JPX Introduces Its J-Quants Project

Retail investors make up a large proportion of the trading volume on Japanese markets. Japan Exchange Group (JPX) considers it an important part of its responsibility as a market operator to help equip these investors with the tools they need, as well as to widen the pool of potential investors, through financial and economic education programmes. As part of this, JPX Market Innovation & Research, Inc. (JPXI), a new subsidiary of JPX established in April this year, is leveraging technology to provide an innovative educational program, the J-Quants project. This program offers retail investors a taste of the power and technology behind data-driven trading and investment analysis, an area that is normally the domain of professional investors in Japan.

Background for Starting J-Quants

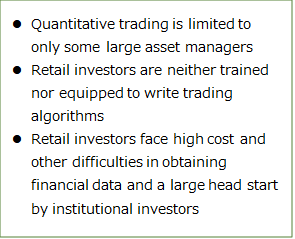

Every year, many new trading firms are born in the securities market in Europe and the US, and lots of these employ quantitative trading methods. In these markets, quantitative trading is increasingly employed not only by hedge funds, but also by retail investors. This increase in quantitative trading among retail investors is backed by a knowledge of the strengths of quantitative data analysis and the provision of financial data services that also offer back testing.

This wave of quantitative trading has not quite reached Japan, where the cost of obtaining raw financial data can be relatively expensive, especially for retail investors. This cost makes it difficult for them to access financial data and causes a large information and technological gap between retail and institutional investors.

The situation in Japan got us thinking about whether retail investors would be interested if there was provision of financial data and an environment where they could try algorithmic trading. When we reached out to some retail investors, we learned that there was strong, latent interest in this area, and that gave us the impetus we needed to launch the J-Quants project.

Bringing Data Analysis to Retail Investors

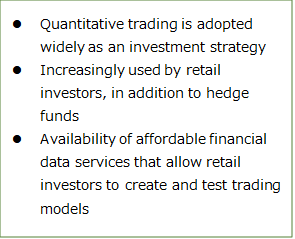

In the J-Quants project, we provided financial data such as stock prices and financial information about listed companies in raw form to retail investors for them to process and analyse. But since having access to data alone does not mean that investors will know how to use it, we also offered tutorials that provided information on how to analyse historical and financial data.

Concept Behind the J-Quants Project

Knowing how something is done, however, does not necessarily mean being able to implement or execute it well. Bearing this in mind, we held a competition for participants to apply their knowledge and showcase their skills. In this competition, participants submitted trading models that were created using the data we provided, and the top-ranking participants gave presentations on how their models functioned. We also created a space for communication among participants by providing threads to ask questions and share experiences.

Our initial competition exceeded all expectations by gathering about 2,400 participants, many of whom were engineers. The younger generation also made up a larger portion of participants than expected. Besides these findings, we also received valuable feedback from participants, asking for such competitions to be held regularly and calling for the launch of a service that provides financial data via API, similar to the way that it was provided for the competition.

Taking in this feedback, we held another competition earlier this year on Kaggle, the world's largest competition platform. The competition drew about 20,000 participants from all over the world to create trading models using data on Japan's securities market. (At the time of writing, submissions were being evaluated, and the winners will be announced later this year).

Data neither restricts by location, nor is subjective. Previous financial and economic education provided by JPX has been largely aimed at domestic retail investors and based around theory rather than linked to actual market data, so through this initiative I think we have crossed many traditional borders and given people around the world the chance to gain a deeper insight into Japan's securities market and its structure through data provision and analysis.

Moving Forward

We are currently providing a free beta version of the J-Quants API for data provision as we work towards shaping an affordable service tailored to retail investors next year.

I believe that there are some retail investors who are more adept at data analysis than many professional investors. With machine learning becoming more mainstream and enrolment numbers in courses on the topic rising, the gap between retail and professional investors looks certain to narrow.

JPX hopes that providing data with the knowledge and the means of how to conduct analysis will increase the number of retail investors adept at handling data, which would lead to a democratisation of data on the capital market. This would in turn lead to increased investor depth. JPX will continue to look at this and other new ways to provide financial and economic education to our retail investors, thereby further enhancing the attractiveness of our markets.