Global IPOs: what are the driving trends in today’s market?

Martin Steinbach, Global & EMEIA IPO Leader, EY discusses the driving trends in today’s global IPO market.

Executing a company growth strategy requires access to capital. One of the primary ways to get funding is to go public with an IPO.

Despite turbulent times and unpredictable markets, IPOs are taking place all over the world in primary markets, which have seen fundamental changes over the last decade.

Global IPOs rebound from market uncertainty with highest activity since 2008

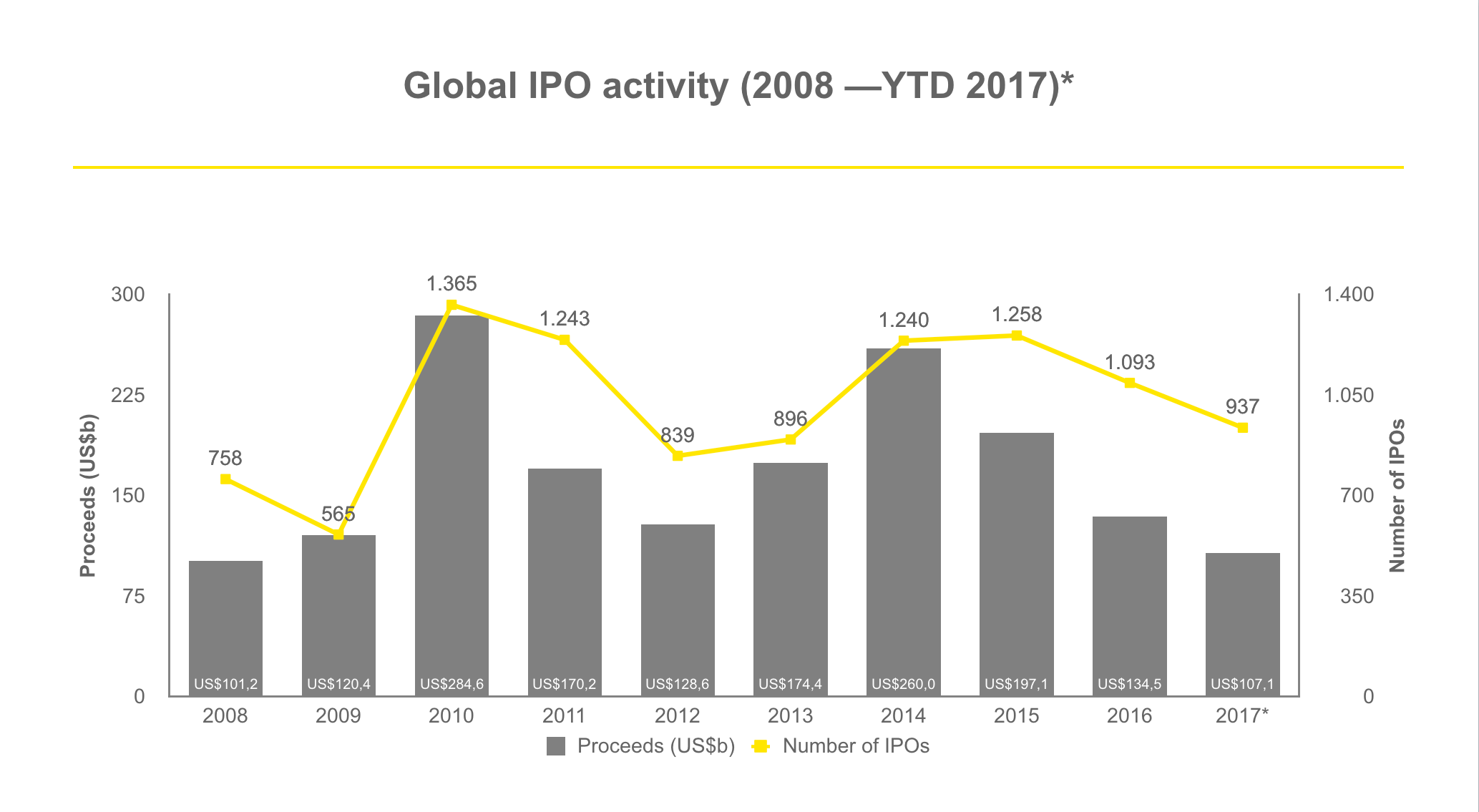

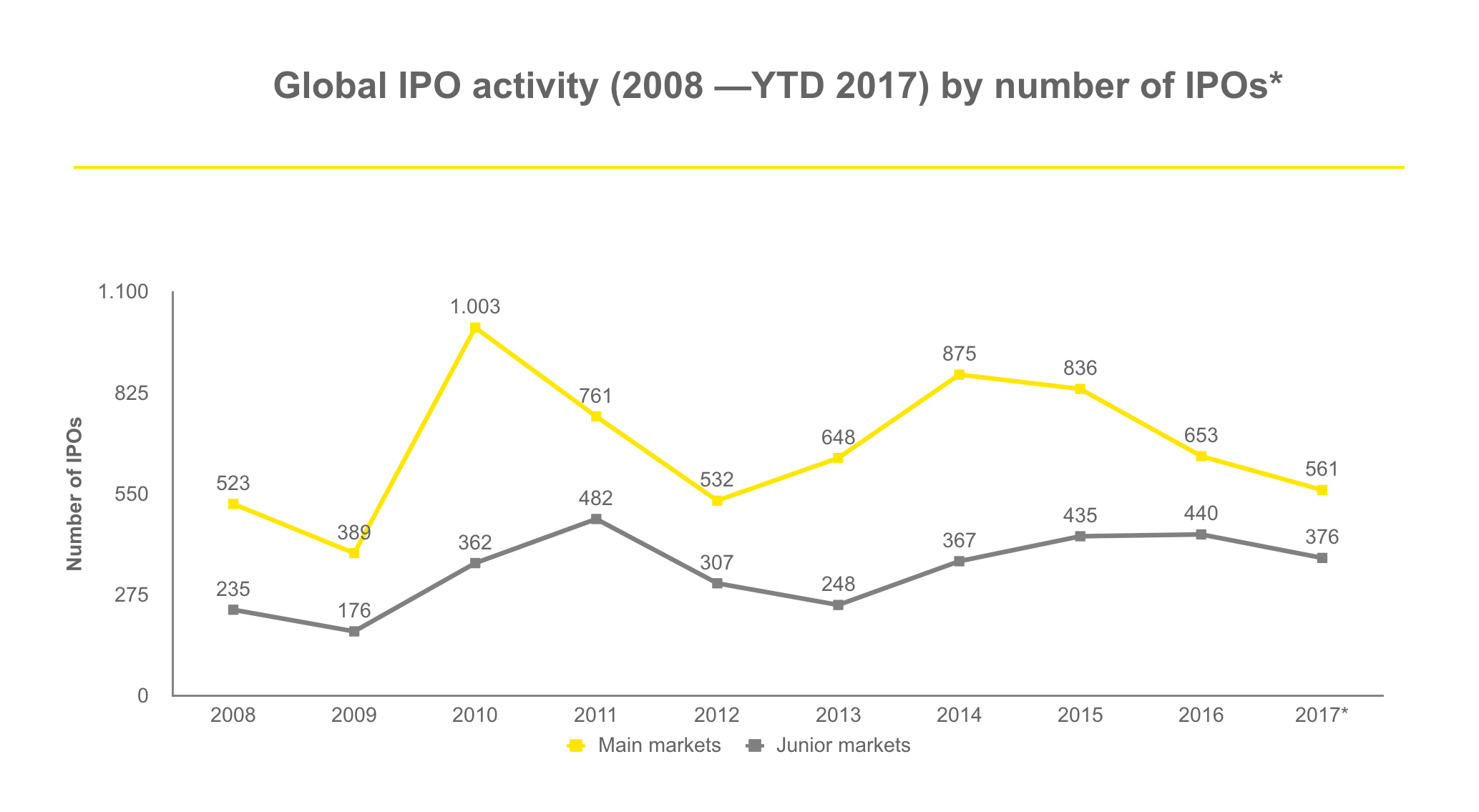

Global IPO markets exhibit a rich diversity of geographies, industries and types of companies. Globalization is taking place in a highly efficient virtual stock exchange and real-time environment, offering access to IPO investors worldwide. In the last decade alone, the size of the global IPO market has seen record highs even with fluctuations from between a low of 565 to a high of 1,365 IPOs, with IPO proceeds of US$101b up to U$285b annually. With broader macroeconomic trends and external shocks mainly impacting regional IPO sentiment, IPO activity in main and junior markets is cyclical and impacted by major external shocks, driving volatility and slowing down IPO activity globally.

*2017 year-to-date (i.e., January to July 2017) is based on priced IPOs as of 31 July 2017. Source: Dealogic, EY

The first half of 2017 has seen a strong start for IPOs globally, with equity indices trending upward and low volatility enabling transaction windows to remain open and active. Liquidity is ample and economic fundamentals are improving in most markets. This was the most active first half of a year by global number of IPOs in nearly a decade.

Asia-Pacific is the engine room: regional highlights and sources of IPO origin

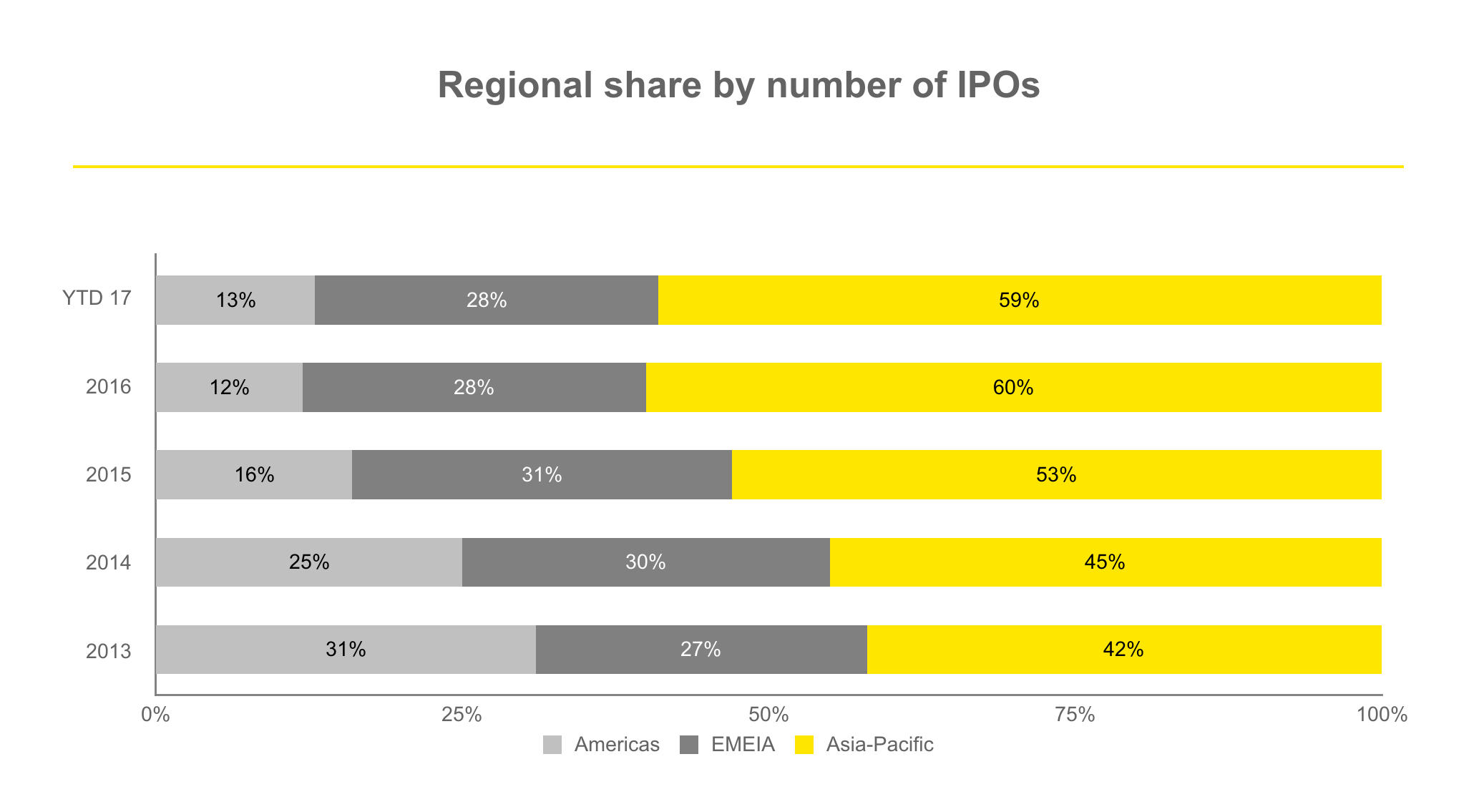

Over the past five years we’ve seen structural changes and a trend toward Asia-Pacific as the global IPO epicenter. The region leads in terms of volume and proceeds, accounting for 59% (553) of IPOs worldwide and 41% (US$43.8b) of all global proceeds, and emerging markets continue to fill the global pipeline.

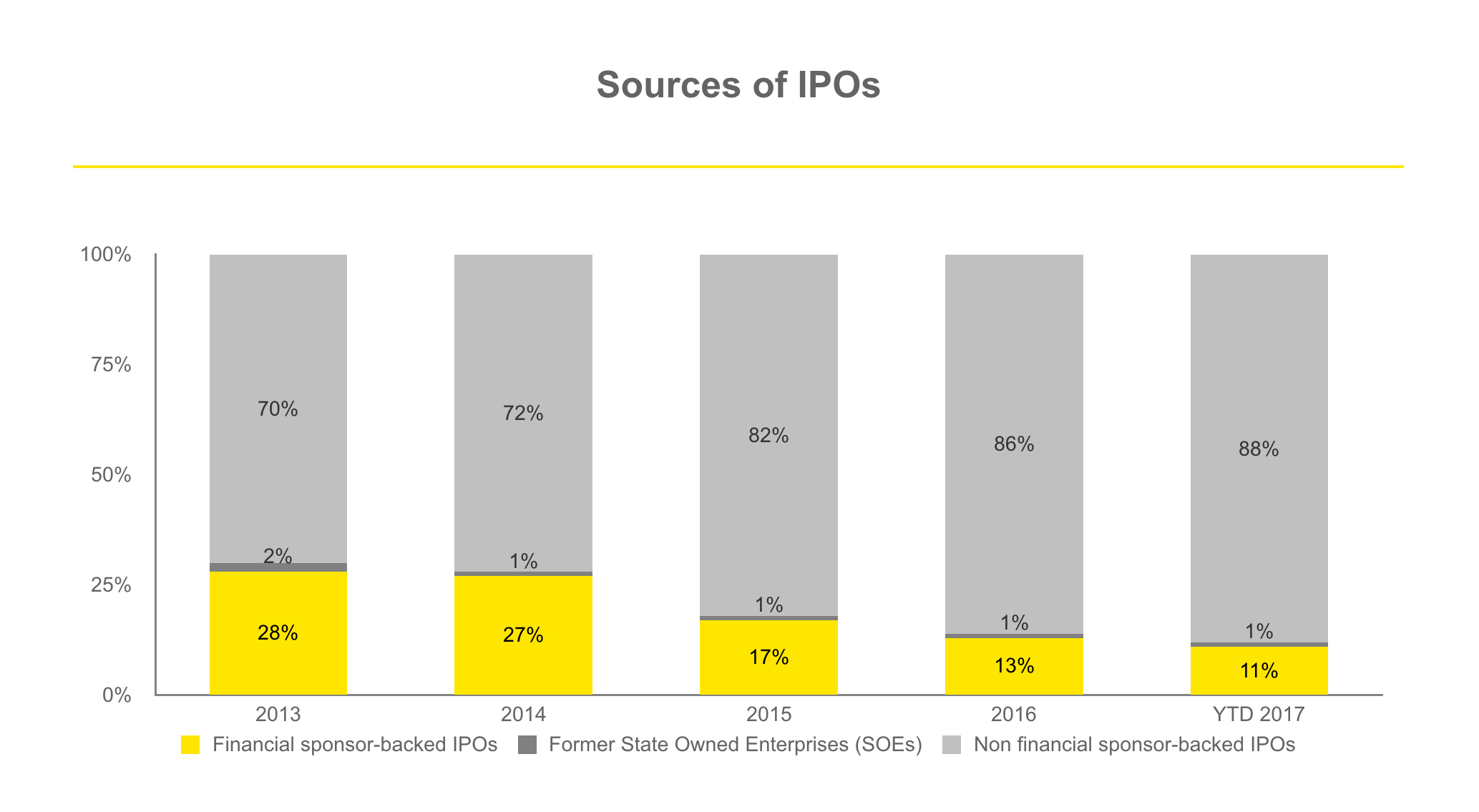

Regions offer various sector profiles and expertise. Their respective IPO markets differ by IPO ecosystems, exchanges listing segment approaches and culture, as IPO advantages and motivations are valued differently. In addition, sources of IPO origin vary between areas and characterize the market. For example, in the field of financial sponsor (PE- or VC-) backed IPOs with a declining trend now make up 11% of all IPOs. Among regions, generally we see a higher share of PE- and VC- backed IPOs in Americas — typically more than a half, whereas EMEIA is around 20% and APAC far less.

Global convergence and best practices meeting investor demands

With highly connected electronic trading platforms and the convergence of investor protection rules, the top three IPO success factors for issuers meeting international investor demands remain: right mangement team, right story and right price. Main IPO process steps are quite similar globally, and markets moving toward accepting and adopting International Financial Reporting Standards (IFRS) as the global accounting standard will improve the ability to compare companies, and will help regulators increase the efficiency of financial marketplaces. Because investors also require high transparency of issuers, the initial and ongoing listing requirements converge and the listing standards in main markets of major stock exchanges no longer differentiate that much. The result: exchange profiles are quite similar, but soft differentiation factors remain in terms of environment, location, sector profile and image.

Gravity of big pools of capital in taking the right spot at home or abroad

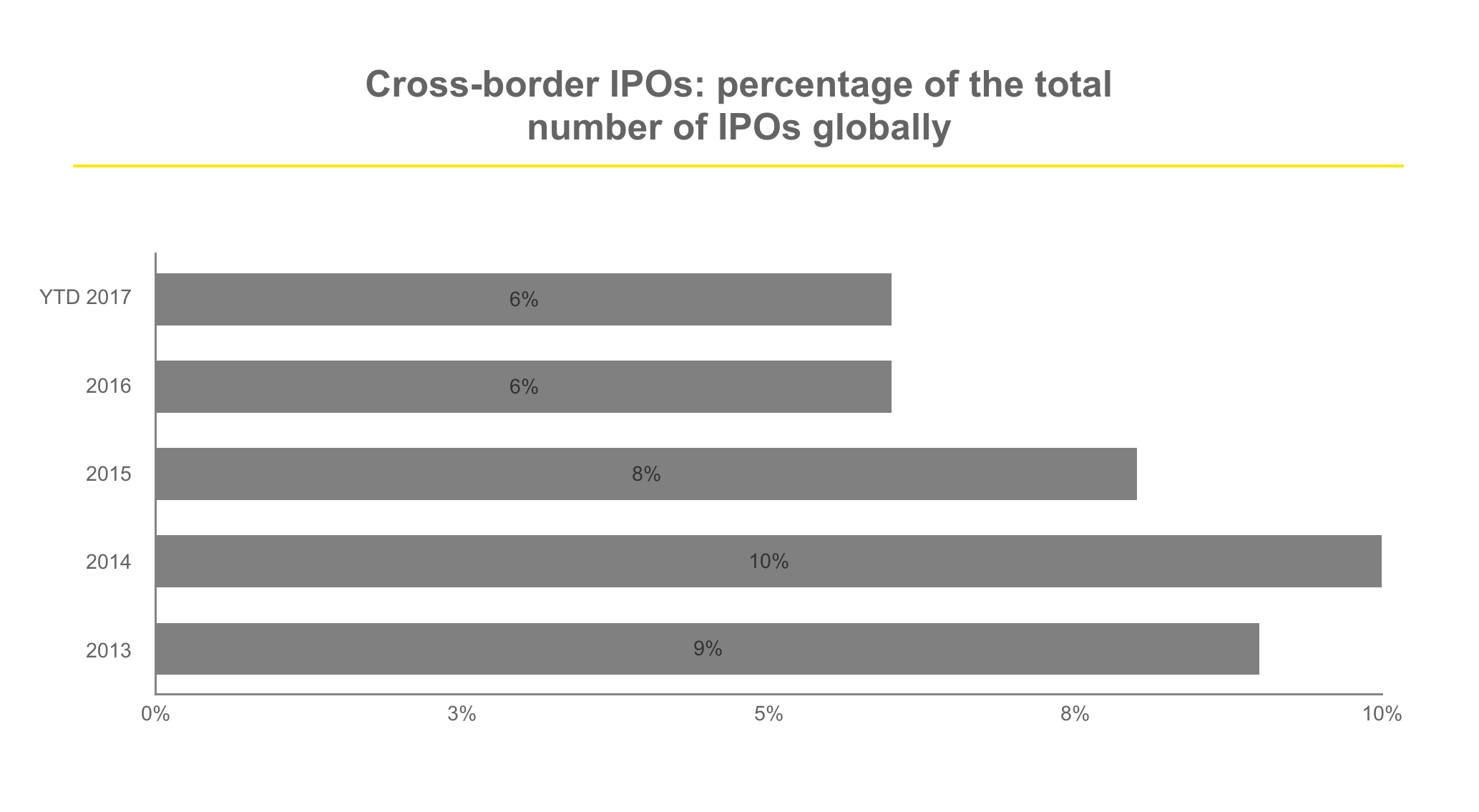

Global capital always follows a good investment story and liquidity is not sticky anymore with the market of the primary listing. In a global environment many issuers now have a choice of where to list, though most companies go public in their home markets (where they are incorporated). A smaller group of companies consider a cross-border listing for many reasons. It often depends on issuers’ growth strategy, sector and availability of the IPO ecosystem in issuers’ domicile market. This is especially true of exchanges in the big pools of capital which developed gravity as the IPO destination of choice. In recent years the trend of cross-border activity has been declining, representing just 6% of all IPOs in 2017.

Keeping options open in M&A and IPO markets to maintain the pace of growth

Companies that have completed a successful IPO know the process involves the complete transformation of the people, processes and culture of the organization from a private enterprise to a public one. Before settling on the IPO journey to growth capital, most IPO candidates and PE firms explore alternative exit and funding strategies. By taking a dual-track approach in parallel, M&A and IPO markets expand a company’s strategic options, improve negotiating leverage and reduce execution risk. Following this strategy, around 12% of all PE- held portfolio companies were exited by an IPO globally.

However, companies around the world continue to ready themselves to go public

When the market timing is right, it’s the companies that are fully prepared that are best able to fully leverage and capture the windows of opportunity. Providing access to the deep pool of global capital is essential to fund growth and innvovation, and it is creating jobs for businesses and economies. Stock exchanges around the world continue to play a pivotal role in this value journey of IPO candidates being an important part of the whole IPO ecosystem.

EY publishes a quarterly review of worldwide IPO activity, a regular snapshot of the changing primary market. To read more from EY’s quarterly Global IPO trends report, and other insights, please visit bit.ly/WFE-IPO or follow Martin on social media (@SteinbachEY or #IPOreport).