ETFs and the making of the modern market

On the second day of the WFE's recent Annual Meeting in Athens, Samara Cohen, Head of iShares Global Markets, BlackRock gave a fascinating presentation on the ETF market, tracing trading and markets back through time to the use of clay tokens in 3500 BC. Samara summarises that presentation in this month's Focus.

Trading and markets have evolved over millennia - from the barter economy to the development of commodity-based currencies to the earliest forms of financial contracts. We have evidence of an ancient forward contract dated around 3500 BC, in the form of a clay globe from Sumer, Mesopotamia, with an inscription on the surface and multiple clay tokens baked inside. Historians have debated the utility of this object, but many believe that each token represented a commodity such as grain, and the inscription described a quantity and delivery date.

“Accountancy Clay Envelope” by Marie-Lan Nguyen, licensed under CC BY 2.5

Important to our story is the inherent dispute resolution mechanism: If two parties disagreed on the value of the globe, they could resolve their differences by cracking open the package and exchanging the individual tokens inside.

This, in essence, describes the arbitrage mechanism used today by exchange traded funds (ETFs) to help closely track the value of their underlying securities. As ETF shares trade throughout the day, a discrepancy between the ETF price and the value of its holdings can be resolved by market makers, who may 'crack open' the wrapper (creating or redeeming shares of the ETF) and buy or sell the individual securities instead.

Creating a framework for seamless market transactions is an ancient idea, but deployed by ETF issuers in a completely modern way.

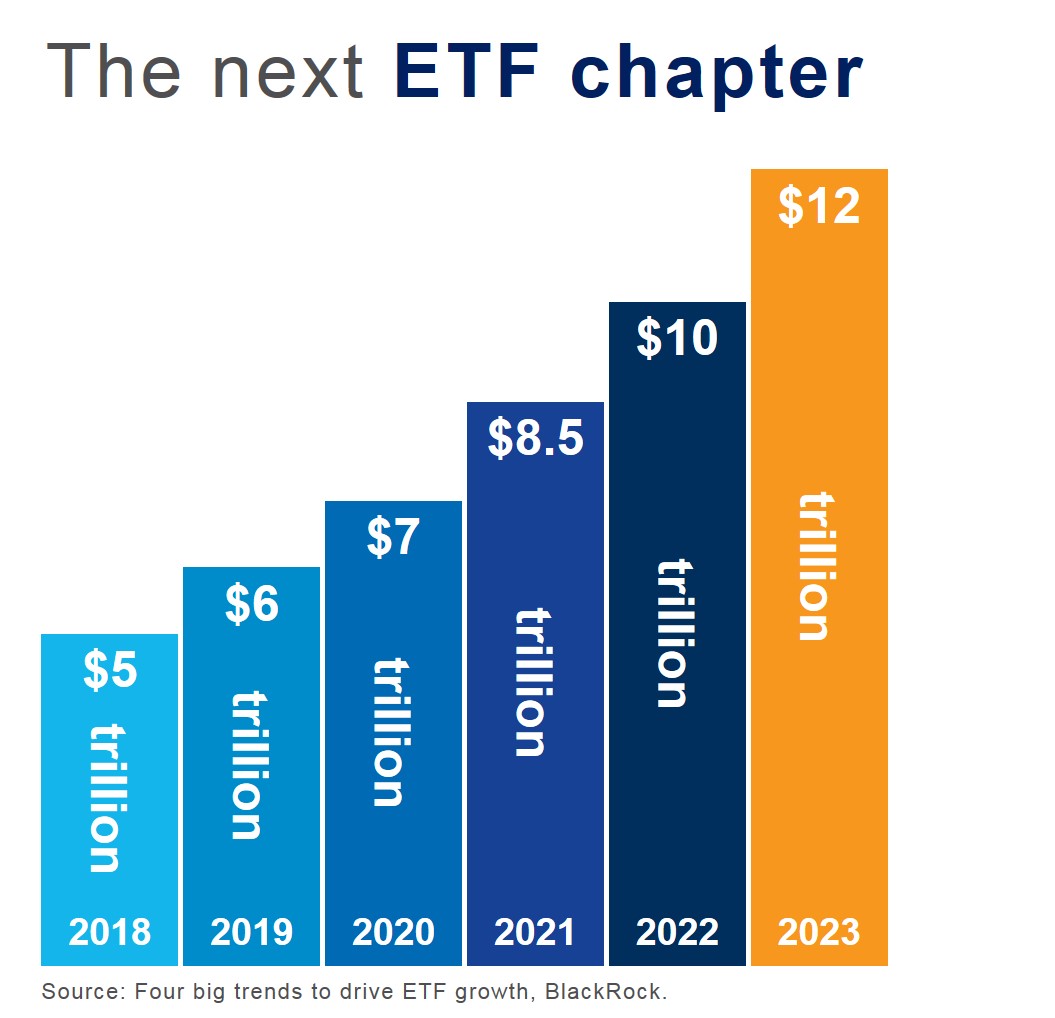

ETFs have experienced rapid growth in recent years, representing more than $5 trillion of assets globally as of September 2018. (Sources: BlackRock, Bloomberg. Industry numbers as of 2/28/2018.)

While still a relatively small portion of the overall equity and fixed income markets, ETFs have become a widely used investment and trading tool, sitting alongside individual securities, futures and swaps.

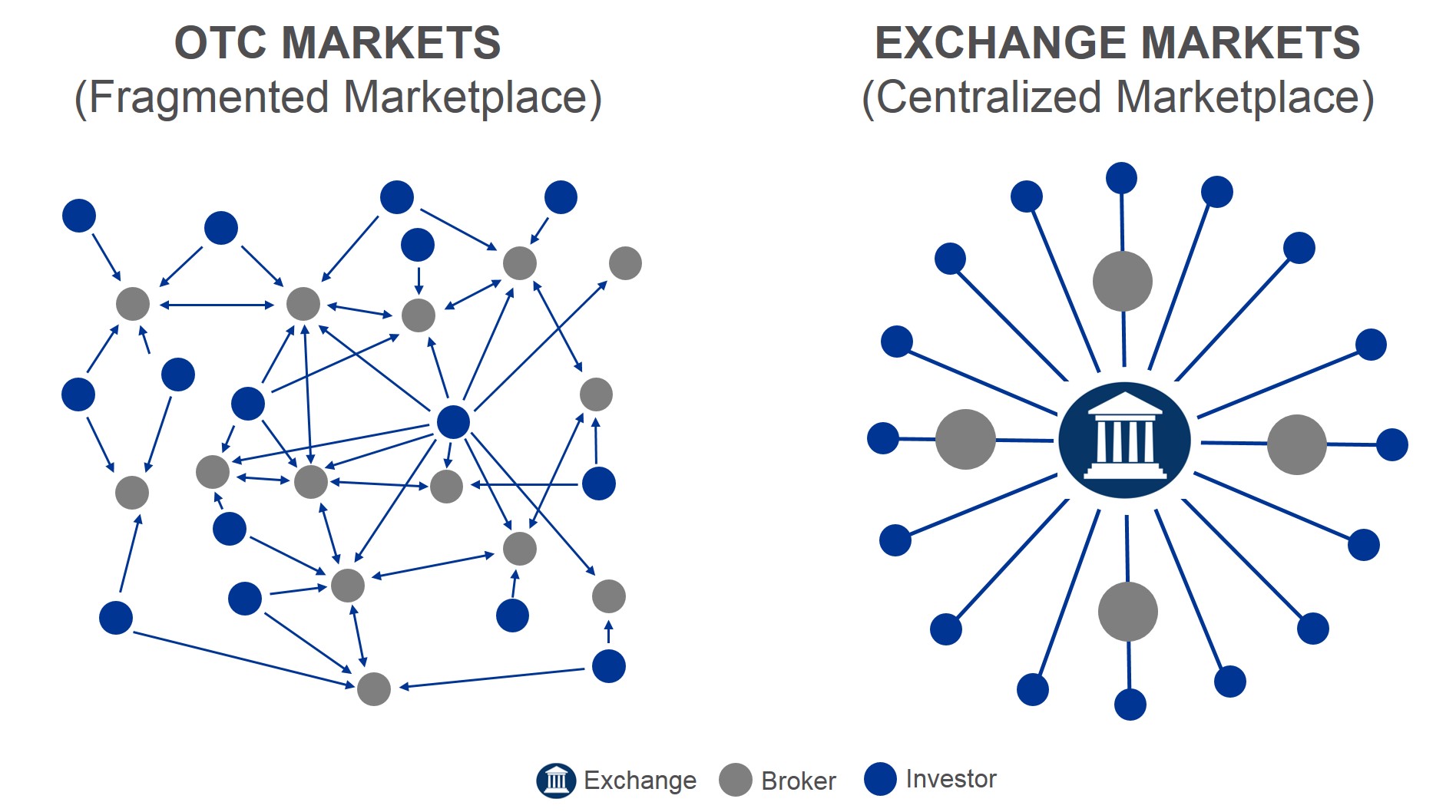

What’s driving the pace of growth? There has been a gravitational pull of financial exposures onto exchanges, as millions of market participants embrace the low cost, ease of use, transparent pricing and liquidity of ETFs. They include traders seeking more efficient execution, asset managers seeking alpha in their portfolios and retail investors building for the future. In other words, these so-called passive vehicles are being actively deployed for a wide range of uses.

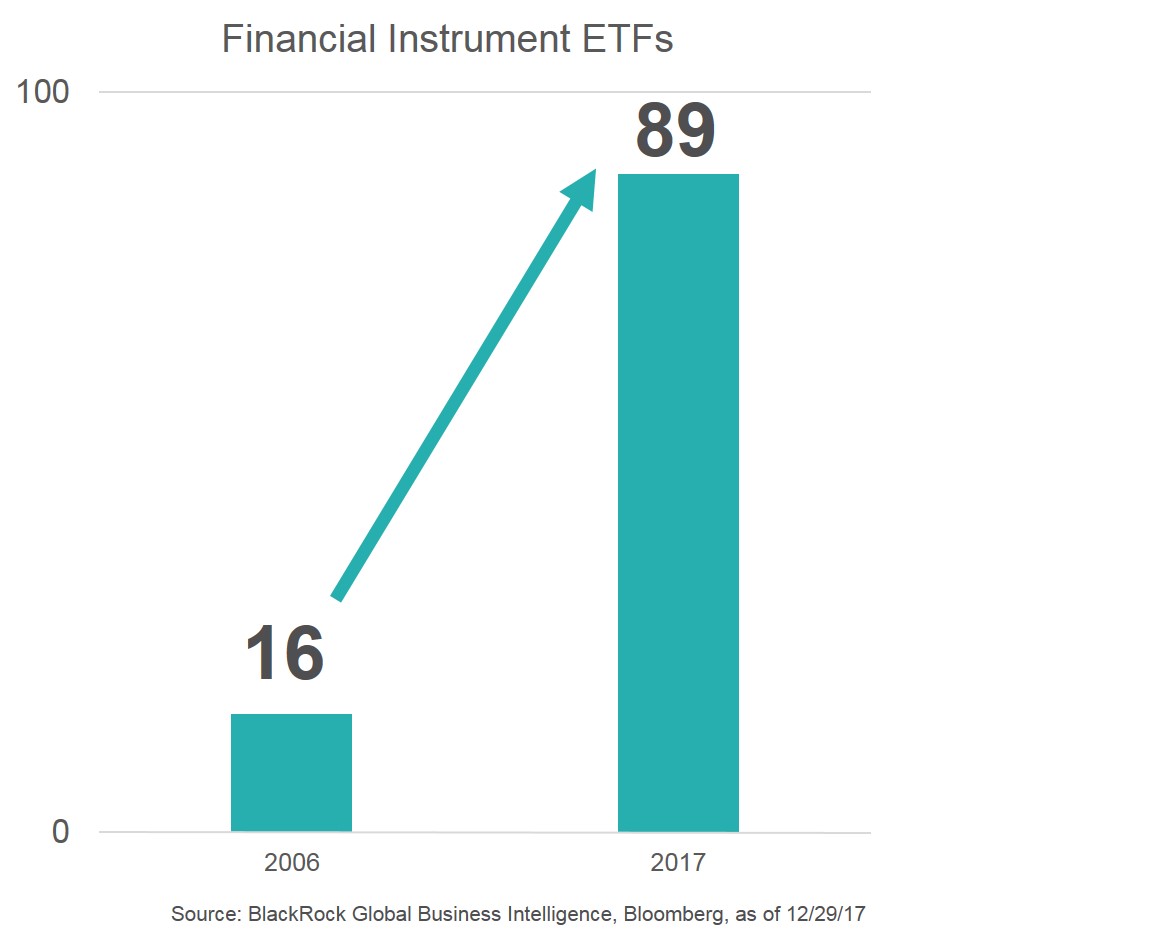

Structural changes are also propelling financial exposures towards exchange trading. Post crisis, derivative and bank reforms are repricing over-the-counter risk transfer, making ETFs a welcome complement to swaps, futures and individual bonds. At BlackRock, we define a 'financial instrument ETF' as a fund with a minimum of $1 billion in assets under management, trading of at least $100 million in notional value per day and a persistent options and lending market. In 2006 there were 16 ETFs that met those qualifications; at the end of 2017 there were 89.

The liquidity boost from ETFs has had a striking impact on the smooth functioning of global markets. This is particularly evident during high-velocity sessions and times of market stress, as investors turn to the most liquid trading vehicle available. We saw this dynamic at work on 5 February 2018, for example, when the Dow Jones Industrial Average logged its largest-ever point fall and then quickly rebounded. That day, ETFs posted $240 billion of trading volume globally - three times their five-year average - helping markets efficiently move capital and investors to implement their different views throughout the day. (Sources: BlackRock, Bloomberg.)

These attributes suggest continued, rapid expansion for the ETF. BlackRock forecasts global ETF AUM reaching $12 trillion by 2023. Much of this growth will likely come from Europe, where we think assets could triple.

Importantly, ETF growth has opened up unique opportunities for partnerships between exchanges and issuers. Modern markets are a prerequisite of meeting the growing demand for ETFs, and there are many cases where working together will achieve better outcomes than competing over the existing exchange-traded pie.

Here are three ideas to start the conversation:

- Prioritise transparency through accessible and consistent market data. Transparency is foundational to investor confidence and will drive more commitment to trading on exchange.

- Leverage the expertise of the global markets community, through organisations such as the WFE, to apply best practices around price formation (auction procedures, volatility protocols) as well as post-trade processes (cross-border settlements).

- Help protect investors by adopting a clearer naming convention for exchange traded products. Not every non-single-stock product that trades on an exchange is an ETF, and products such as levered and inverse instruments, notes and commodity pools have very different risk profiles than traditional funds.

I am often asked what drives BlackRock’s listing decisions, and it is this: The effort and investments by exchanges to improve the trading integrity of our funds and to strengthen the ecosystem around them.

We have come a long way from clay tokens. Let’s lay the groundwork for tomorrow’s market innovations. Together, we can help more and more investors participate in economic growth and improve their financial futures.