Promoting sustainable business growth in the fourth industrial revolution

The New Realities

Recent years have witnessed the emergence of some new realities which natural resources-rich countries, such as Kazakhstan, cannot ignore:

Firstly, there is an increased emphasis on sustainable economic development.

Kazakhstan is a signatory of both the 2015 Sustainable Development Goals and the 2016 Paris Agreement. This implies that we and other countries have made global commitments to reduce climate emissions and contribute to more sustainable societies. At the Astana International Financial Centre (AIFC), we define sustainability as balancing and growing all five capital stocks simultaneously – natural, manufactured, social, human and financial.

It is also the case that the commodities super cycle came to an end during the bear market of 2011-2015 and is unlikely to find a new growth model with slower growth in China, global trade tensions and the increased emphasis on sustainability.

The Fourth Industrial Revolution (4IR) has arrived. In 2016, Klaus Schwab of the World Economic Forum argued that we stand on the brink of a technological revolution that will fundamentally alter the way we live, work, and relate to one other. He defines the 4IR as: “… a range of new technologies that are fusing the physical, digital and biological worlds, impacting all disciplines, economies and industries, and even challenging ideas about what it means to be human.”

Especially, physical and digital fusion will happen at an unprecedented, rapid pace. Since the global financial and economic crisis of 2008, global data flows, and increasingly digital trade, have grown exponentially. Exchanges must be at the forefront of this new reality.

The AIFC as a dynamic ecosystem

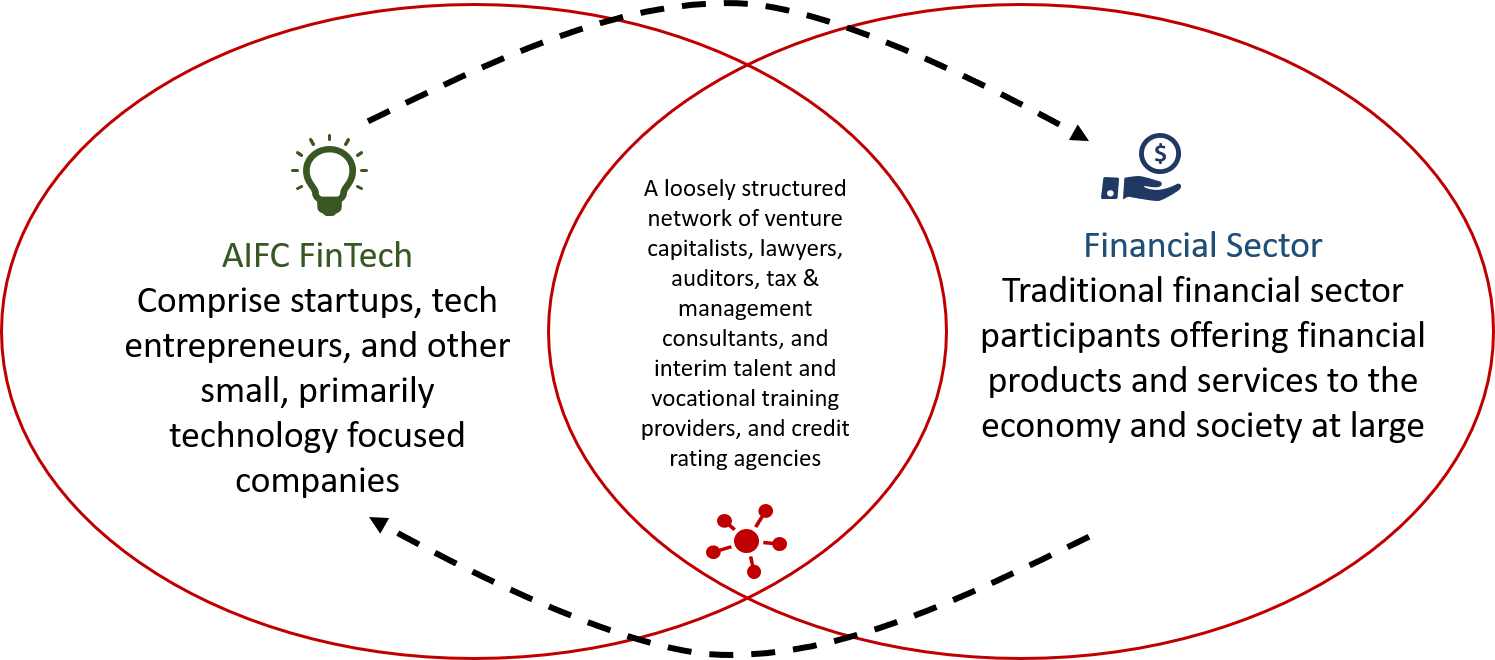

Economies and companies that want to experience sustainable business growth need to harness the 4IR. This is especially the case for the national exchanges as they seek to maximise the role of capital markets in increasing the benefit to the national economy and the long-term well-being of the country. Increasingly, financial Hubs, such as the AIFC, consist of two interrelated sub-ecosystems (Figure 1).

Sub-ecosystem 1 comprises traditional financial sector players, such as commercial banks, private banks, investment banks and insurance companies. Their main objective is to provide financial products and services to the economy and society at large.

Sub-ecosystem 2 (AIFC FinTech) comprises of start-ups, tech entrepreneurs, and other technology companies that focus on the crucial technology aspects of the 4IR, such as blockchain, cybersecurity, and AI. Professional services firms operate at the intersection of the two sub-ecosystems, alongside VC firms, R&D centres and training providers. Successful AIFC FinTech companies eventually become financial sector players or help transform traditional financial sector players to disrupt their business model. These two reinforcing sub-ecosystems make it a dynamic and innovative financial sector ecosystem ready to compete in the 4IR.

Figure 1: The AIFC as a Dynamic Ecosystem

Three critical enablers

At least three critical enablers are needed to attract capital and improve liquidity. These are: 1) the development of capital markets and the need for Kazakhstan to transition from frontier to emerging market status on a number of indices, including MSCI. There is also a need to develop an SME market. An SME market provides further access to equity capital, bolster corporate governance, and offers exit options for Venture Capture firms, 2) the need to develop trust by developing an independent judicial system and jurisdiction based on English common law. This has been achieved and was one of the key priorities during the early stages of the development of the AIFC, and 3) the need to provide stewardship to companies through the development of a principles-based corporate governance framework that promotes accountable, transparent and equitable governance in Kazakhstan and the region.

How the AIFC could stimulate sustainable business growth

There are at least three areas where the AIFC seeks to stimulate sustainable business growth:

1. Doing things smarter: Leverage the circular economy (CE) to make existing assets more sustainable and competitive. According to McKinsey, the circular economy has the potential to create €1.8 trillion of incremental value in Europe by 2030. In natural resource-rich countries, the potential (as a percentage of GDP) is much larger and estimated at up to 2% of incremental annual GDP growth. This is because there are many opportunities to reduce, reuse and recycle waste in the extraction industries value chain by leveraging skills, enabling infrastructure, and SMEs. The circular economy in natural resource-rich countries will create skills, jobs, maintain and improve or at least help maintain natural capital, and create financial capital that is not dependent on the volatility of the demand of natural resources.

2. Capture value-added: Capture value-added through supply-chain integration and the development of physical infrastructure. To connect the more than 5 billion people who live in the Eurasian region, Kazakhstan plays a central role given its geographic location and good relationships with its neighbours. Investment in infrastructure, including clusters, will be key to make the New Silk Road a success given infrastructure has a high economic multiplier. The Asian Development Bank estimates that, on average, $750 billion per year of infrastructure investment is required until 2030 in Asia alone. Not all will be destined to make the New Silk Road a reality, but it is probably the largest, multi-country infrastructure project ever undertaken to enable east-west trade.

3. Leapfrog into the future: Given the 4IR, it would be unwise not to leverage some enabling technologies to make better use of infrastructure. For example, the internet of things (IoT) combined with autonomous vehicles has the potential to dramatically improve the efficiency of how infrastructure is used, because logistics providers will now be able to track each item in the supply chain and ensure that it finds the fastest and most cost-effective way to its ultimate destination. The potential for digital technologies to disrupt value chains is enormous.

Conclusion

Now that the commodities super cycle has ended, natural resource-rich countries need to find a sustainable business growth model that is less influenced by external factors, such as commodity prices.

This is sponsored content from AIFC.