Current developments for European asset managers

Alexander Schindler, Member of the Executive Board, Union Asset Management Holding AG outlines the current developments in the European asset management industry, touching on Brexit, MiFID II and PRIIPS.

The financial industry is still facing a tremendous amount of international regulation.

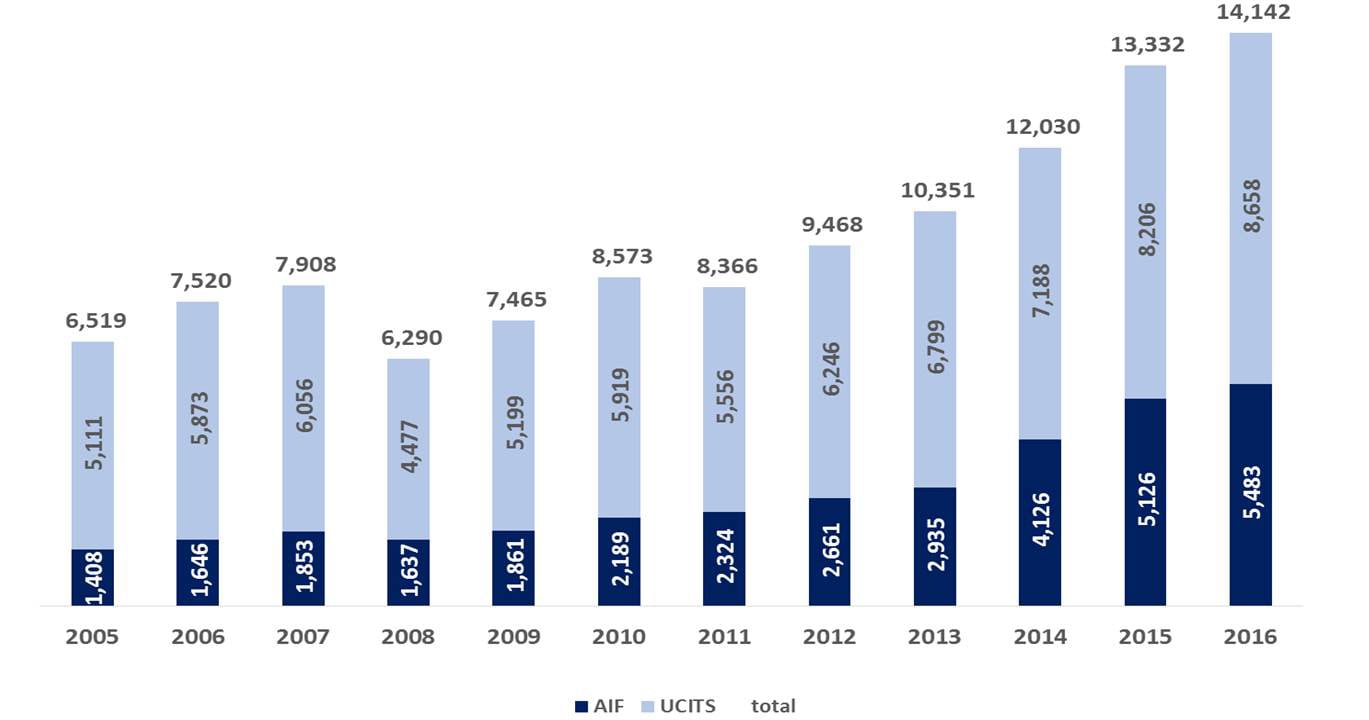

Banks and insurance companies as well as asset managers must cope with the wide landscape of regulatory initiatives. Issues such as Brexit, and initiatives like the Capital Markets Union, MiFID/MiFIR and PRIIPS challenge the industry. Disruptive changes can be predicted for the upcoming years, and costs will increase further along the path. Despite this, the European investment funds have shown robust asset growth over years which is a positive signal for the overall economy.

Regulatory landscape still a dominant topic for the asset management industry

Taking Brexit as the overshadowing example for all regulatory issues, it is going to have a massive impact on the UK’s as well as continental Europe’s economy. The implication of big changes and the long negotiation process will maintain uncertainty within the financial markets and economies. For the European Capital Markets Union (CMU), the Brexit negotiation process may have a positive effect, since the European Commission now faces higher pressure to complete its 33 planned measures in the CMU context.

However, it needs to ensure that no "regulatory dumping" or “regulatory arbitrage” will be the outcome of these negotiations. In order to make the European capital markets more attractive instead, aspects such as facilitating access to finance for small and medium-sized enterprises (SMEs) and the promotion of alternative, non-bank-based sources of financing should be facilitated.

Another topic which has been neglected is the required research unbundling – the separate publication of research costs. This will have a significant effect on researchers, brokers and investment bankers, especially when it comes to the regulation of fixed income. It also means that asset managers need to report their research costs separately to comply with the regulation, which will lead to higher costs and high investments for IT-implementation.

Another example where tremendous change is needed is the PRIIPs regulation (packaged retail and insurance-based investment products) where a standardisation of information needs to be established. Though the ambitions on PRIIPS were excellent, flawed technical implementation measures might put investors into a harmful position. The latter stems from the fact that PRIIPS does not allow for historic performances as a reference, goes for “averaged” cost disclosures which do not allow for product comparison, and includes a misleading methodology on transaction costs.

All these examples illustrate that the true involvement of the buy side is important, and education is essential for all stakeholders along the value chain. There are many challenges ahead, and the integration of European financial markets is crucial to strengthen the competitiveness of Europe.

About Union Investment:

Union Investment, as one of Germany’s leading asset managers for both retail and institutional investors, is in constant exchange with all important market players in order to jointly overcome the challenges for the industry and to contribute to sustainable capital markets.

For over 60 years now, the Union Investment Group has been a reliable partner for its clients. With more than four million investors that have placed their trust in its experience, the company delivers solutions involving equity funds, fixed-income funds, money market funds, mixed funds, funds of funds, guarantee funds and open-ended real estate funds.