Financial Literacy for the Next Generation of Market Participants

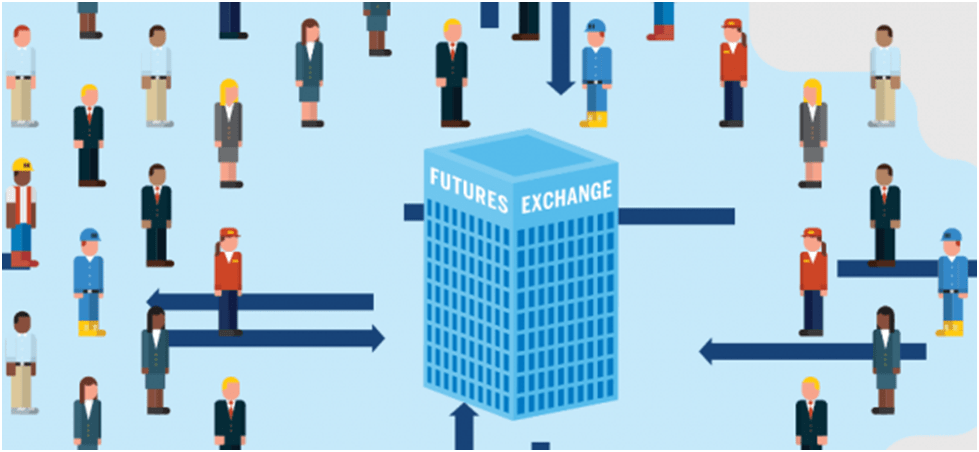

Thousands of market participants come to futures markets every day to manage their business risk or invest in opportunities. This could include a farmer facing a short supply due to drought, a manufacturer who needs to source parts in Europe or a bank looking to offer mortgages. The risks these market participants face in their businesses can also have an impact on the prices and rates we pay for everyday things like gasoline, the food we eat or a loan.

For those who don’t follow futures markets, they can be difficult to understand. The process can be confusing and the terminology dizzying.

Much of that is due to the fact that market education is underdeveloped. In many countries, much of the focus on financial literacy has been around personal finance – the basics of saving, spending and investing. And there’s no debate that these concepts are critical. However, financial literacy needs to encompass more than an understanding of what credit card is best for your needs or why it is important to save for retirement – it has to include the fundamentals of how our global economy and financial markets function.

That’s where Futures Fundamentals comes in: a website focused on helping learners of all levels grasp the concepts essential to the marketplace and educating those new to futures markets.

As a non-profit organization supported by a number of industry leaders including CME Group, FIA NFA, ICE, and CFTC, Futures Fundamentals is a one-stop educational resource designed to simplify and explain complex market topics.

Exchanges and clearing houses have a role to play in helping the next generation of market users, prospective employees, policy makers and other stakeholders understand the critical role our markets play. Futures Fundamentals is the driving force in this collective effort to develop risk management education and enhance financial literacy.

We are very pleased to partner with the industry to help a broad range of audiences understand the importance of the derivatives markets to our economy and our everyday lives. We hope to be able to build on the success of this initiative, and onboard more organizations to make Futures Fundamentals an even more compelling resource for the next generation of market participants.

Through interactive features and rich content, including trading simulators and free online modules for educators to use in their classrooms, the website explains futures markets and provides information on the derivatives industry as a whole. The site averages 135,000 visitors a year. Through an innovative partnership with Discovery Education on the Econ Essentials program, nearly 2 million students have engaged with this content in classrooms across the United States.

Among its interactive features, the site offers a trading tutorial and simulator that lets visitors apply the website’s lessons and practice making electronic trades. The simulator tracks real markets and provides near real-time updates on a simulated balance. If you’ve never traded before, it is a good introduction to testing your skills before trying the real thing.

The lessons on the site are broken into three sections, starting with the basics and wrapping up with a closer look at the innerworkings of the futures marketplace, all told through stories, interactive infographics, videos and quizzes. A section specifically designed for educators is also available with tools and resources that can be applied directly to the classroom.

Get the Basics

The Get the Basics section serves as the introduction unit that provides the user with an overview of the global derivatives marketplace, futures and options, microeconomics and how futures trading plays a role in our daily lives. Videos on futures and options and supply and demand provide you with the necessary knowledge and tools for the site’s second section.

See the Impact

This section dives into an explanation of how familiar tasks like buying food or gas, or obtaining a mortgage, are affected by futures markets. The section also provides a brief introduction of hedging and speculating.

Explore the Marketplace

The final section of Futures Fundamentals combines the knowledge gained from its previous sections and applies it directly to the marketplace. “Explore the Marketplace” provides the user with the necessary information needed to make an actual trade, followed by an overview of algorithms, clearing and over-the-counter trading.

For Educators

In addition to reaching people curious about learning futures, Futures Fundamentals features a section for the classroom that provides a collection of articles, educational videos, interactive quizzes and challenges to help teachers adapt the site to finance or economics curriculum. The section also features several activities, learning modules and videos available through Econ Essentials. Teachers across the U.S. have already put these modules to work.

Other exchanges and clearing houses are invited to join this industry-wide effort – the site is regularly adding new content and additional classroom resources. Learn more at www.futuresfundamentals.org.

As Futures Fundamentals offers a trading simulator to interested students and potential clients, CME Group also sees a continued need for more sophisticated trading education as part of university courses as well.

CME Group’s University Trading Challenge allows teams of undergraduate and graduate students the opportunity to experience the excitement, energy and decision-making required of real-time futures trading in a number of CME Group’s markets across multiple asset classes on a simulated, professional trading platform provided by CQG. Teams have the option of participating as a general student team or pairing with a faculty advisor to serve as a mentor for their team throughout the competition.

By partnering with the emerging generation of finance professionals, we can help ensure their success in driving the world forward, and this is what the University Trading Challenge is about. On a broader level, we are committed to building an ecosystem where we can continue to play a key role in developing traders and providing them with the tools and resources needed to enhance their understanding of the markets and the trading of the derivatives markets.

The 2022 University Trading Challenge has just kicked off its 19th year of competition, with trading continuing through the end of October. In 2021, the University Trading Challenge saw 386 teams across 24 countries registered, with a total of 1,549 students from 167 schools competing. Learn more at www.cmegroup.com/tradingchallenge.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.