Q4 2019 Market Update

Equity and derivatives markets

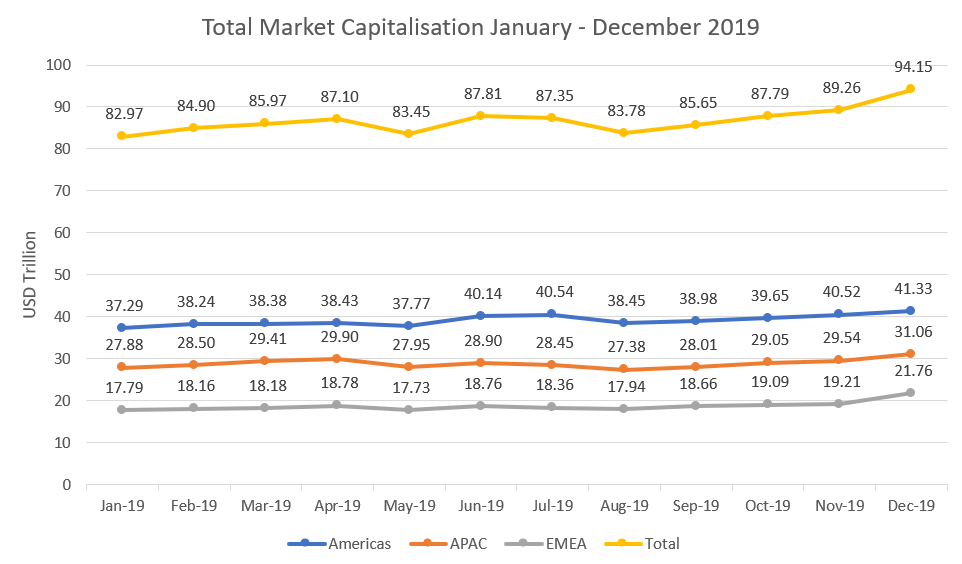

- Domestic market capitalisation amounted to USD94 trillion at the end of December 2019.

- Total market capitalisation increased by 22.85% year-on-year. The EMEA stock grew by 31.48%, Americas’ stock by 21.10% and APAC’s stock by 19.69%.

- At the end of 2019, total market capitalisation had the sharpest monthly increase of the year (5.48%). The region with the highest activity was EMEA (13.27%), mostly taking place at the Saudi Stock Exchange (Tadawul) and MERJ Exchange Ltd.

- The value of trades in equity shares in Q4 amounted to USD21 trillion, down from USD25 trillion a year earlier. And down from USD22 trillion in Q3.

- APAC is the only region which registered an increase year-on-year from USD6.1 trillion in Q4 2018 to USD7.2 trillion in Q4 2019, while in the same quarter Americas experienced a decrease from USD16 trillion to USD10.9 trillion and EMEA from USD3.2 trillion to USD2.7 trillion. Behind this YoY increase in APAC are the Shenzhen Stock Exchange and the Shanghai Stock Exchange.

- In Q4 2019 all regions experienced a decrease in the value of trades in equity shares compared to the previous quarter.

- The number of equity trades declined by 7.25% in Q4 in comparison to the previous quarter and by 3.82% compared to Q4 2018. Americas experienced a 10% decline QoQ and 26% YoY, APAC a decline of 6.77% QoQ, but a 16.58% increase YoY, while EMEA registered a 32.49% increase quarter-on-quarter and a 15% increase YoY. Borsa Istanbul had a particularly good final quarter, while Tehran Stock Exchange and Iran Fara Bourse Securities Exchange had a good year.

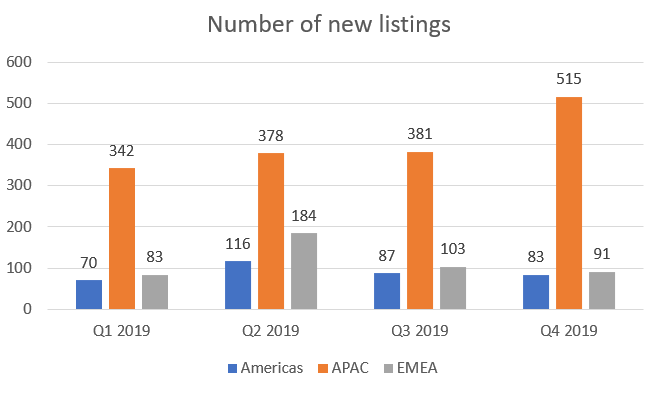

- There were 689 new listings in Q4 2019, up 20.67% compared to Q3 2019 and up 3.30% compared to Q4 2018. Notably APAC registered a 35.17% change in Q4 2019 compared to Q3, from 381 to 515 listings, with Hong Kong Stock Exchange registering 51 more new listings in Q4 compared to Q3, and Shanghai Stock Exchange registering 47.

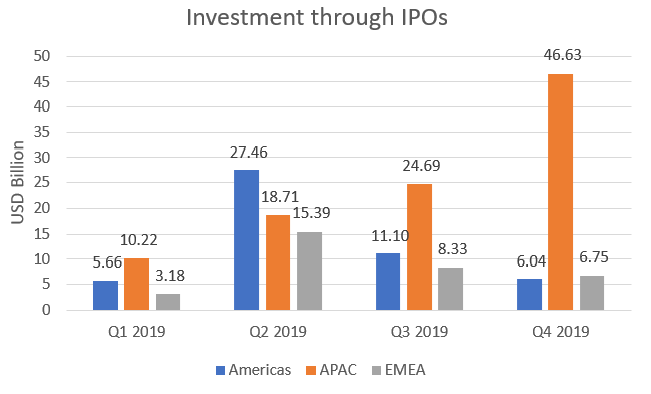

- Investment through IPOs in Q4 was valued at USD59.42 billion, up 34.69% from the previous quarter, but down 4.68% compared to Q4 2018. Behind APAC’s staggering 88.84% increase QoQ and 17.61% annually are Hong Kong Exchanges and Clearing and Shanghai Stock Exchange.

Derivatives

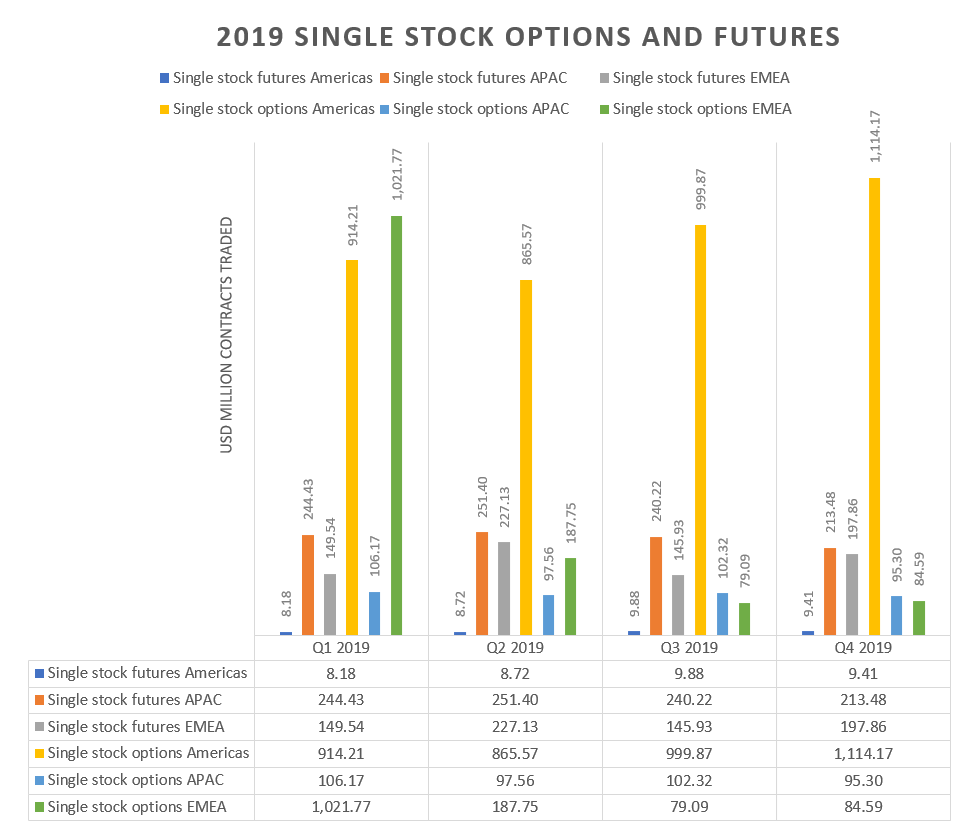

- Single Stock Options volumes in Q4 were up by 9.55%, APAC being the region which registered a decrease by 6.86%, while EMEA and Americas registered an increase of 6.95% and 11.43% respectively. Notable contributors to this increase in the Americas are B3- Brasil Bolsa Balcao and Nasdaq-US. Year-on-year single stock options increased by a quarter; the largest increase was registered in the Americas (30%), while APAC and EMEA had a very moderate increase of 0.86% and 0.70% respectively. Cboe Global Markets, Nasdaq-US and MIAX Exchange Group had a particularly good year.

- Single Stock Futures volumes were up in Q4 by 6.24% compared to the previous quarter and up 4.77% annually. EMEA had a significant increase of 36% QoQ and 26% YoY, while APAC registered a decline of 11.13% QoQ and 9.85% YoY. Americas declined QoQ by 4.73% while annually it registered a significant increase of 28%. B3- Brasil Bolsa Balcao, Bourse de Montreal, Borsa Istanbul and Deutsche Borse had a particularly good year.

- Stock Index Options volumes were up by 13% in the last quarter of 2019 compared to Q4 2018, with APAC registering an increase of 25.31% YoY, while the Americas and EMEA experienced a decline of 28.83% and 11.20% respectively. The National Stock Exchange of India had a very good year overall. QoQ all, all three regions experienced a decline: the Americas by 12%, APAC by 6.15% and EMEA by 4.83%. The overall QoQ decline was 6.66%.

- Stock Index Futures volumes declined in the last quarter of 2019 by 6.78% compared to the previous quarter, but registered an overall increase YoY of 4.48%. The Americas region had a very good year registering an increase of 33%, the main contributor being B3-Bolsa Balcao. While APAC and EMEA YoY volumes were down 23.37% and 19.27% respectively.

- ETF Options volumes decreased YoY by 11.11% and QoQ by 4.48%. In the Americas the decline was 4.46% QoQ and 11.12% YoY, while in APAC the volumes declined by 16.89% QoQ, but increased by 2.73% YoY (mostly due to Japan Exchange Group and Hong Kong Exchanges and Clearing).

- ETF Futures volumes declined by 15.67% QoQ and by 58.85% YoY, with Americas being the only region which experienced an increase of 46% in Q4 compared to the previous quarter.

- Currency Options volumes were down by 13.39% QoQ, but up by 10.58% YoY, with APAC experiencing an increase of 13.12% YoY, mostly due to NSE India, while both the Americas and EMEA registered a decrease of 28.96% and 12.45% respectively YoY. QoQ, all regions experienced a decline: the Americas 0.89%, APAC 14% and EMEA 5.75%

- Currency Futures volumes were down by 14.41% QoQ and 25.93% YoY, with all regions experiencing declines. In Americas the volumes were down by 18.39% QoQ and 42.77% YoY, in APAC by 10,31% QoQ and 11.69% YoY, in EMEA by 16.47% QoQ and 20% YoY.

- Interest Rate Options volumes were down 15% QoQ and 8.41% YoY. QoQ the only region that experienced an increase was APAC, going up by 1.10%, while Americas and EMEA experienced a decrease of 17.80% and 5.16% respectively. YoY the Americas registered a decrease of 12.45% while EMEA and APAC experienced an increase of 6.46% and 30.33%, respectively due, mostly, to ASX Australian Securities Exchange.

- Interest Rate Futures volumes were down by 12.94% QoQ and 11.12% YoY. In the Americas they were down by 12.98% QoQ and by 6.93% YoY, in the APAC by 7.95% QoQ, but were up by 5.59% YoY (mostly due to Korea Exchange and China Financial Futures Exchange). In EMEA the volumes were down by 14.16% QoQ and by 23.92% YoY.

- Commodities Options volumes were down by 5.25% QoQ, but up by 4.33% YoY. The Americas experienced a decline by 17.91% QoQ and 20.22% YoY, APAC had a QoQ increase of 17% and a more notable one of 143% YoY (due mostly to Dalian Commodity Exchange and Zhengzhou Commodity Exchange), while EMEA had a more modest QoQ increase of 9.13% but a stronger YoY performance of 17.17% (due mostly to Deutsche Borse).

- Commodities Futures volumes declined by 10.30% QoQ, but increased YoY by 18.86%. In the Americas the volumes registered a decrease of 6.80% QoQ and 3% YoY. In APAC they decreased QoQ by 9.39%, but increased YoY by 30.91% (mostly due to Dalian Commodity Exchange and Shanghai Futures Exchange), in EMEA the volumes decreased by 15.53% QoQ, but increased by 4.45% YoY (notably due to Moscow Exchange, Borsa Istanbul and ICE Futures Europe).