Japan's exchanges pushing for a shift from savings to investment

In Japan, households hold financial assets in abundance, totaling more than JPY1.95 quadrillion (approximately US$17 trillion). However, these assets are not being fully utilised.

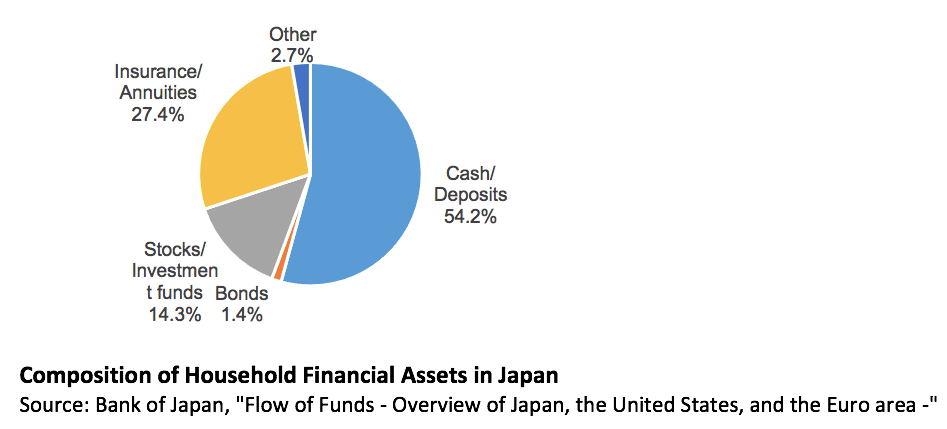

Statistics on the composition of Japanese household assets indicate that cash and deposits account for a high proportion, approximately 54% of the total, while stocks and other investments account for just over 14%. Faced with problems of a shrinking workforce and the limits of its social security system, the major task at hand for Japan is figuring out how to use these assets as efficiently as possible to generate economic growth for the next generation.

JPX believes it can help to address these issues by raising the financial and economic literacy of each and every member of society, and by pushing for a shift from savings to investment. To this end, JPX implements various initiatives.

Fostering financial education in schools

Although our daily lives are closely related to the economy and listed companies, the younger generation have few opportunities to learn about these topics in school. To address this situation, we send staff to schools to give lectures on how public companies work, and mix in some roleplay and skits to help familiarise students with financial and economic concepts.

Also, in collaboration with schools and regional communities, we provide the JPX Entrepreneur Experience Programme, which gives students the experience of setting up and running a pseudo stock company that operates a bazaar stall. This programme enables participants to learn and gain the ability to think independently, thereby contributing to the development of more well-rounded individuals with business-savvy minds.

Besides programmes for students, we also provide seminars for junior high and high school teachers, mainly in the form of summer holiday courses that aim at equipping teachers with economic knowledge and concepts to aid them in their teaching.

Lectures and sponsored courses

For university students, JPX offers lectures nationwide to substantially deepen their understanding of finance, economics, and securities markets, and help them on their way to being deeply involved in the Japanese economy. To foster familiarity with exchanges, we also give university students real-time virtual visits to the exchange alongside online lectures. An total of 8,300 students joined 80 such sessions in fiscal year 2020.

To help nurture the next generation of leaders, JPX holds sponsored courses and joint courses at a number of universities, including Keio University, Sophia University, and Waseda University. The courses cover the latest developments in law, economics, management, and accounting related to the securities market, along with the roles expected of listed companies.

Over the course of the COVID-19 pandemic, some educational institutions have been forced to temporarily suspend classes, but we have continued to carry out our programmes for schools and universities with a mix of in-person and online formats.

Expanding the investor base

With the aim of expanding Japan's investor base, as part of our outreach programme, we leverage our fair and neutral position as Japan's securities market infrastructure to offer various courses for new and novice investors, as well as those not interested in investment.

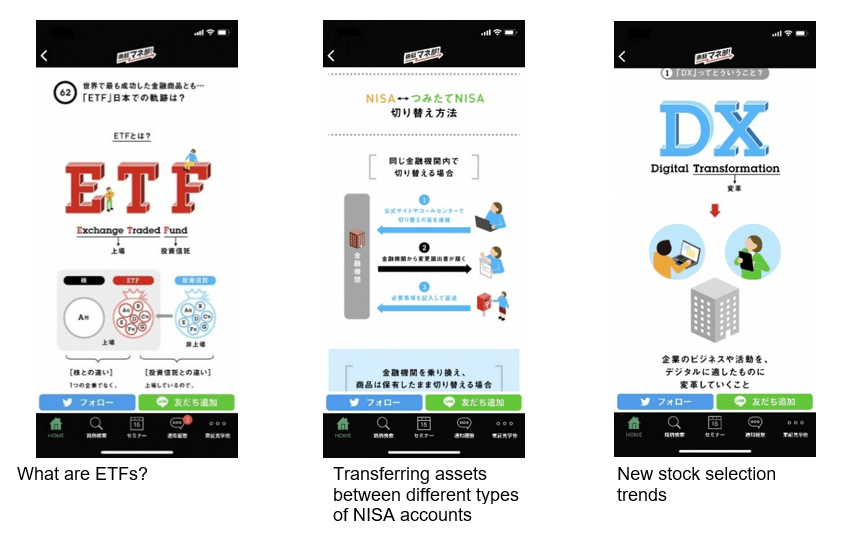

For example, at Tokyo Stock Exchange, there is a dedicated website for retail investors that is focused on asset building – TSE's Money Club – where new articles are posted daily. To draw broad interest, even from those not interested in investment, the articles often touch on the topic of money in everyday situations before moving on to conveying the importance of building up one's own financial assets through long-term and diversified investment.

In order to guide individuals toward securing their financial futures, besides covering defined contribution plans and NISA (Nippon Individual Savings Accounts, Japan's version of the UK's ISA), articles on the website also share information on preparing one's finances for retirement in the era of a 100-year life, while video clips and intuitive infographics are employed to make difficult concepts accessible across the different age groups.

Care is also taken to ensure that content also reaches those not interested in investment, through distribution via social media channels and popular news aggregator applications.

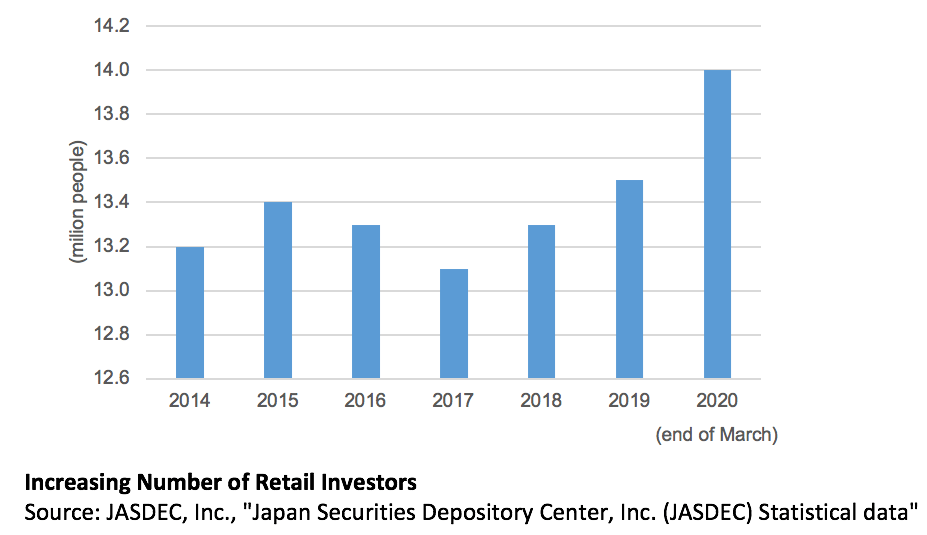

Over the course of the pandemic, Japan has seen an increase in the number of young retail investors creating new online trading accounts, and this had resulted in even greater demand for online content that is more accessible to the younger generation, who often turn to their smartphones for information. The access figures for the TSE's Money Club website clearly demonstrate this trend, with the number of page views climbing steadily since the website's launch in December 2016.

TSE's Money Club articles as viewed on a smartphone

In future, JPX will continue to engage in a variety of educational activities while considering the most effective approach to reach the different age groups, from elementary school students to adults, and also for people with varying levels of investment experience, including new and novice investors as well as those who are just starting to get interested.

JPX hopes our efforts to convey the importance of investment will help people build more secure financial futures and, in turn, contribute to the long-term resilience of the Japanese economy.