Japan Exchange Group and Tokyo Stock Exchange publish ESG disclosure handbook

In recent years, with a fast-growing number of investors both inside and outside Japan including ESG issues in their investment decisions, Japanese listed companies have come under pressure to disclose more information related to environmental, social and governance (ESG) issues and make it more useful for investors. However, although a large proportion of companies are showing interest in ESG disclosure, many have struggled to understand what exactly investors are looking for, and progress has been patchy, especially outside the largest companies.

Although a large number of standards, frameworks and guidance documents for ESG disclosure have been published by governments, stock exchanges, NGOs and others around the world, many Japanese companies have reported difficulty in telling these frameworks apart and confusion over how to use each one.

Japan Exchange Group, Inc. (JPX) considers this gap in understanding between corporates and investors as a barrier to improving the sustainability of Japanese companies, so with the goal of improving transparency and dialogue between the two sides, on March 31, 2020, it published a Practical Handbook for ESG Disclosure in conjunction with Tokyo Stock Exchange.

The Handbook was created in consultation with various institutional investors, and focuses on linking ESG issues to corporate value and disclosing those links. Nothing in the Handbook is prescriptive or absolute; rather, it brings together issues that companies will come across when beginning voluntary ESG disclosure and suggests points to consider and processes that companies may wish to follow to tackle these issues. The issues are split into four main Steps that companies can refer to as they choose.

Importantly, the Steps were chosen in reference to common parts of existing frameworks (The Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB), The International Integrated Reporting Council (IIRC), The Global Reporting Initiative (GRI) and others), and the relevant parts of each framework are specified throughout so that readers can refer back to them.

The Handbook also illustrates the main points with real-life examples of disclosure from companies so that readers can form a realistic image of the processes involved.

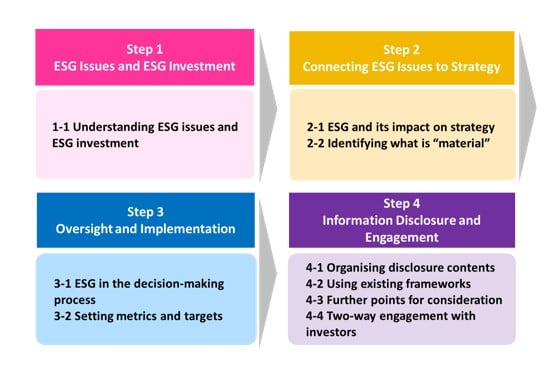

The four Steps of the Handbook are shown below:

Step 1 introduces ESG and ESG investment to help set out why disclosure of ESG information is important. Step 2 aims to help companies consider how ESG issues can impact their business model and strategy as either risks or opportunities, and also to identify which issues are material to their business. Step 3 suggests ways to incorporate material ESG issues into the decision-making process, and how to set metrics and targets to manage progress on activity in response to these issues. Finally, Step 4 brings all of this together to help companies organise the contents of their disclosure and use it to engage with investors.

The Handbook stresses that any amount of disclosure can lead to more purposeful engagement, leading in turn to further improvements in ESG activities and better disclosure.

Our vision is that all listed companies in Japan, no matter what size, will be able to enter this cycle, improving their sustainability and leading to a more sustainable economy in general.

The Practical Handbook for ESG Disclosure can be downloaded from here:

https://www.jpx.co.jp/english/corporate/sustainability/esg-investment/handbook/index.html