JPX Survey Shows Companies' Response to Climate Disclosures

JPX Publishes Survey of TCFD Disclosure in Japan

In November 2021, Japan Exchange Group, Inc. (JPX) published a Survey of TCFD Disclosure in Japan. This looked at the status of disclosure based on the Task Force on Climate-Related Financial Disclosures (TCFD) among Japanese-listed companies which have declared support for TCFD. JPX hopes that this survey can help Japanese companies working on their own climate-related disclosure, as well as support efforts to enhance disclosure in general.

JPX has been working with the Japanese Financial Services Agency and the Japanese government to encourage the spread and traction of TCFD in Japan since the launch of its recommendations, through the provision of seminars, guidance, and discussion platforms for listed companies and institutional investors. In fact, Japan has the highest number of organizations who have expressed support for TCFD of any single country, and many listed companies have begun disclosing on climate-related information using TCFD.

In June 2021, Tokyo Stock Exchange added a new climate-related disclosure principle to Japan's Corporate Governance Code. Companies listed on the new Prime Market (expected to launch in April 2022) are asked on a comply-or-explain basis to enhance the quality and quantity of disclosure on climate-related issues using the TCFD recommendations or an equivalent framework. This has spurred a further surge in the level of interest in TCFD among Japanese companies and investors.

However, until now, there has not been a clear picture of exactly how many companies are disclosing using TCFD or what kind of information is being disclosed. This means that companies have little guidance on where to start and makes it difficult to know what areas to focus on to enhance disclosure in general. To tackle this knowledge gap, JPX carried out a survey of the disclosures of all Japanese-listed companies that declared support for TCFD (and were listed as a TCFD Supporter on TCFD’s official website) as of the end of March 2021 – 259 companies in all.

The survey focused on the 11 "Recommended Disclosures" set out in the 2017 TCFD Recommendations. It confirmed whether there was published information corresponding to each of these 11 categories in each company’s Annual Securities Report, integrated or annual report, ESG, CSR, environment or sustainability report, or TCFD report (most recent reports available as of the end of June 2021). The survey confirmed only the existence of information corresponding to each category and did not evaluate the quality of the disclosed information.

The 11 Recommended Disclosures, along with the shortened identifiers used in the survey and this article, can be found on page 5 of the survey (link below).

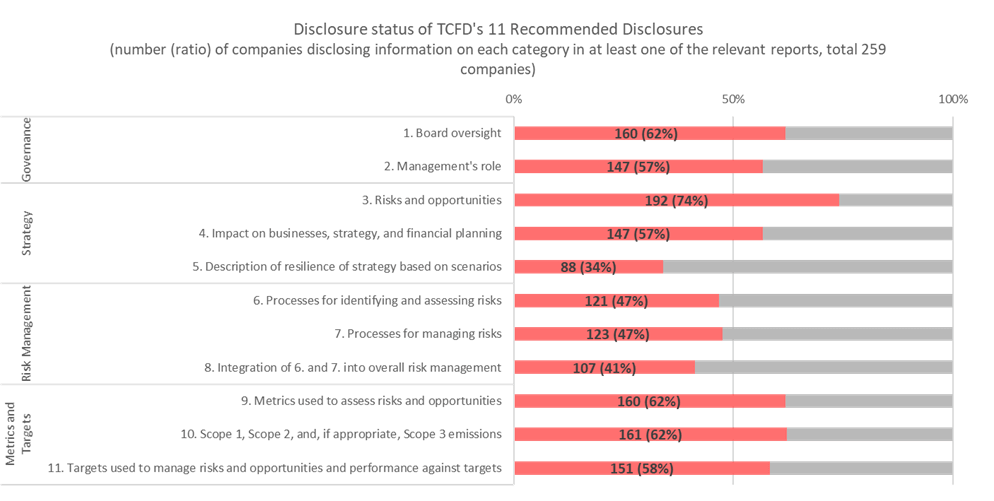

The survey found that, overall, the most-disclosed category was 3. Risks and opportunities, with 192 companies or 74% disclosing information on this topic. Following this were 10. Scope 1, Scope 2, and, if appropriate, Scope 3 emissions (161, 62%); 1. Board oversight (160, 62%); and 9. Metrics used to assess risks and opportunities (160, 62%). On the other hand, the least-disclosed category was 5. Description of resilience of strategy based on scenarios, with 88 companies or 34% disclosing. These trends are similar to those seen in the TCFD's own Status Report, which covers 1,600 companies across the world.

The survey also broke down disclosures by number of disclosed categories, types of report, market capitalization, and sector. These breakdowns aim to help listed companies understand the trends among their own peers, which they can then use to inform their own disclosure efforts.

Firstly, the survey counted how many of the 11 Recommended Disclosures each company disclosed. Of the 259 companies surveyed, 42 disclosed on all 11 categories, while 36 had not included information on any of the categories in any of the relevant reports.

Companies that disclosed on only one to three categories tended to choose 3. Risks and opportunities (57%) and 10. Scope 1, Scope 2, and, if appropriate, Scope 3 emissions (43%). The same two were popular among those disclosing four to six categories, along with 4. Impact on business, strategy, and financial planning (56%); 1. Board oversight (54%); and 9. Metrics used to assess risks and opportunities (54%). Among companies disclosing on seven to nine categories, while the rates of disclosure were higher for all the Recommended Disclosures, only a minority disclosed on 5. Description of resilience of strategy based on scenarios (37%) or 8. Integration of 6. and 7. into overall risk management (44%).

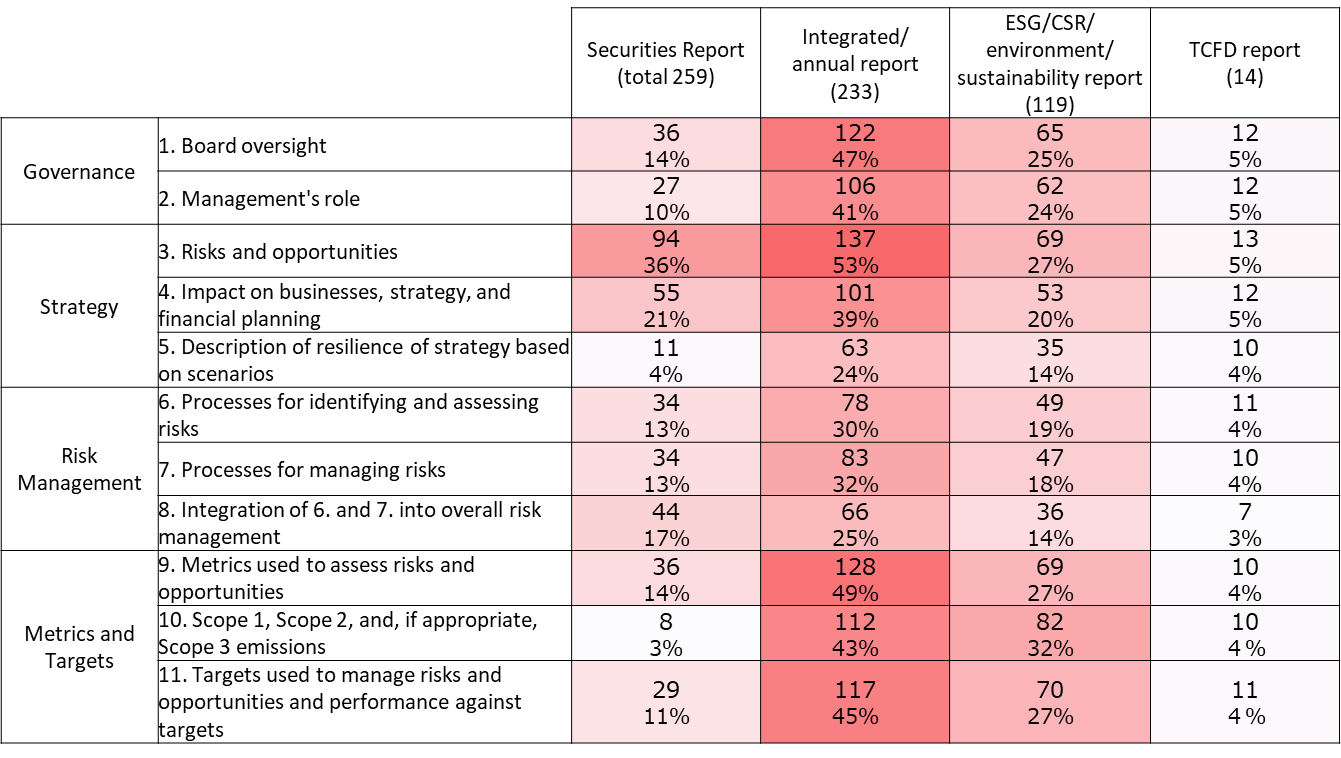

Another aspect of the survey was the different types of reports. It found that of the 259 surveyed companies, all had published a statutory Annual Securities Report, 233 had published an integrated or annual report, and 119 had made an ESG, CSR, environment or sustainability report, while only 14 had a TCFD report. While TCFD recommends that climate-related information should be included in statutory disclosures, all 11 Recommended Disclosures were disclosed on most in integrated or annual reports. The information most commonly found in statutory disclosures (Annual Securities Reports) was on 3. Risks and opportunities, with 94 companies disclosing.

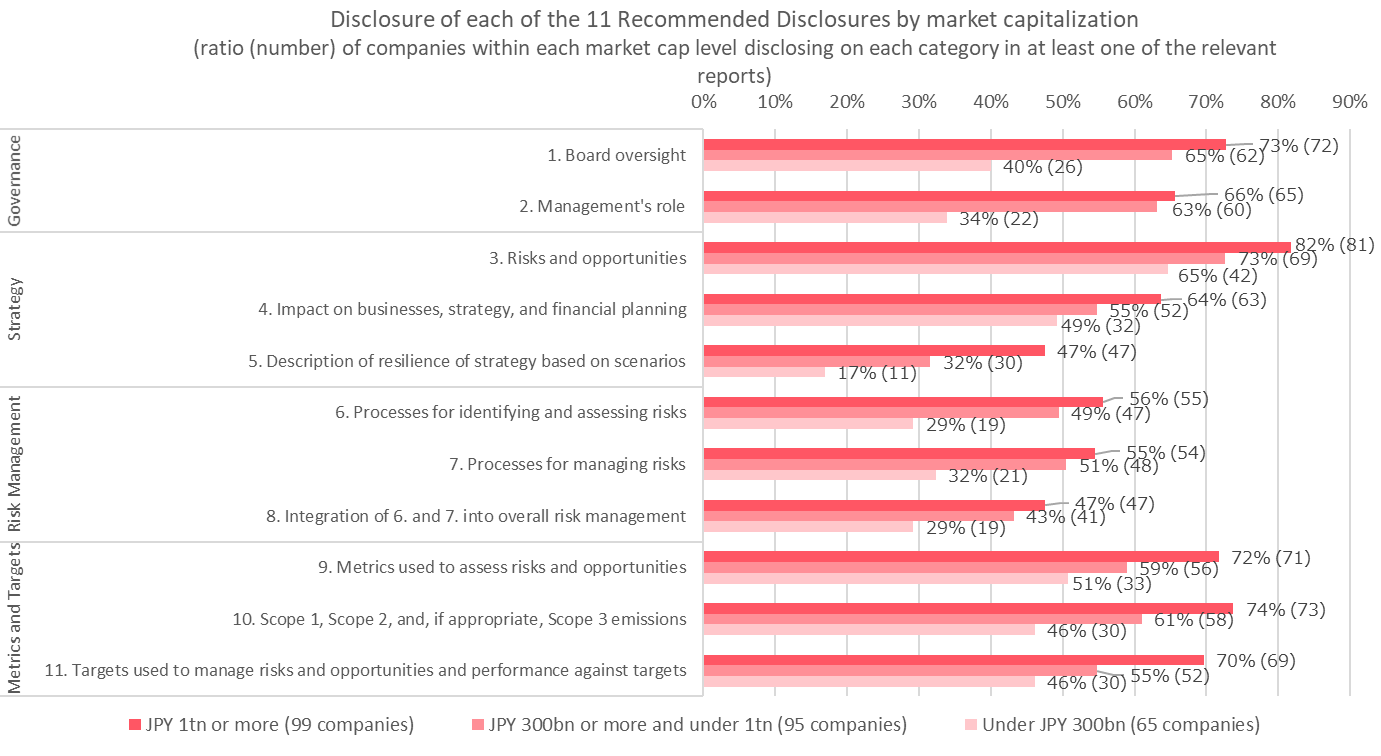

The survey also looked at disclosure by market capitalization. While disclosure on all categories was highest among the largest companies, those worth JPY 1tn or more, in some categories there was only a small gap between these and mid-sized companies, worth 300bn or more. Following the overall trend, even among those largest companies, only a minority (47%) disclosed on 5. Description of resilience based on scenarios or 8. Integration of 6. and 7. into overall risk management. Among the smallest companies in the survey, those worth under JPY 300bn, disclosure was most common on 3. Risks and opportunities (65%) followed by 9. Metrics used to assess risks and opportunities (51%).

Lastly, looking at disclosure among different sectors, disclosure was generally higher among high-emissions sectors such as raw materials & chemicals and construction & materials, while it was generally lower among IT-based and finance companies (excluding banks). Trends for each Recommended Disclosure category mainly held true for all the sectors.

As many Japanese companies publish their annual or integrated reports in the summer, the situation may have changed since the survey was carried out. JPX intends to update the results periodically to reflect changes over time.

As well as helping listed companies with their own disclosure efforts, JPX also hopes that this survey can be referred to in international discussions on enhancing TCFD disclosure, and by investors when engaging with Japanese companies. The survey can be found in English through the below page.

https://www.jpx.co.jp/english/corporate/news/news-releases/0090/20211130-01.html

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.