Tadawul's Nomu market offers SMEs path to access Saudi capital market

Nomu, the Arabic word for growth, began as a dream to offer small-and medium-sized enterprises (SMEs) a path to access the Saudi capital market.

It is a parallel equity market with lighter listing requirements (figure 1) that makes it easier for SMEs to list and get access to the capital they need to grow their business.

Currently, the Saudi SME sector makes up 20% of total GDP in the kingdom of Saudi Arabia, with the goal of reaching 35% by 2030, as set out in the Kingdom’s Vision 2030 plan, with “Nomu – Parallel Market” playing a significant role in making this a reality.

In February 2017 Nomu started operations with seven companies listed on the same day, and 10 public offerings by 2019. To ensure market stability, trading in Nomu was limited to Qualified Investors which include: authorized persons, government-owned entities, financial institutions, investment funds, and natural persons who meet specific qualification criteria.

Nomu has come a long way from its modest beginnings, overcoming numerous challenges with book coverage, liquidity and regulations. Each issue was studied in turn, and solutions were developed that resulted in dramatic improvements in Nomu’s overall performance benefiting issuers and investors alike.

The Saudi Stock Exchange Company (Tadawul), alongside the CMA (Capital Market Authority of Saudi Arabia), has introduced many enhancements over the short period since Nomu’s inception.

Direct listing

One of the most important changes was the introduction of direct listing, which allows companies to list their shares directly on Nomu without a public offering.

This can be done through two methods: floating the company’s shares with a staged liquidity plan; or through private placements.

If a company opts for the liquidity plan, an independent financial advisor provides a valuation and prepares the plan with the issuer to be submitted as part of the listing application and described in the listing document.

The private placement transaction method can take place before the direct listing in order to meet the entry requirements, which also helps the price discovery process.

A particularly important regulation change on Nomu to help potential issuers was the increased flexibility in listing requirements. Instead of 30% of the company, as the Main Market requires, it’s either 20% or SAR 30 million worth of shares, whichever is less.

Compliance costs

The change in reporting frequency from quarterly to a semi-annual basis has also reduced the cost of compliance and lessened the burden on management, allowing SMEs to spend more time creating value by focusing on developing their core business.

Tadawul and the CMA also introduced several other technical and regulatory changes to Nomu such as the introduction of index capping. Listed companies are capped at 35% of their index weighting to ensure an accurate reflection of a company’s value of the parallel market.

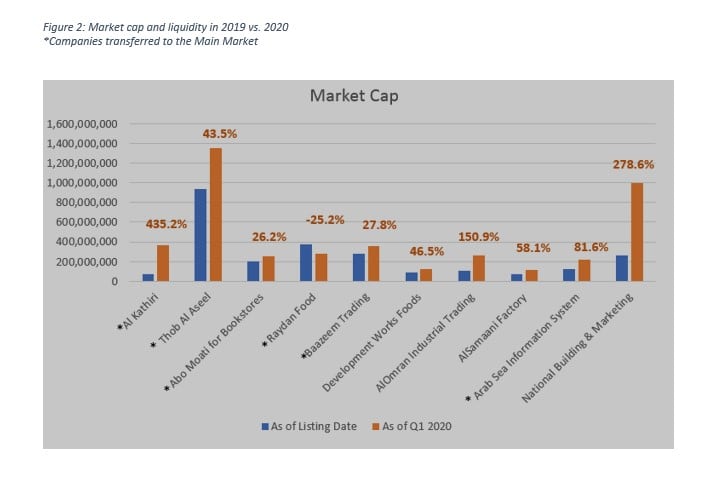

This, combined with the increase in the volatility guard to 20%, compared to the Main Market’s 10%, and the reduction in trade thresholds from SAR15,000 to SAR2,500 better captures the trading environment on the overall calculation of the index and its price, leading to a fundamental increase in price stability and confidence in companies’ valuations (figure 2).

To support SMEs’ expansion plans further, Nomu provides its listed entities the opportunity to transition to Tadawul’s Main Market, provided they have met all of the requirements for listing on the Main Market (except for market capitalization).

With these improvements, six Nomu listed companies have been able to upgrade to the Main Market, affirming Nomu’s credentials as a market that provides a fast-track to growth for SMEs and a springboard onto the Main Market index.

This enables businesses to fund their growth plans, provides investors with opportunities to generate financial returns and support overall economic growth. Tadawul and the CMA have also been working on introducing Real Estate Investment Trusts and closed-ended funds into Nomu. This will increase the number of products Tadawul provides and increase liquidity in the market.

Research provision

One of Tadawul’s more recent initiatives is the creation of a fund for an independent research provider to conduct research on Nomu stocks. The results will be made available through the exchange, providing more information and further boosting market transparency. The government has also been keen to assist SMEs to list on Tadawul and has provided a list of incentives for companies from multiple governmental entities to encourage them to make the leap onto Nomu, creating new and exciting opportunities for investors and issuers.

Our main goal is to provide a diverse selection of products and services that add real value to all market participants. All changes and improvements have been towards this goal and have translated into a stronger and more stable market.

Tadawul is proud to have been able to make such significant developments to the Saudi capital market in such a short time. With our passion and commitment to innovation we are confident that SMEs on the Nomu market will continue to blossom into much larger and successful organizations, and we are honored to be able to help these companies on their journey.

Figure 1: Listing requirements of Main Market vs. Nomu

|

Listing Requirements |

Main Market |

Nomu market |

|

Minimum market cap |

SAR 300 million |

SAR 10 million |

|

% Offering size |

at least %30 |

at least 20% or SAR 30 million whichever is less |

|

Public shareholders |

at least 200 |

at least 50 |

|

Continuous obligations |

quarterly financial statements and an end of the year annual financial statement |

semi-annual financial statement and an end of the year annual financial statement |

|

Daily fluctuation limits |

10%+- |

20%+- |