Commodity derivatives

In this article we analyse the trends in commodity derivatives in 2020 compared to 2019, including contracts split by underlying commodity[1], as set out below:

- Agriculture

- Energy: this includes emissions contracts and ethanol and methanol contracts, to the extent that these are energy-related

- Non-precious metals

- Precious metals

- Index commodity derivatives: a commodity index tracks a basket of commodities. The commodities in the index may all reference a particular underlying category (ie agricultural commodities) or a cross-section of commodities

- Other: meant to capture all contracts that do not clearly fall into one of the above–mentioned categories. It includes instruments like freight, plastic-polypropylene, and glass contracts.

The data is taken from the WFE Statistics Portal.

The number of commodity derivatives contracts traded in 2020 was 9.3 billion, which was a 35.3% increase on the previous year.

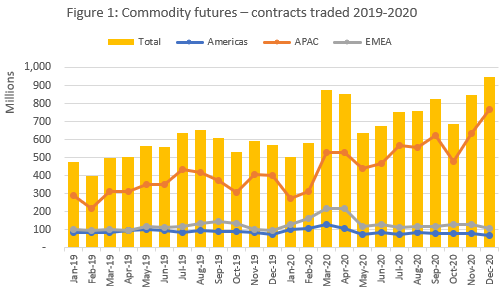

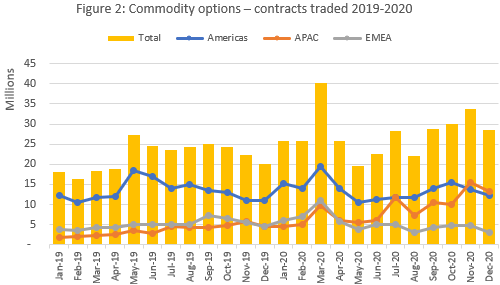

In 2020 both commodity futures and commodity options volumes went up by 35.7% to 8.9 billion and 26.2% to 0.3 billion respectively compared to 2019, possibly because during highly uncertain times (like the ones faced during 2020 because of the COVID-19 pandemic) investors are more likely to hedge risk than in normal circumstances.

Futures account for 96% of all commodity contracts traded, while options only for 4%.

With regards to futures contracts traded, year-on-year the Americas increased by 0.4%, APAC by 48.3% and EMEA by 24.7%.

As Figure 1 shows, the APAC region accounted for the largest share of futures contracts traded (69%), while Americas and EMEA represented 12% and 19% of total trade, respectively. Asian exchanges with an excellent performance in 2020 compared to the year before were the Dalian Commodity Exchange (up 62%), the Shanghai Futures Exchange (up 49%) and the Zhengzhou Commodity Exchange (up 54%).

In March 2020 we observed an exceptional 50% month-on-month increase, due to COVID-19 related uncertainty. After the peak in March, we observed a pronounced increase for the rest of the year compared to pre-pandemic levels, largely towed by the APAC region, while in the Americas and EMEA the number of contracts remained overall constant. Volumes in Dec 2020 surpassed the March peak.

During Q4 2020 volumes of futures were up by 46% compared to Q4 2019.

With regards to options contracts traded, year on year in 2020 the Americas increased by 2.4%, APAC by a significant 142.6% and EMEA by 5.4%, compared to 2019.

As Figure 2 shows, the Americas region hosted the largest share of options contracts traded (49%), while the corresponding shares in APAC and EMEA were 32% and 19% respectively. As for futures contracts, the increase in volumes in March 2020 stood out. This represented an 8.7% increase on Feb 2020, due to increased trading activity in all regions because of COVID-19 related market uncertainty. APAC volumes increased for the rest of 2020 compared to pre-pandemic times, while in the Americas and EMEA the number of contracts traded was overall constant, with a decline towards the end of the year.

In Q4 2020 volumes of options were up by 39% compared to Q4 2019.

Regarding futures volumes, every quarter in 2020 represented an increase on the previous quarter, while options volumes went up only in the last two quarters of 2020.

In terms of commodity derivatives by underlying, agriculture and energy contracts accounted for the largest share of contracts traded in 2020 with a 36% and 31% share, respectively, while precious metals, non-precious metals and other commodities accounted for 8%, 9% and 17%, respectively.

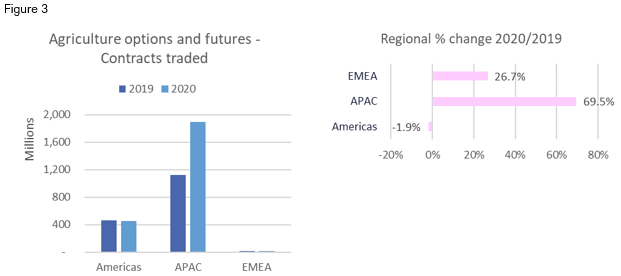

Year on year, agriculture options and futures volumes increased by 48.6% to 2.4 billion, due to APAC and EMEA regions, while the Americas decreased as shown in Figure 3.

We notice the outstanding performance of Dalian Commodity Exchange (up by 90.9% to 1.3 billion contracts traded with notional value of 8.1 trillion USD) and Zhengzhou Commodity Exchange (up by 36.1% to 584 million contracts traded with a notional value of 4.8 trillion USD).

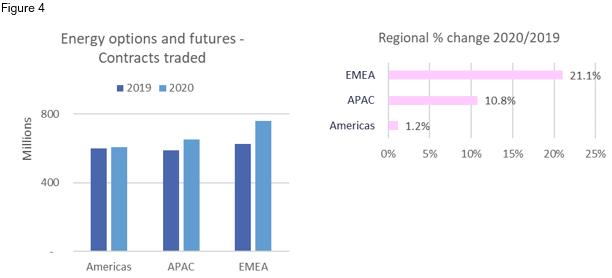

Energy options and futures volumes increased by 11.2% to 2 billion, due to all regions. Notable is the increase recorded by Dalian Commodity Exchange (69.9% to 133 million contracts traded with a notional value of 2.7 trillion USD), Zhengzhou Commodity Exchange (43.4% to nearly 420 million contracts traded with a notional value of 1.6 trillion USD) and Moscow Exchange (21.1% to 758 million contracts traded with a notional value of 298.7 billion USD). On CME Group 605.7 million contracts were traded in 2020 (up by 1.2% on the previous year) with a notional value of 21.9 trillion USD.

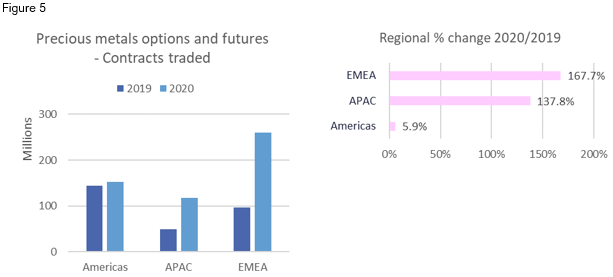

Precious metals options and futures volumes went up by a significant 82.4%, all regions contributed to this result as shown in Figure 5. The volumes traded on Borsa Istanbul went up by 169.4% to 157.6 million with a notional value of 40.5 billion USD. Other exchanges with an excellent performance were Multi Commodity Exchange of India where volumes increased by 158.8% to 105.5 million with a notional value of 637.5 billion USD and Moscow Exchange which went up by 170.0% to 101.6 million contracts traded with a notional value of 75.5 billion USD.

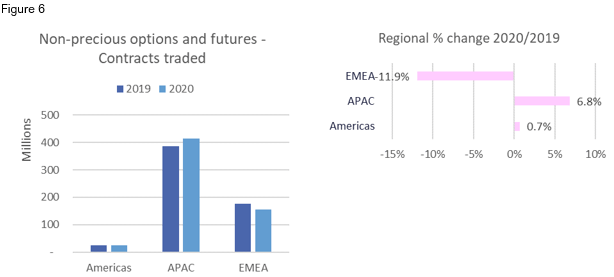

Non-precious metals options and futures volumes recorded an uptick of 1.0% to 593.2 million, due to the Americas and APAC regions going up. An increase in trading activity was noticeable on Zhengzhou Commodity Exchange by 274.1% to 76.6 million contracts traded with a notional value of 371.4 billion USD, on Singapore Exchange by 12.5% to 22.3 million contracts traded and on Hong Kong Exchanges and Clearing by 232.1% to 284,015 contracts traded with a 6.1 billion USD notional value.

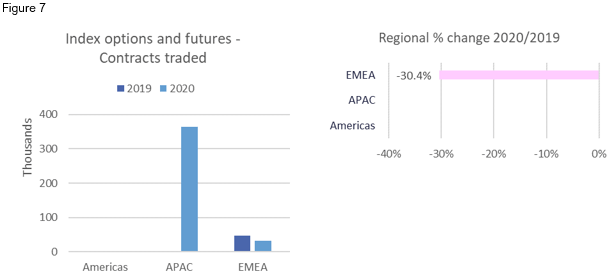

Index commodity derivatives options and futures volumes increased by 706.5% in 2020 to 395,678 contracts with a notional value of 5.5 billion USD. They are traded on Multi Commodity Exchange of India, BME Spanish Exchanges and Deutsche Borse.

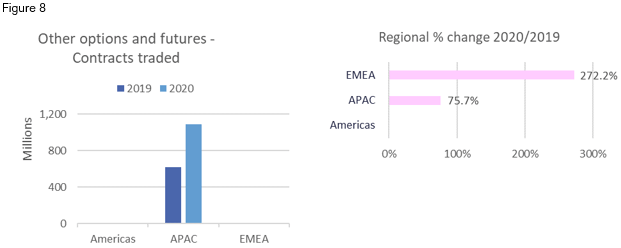

Other commodities options and futures recorded a 75.7% increase in 2020 to 1.1 billion contracts traded with a notional value of 4.9 trillion USD. This result is due to all exchanges witnessing an increased trading activity. Notable is the growth recorded by Zhengzhou Commodity Exchange where volumes went up by 77.4% to 620.5 million with a notional value of 2.4 trillion USD, Dalian Commodity Exchange increased by 73.7% to 467 million contracts traded with a notional value of 2.5 trillion USD, but also the increase registered on Singapore Exchange where volumes increased by 16.6% to 1.1 million and Nasdaq Nordics and Baltics where the number of contracts traded went up by 89.0% to 103,441 with a 720 million notional value.

[1] While we received the data from 70% of the market, several exchanges did not submit granular commodity derivatives by underlying.