Q&A with Mario Palhares, Director, B3 on the firm’s success in the ETF market

Please could you provide some history of how B3 developed its Exchange Traded Fund (ETF)/Exchange Trade Product (ETP) market?

We believe that the ETF is an important product, especially for retail investors entering the stock market as it offers diversification in a passive and transparent manner.

On January 2002, the Securities and Exchange Commission of Brazil (CVM) issued Instruction 359, which regulates the constitution, management and operation of ETFs in the Brazilian market.

The first Brazilian ETF (PIBB11) was launched in 2004 through an initiative of The National Bank for Economic and Social Development (BNDES). The PIBB11, managed by Itaú Asset, was open as a public offering and had great take-up of individual investors. Until 2007, PIBB11 was the only ETF listed. Then in 2008, several new ETFs were listed on B3, including BOVA11 (currently the largest traded ETF) and the first international ETF (IVVB11).

Until July 2016, international ETFs could only be operated by qualified investors. B3, together with market participants, negotiated with the regulator and gained retail investor access to the product.

With the evolution of the market, and the need to increase the range of strategies for investing ETF equity in assets that are part of indexes that do not reflect only the variation of the equity market, CVM published Instruction 537 allowing the use of indexes that refer to public or private fixed income assets. Even with the legal provision for the constitution and operation of fixed income ETFs, there was still a need to define the applicable taxation policy. In November 2014, Law 13.043 was published, thus completing the necessary rules enabling the launch of this new category of ETFs.

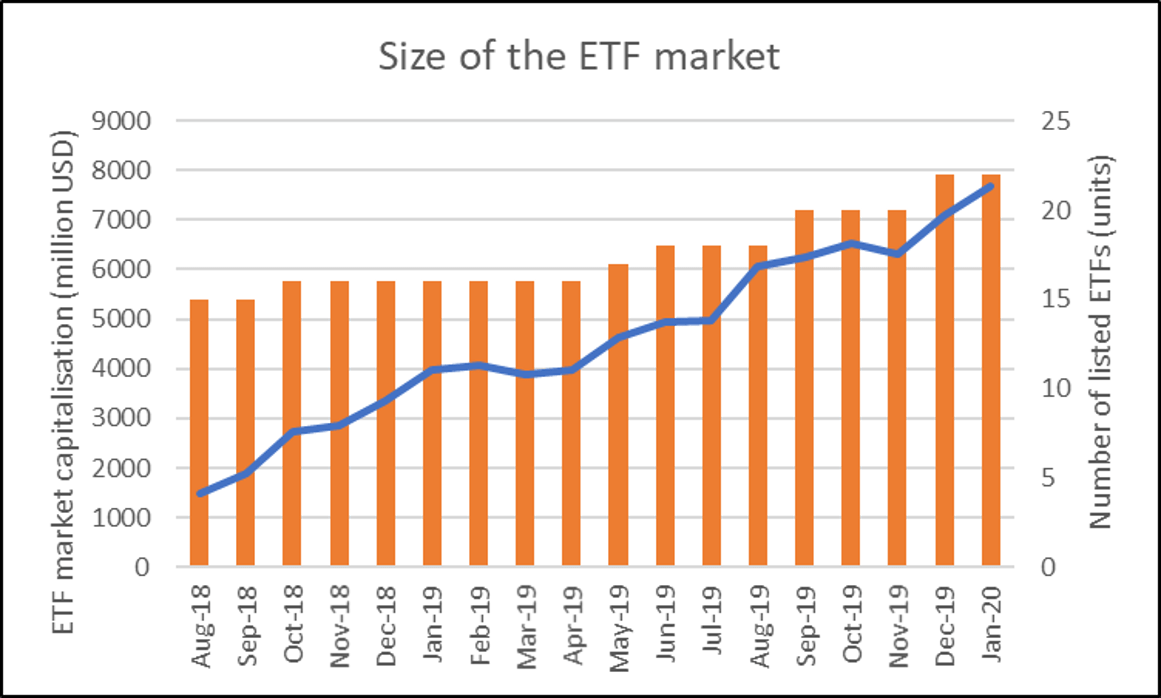

The first Fixed Income ETF was launched in 2018, followed by the launch of five new fixed income ETFs in 2019, including the Issuer Driven ETF Programme (ID ETF). The ID ETF was an initiative of the World Bank aiming to support the development of domestic bond markets of emerging market economies. The Brazilian experience with the ID ETF was pioneered and could serve as a reference for replication of the programme globally.

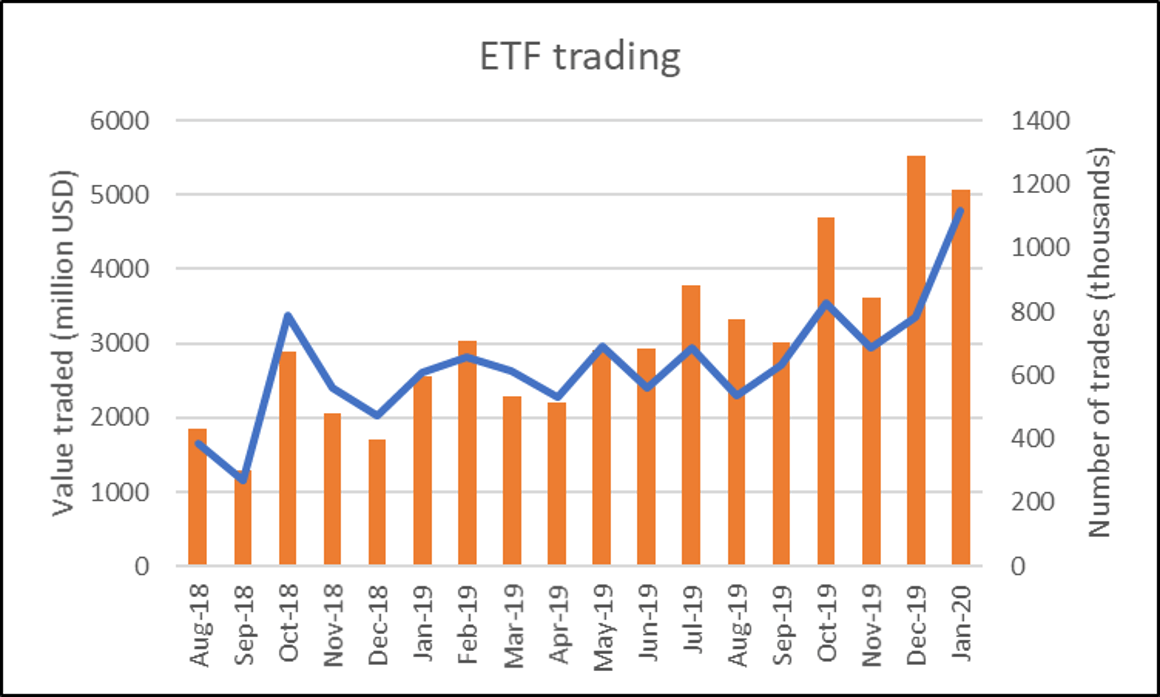

In Brazil, the numbers are still modest. There are currently 22 ETFs listed on B3, 16 referenced to stock indexes, two of them foreign (referenced to the S&P 500), and six tracking fixed income indexes. These ETFs reached, in November 2019, a total of BRL 26.6 billion of AuM (+126% versus 2018), with daily turnover above of BRL 762 million (+76% versus 2018). In addition, the number of investors grew 141% from 41,468 in December 2018 to 100,029 in November 2019.

What are the underlying reasons behind the recent growth?

With the improvement in the country's macroeconomic scenario and the low interest rate, the product proved to be an excellent alternative for investor entry in the stock market. BOVA11 is currently the largest traded ETF. It’s always among the top 10 most traded cash equities assets.

Professional and individual investors use ETFs for many purposes, from an efficient way of gaining exposure to a potentially large set of assets (buy-and-hold) up to more sophisticated arbitrage, Long&Short, and trading at high frequency.

B3, as a way of encouraging liquidity in this market, offers a set of products and services related to ETFs or their benchmarks, such as securities lending, forward contracts, futures contracts, listed and flexible (OTC) options, and acceptance of ETF shares as collateral to the Clearing.

We also have market makers (MM) in all listed ETFs. And we’re always working on initiatives to improve the performance of MMs and encourage liquidity growth. An example is the hedge policy. All MMs have exemption on the trading fees of the assets that make up the ETF index benchmark.

ETF liquidity in Brazil is still low compared to international markets. But it is developing and showing great growth rate in recent years.

Another good thing observed is the increase in volume traded by high frequency investors (HFTs), evidence that the product has reached volume enough to attract attention from this class of investor, who does not operate illiquid products.

The breakdown by investor in trading volume is around 72% of institutional investor, 14% financial investors, 10% retail, and 4% international investor.

Are you planning to introduce any new products in the future?

We are always studying alternatives and improvements for ETFs with both the market and the regulator, especially in relation to what already exists in other markets, but is not yet applied in Brazil.

As an example, we are working with the regulator to allow ETFs on other assets, such as Real Estate ETFs.

Additional information and charts provided by Dr. Stefano Alderighi, Senior Economist – Researcher, The World Federation of Exchanges