricing. However, some have suggested that “frequent batch auctions,” which aggregate all orders for a defined time period before any executions can occur, may be preferable.

While there has been a robust theoretical debate on the topic, there have been limited opportunities to empirically assess the trade-offs between the two market structures because most of the world’s largest exchanges utilise a continuous trading model. When exchanges used batch auctions, it was difficult to compare them to continuous trading markets because they were often in different countries with different market structures.

In March 2020, however, the world’s largest discrete trading venue, the Taiwan Stock Exchange (TWSE), shifted from a frequent batch auction process to continuous trading. This change presented an ideal opportunity to test, in actual market conditions, which market structure generates better outcomes for investors.

Our analysis of the TWSE’s transition clearly demonstrates that continuous trading results in better liquidity provision, lower bid-ask spreads, more stable prices and enhanced price discovery, as well as higher trading volumes.

Volumes on the TWSE were just over $4 billion (USD) per day before the shift to continuous trading. After the move, volumes doubled to roughly $8 billion per day. This increase must be normalised to account for the impact of Covid-19 and other factors on exchange volumes globally. Comparing the TWSE with the Hong Kong Stock Exchange (HKEX), which has similar characteristics to the TWSE, demonstrates that the shift to continuous trading resulted in a volume increase of 15% over and above the pandemic-induced gains in volume seen elsewhere.

The shift to continuous trading also improved liquidity provision and decreased spreads. In a continuously traded market, market makers can better manage risk and provide more efficient arbitrage, enabling them to post narrower quotes and provide more liquidity.

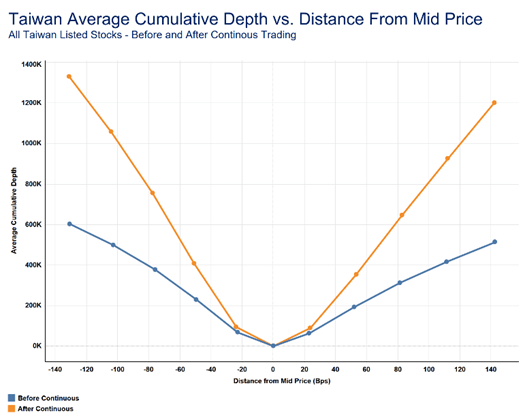

As the chart above shows, at each point beyond the top of book bid and offer, substantially more liquidity is available in continuous trading than in discrete trading. The average number of shares on offer in the top five levels away from the midpoint, for example, is about 600,000 before continuous trading. After the move to continuous trading the depth more than doubles to approximately 1.3 million shares. This effect is even more pronounced in the most liquid names where liquidity levels are 4-5 times greater in continuous trading than in auctions and spreads are about 8% narrower. Extrapolating this increased market liquidity means that investors are saving between $550 million and $1.36 billion TWD each year.

Volatility and price discovery were also part of our analysis. In the year up to March 23, 2020, the TWSE’s two-minute volatility was 0.0147%. In the year after the conversion to continuous trading, volatility decreased by about 5.5% to 0.0139%. Normalising volatility by comparing it to HKEX showed that the impact was actually greater. Volatility for Hong Kong increased (from a lower base). Two-minute volatility in Hong Kong was 0.00281% in the year prior to the TWSE’s transition to continuous trading. That rose to 0.00316% in the following year, an increase of 12.5%. Once normalised, the shift to continuous trading actually resulted in an idiosyncratic decline of about 18%, assuming that the TWSE’s volatility would have mirrored Hong Kong’s without the transition to continuous trading.

The lower volatility points to more stable prices for the TWSE’s investors and improved price discovery. Order imbalances in an auction market can cause prices to fluctuate, increasing volatility as market makers are less able to bridge supply and demand imbalances. In a continuous market, market makers are better able to supply liquidity. As a result, volatility will decline and prices will more accurately reflect the value of the security.

The Taiwan Stock Exchange’s transition from an auction process to continuous trading demonstrates the benefits continuous trading provides to both retail and institutional investors. The shift to continuous trading led to increased liquidity provision, lower bid-ask spreads, more stable prices, enhanced price discovery and more volume. This resulted in a net annual benefit of $550 million to $1.36 billon TWD to investors, which lowered the cost of capital and improved the real economy.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.