Australian Derivatives and Decarbonisation: How Financial Markets Are Supporting the Energy Transition

As the climate crisis escalates, the world is looking for scalable solutions to accelerate the roll-out of renewable energy technologies and broader decarbonisation plans. While financial derivatives might not immediately spring to mind as having a useful role to play, they can make the transition cheaper and faster, by helping those involved to manage economic uncertainty and risk and incentivise scaled investment.

Key Points:

- Global carbon markets approached a record value of US$950 billion in 2023, helping to make possible the clean energy transition, and playing a key support role in efforts to decarbonise in many economies.

- Financial derivatives, such as futures contracts, have helped businesses to manage uncertainty and risk in various commodities since the 1800s.

- The Australian Securities Exchange (“ASX”) offers a range of derivative contracts that enable price discovery and hedging in the electricity, gas and agricultural sectors.

- To support Australia and New Zealand’s decarbonisation efforts, the ASX will be launching a new suite of Environmental Futures contracts serving the markets for Australian Carbon Credit Units, Large-scale Generation Certificates (LGCs), and New Zealand Units (NZUs) (1).

- These futures contracts will help to scale up carbon and renewable energy trading markets, which in turn will help speed the transition and lower costs.

The international renewable energy transition has long been supported by the development of liquid carbon trading markets, with the majority of volume transacted via derivatives.

According to the London Stock Exchange, global carbon markets approached a record value of US$950 billion in 2023, with European Union Allowances (EUAs)—the unit traded in the world’s most mature cap and trade system—making up the majority of this. Of the US$840 billion EUAs transacted in 2023, approximately 90% was via the derivatives market.

This derivatives-based international experience provides a powerful blueprint for growing the carbon markets in Australia and New Zealand. Derivatives have a unique ability to scale the size of the markets they represent by alleviating uncertainty.

Unpredictability is a major factor limiting the pace and scale of business efforts to decarbonise. This is driven by a range of factors, from evolving government policy to changing investor and consumer expectations. Addressing unpredictability and improving certainty is key to growing investment in the carbon market and maximising abatement potential.

In this article, we discuss how derivatives can support decarbonisation by reducing the risks associated with uncertainty, and we describe how the ASX plans to scale carbon markets in Australia and New Zealand.

Transparent price signals help to mitigate risk

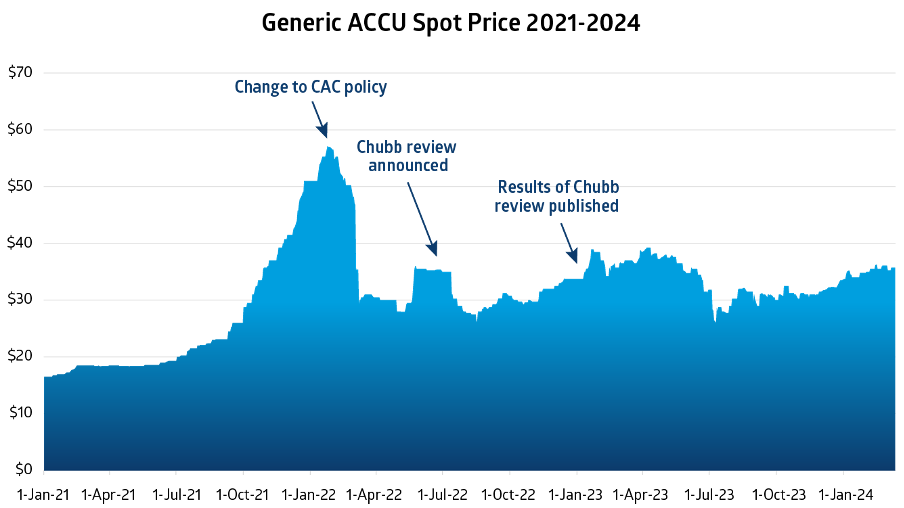

Two announcements in 2022 – both intended to support broader policy goals – highlight the impact of uncertainty on spot prices for Australian Carbon Credit Units (ACCUs).

In March of that year, the former Federal Government unexpectedly announced that carbon project developers with binding contractual arrangements to sell ACCUs to the government at a fixed price would have the option to exit these for a fee, and instead sell their ACCUs on the secondary market.

Uncertainty about the extent to which projects would exit their government contracts, and the impact this might have, saw the spot price drop, as seen in Figure 1.

Then, in July 2022, the current Federal Government launched an Independent Review of the scheme, the Chubb Review, which was followed by a dip in ACCU prices that lasted for the duration of the review. As a result, the generic ACCU price fell as low as $26 in August from a high of $57 at the start of the year. The impact of these two events on ACCU prices shows how uncertainty can contribute to market volatility. To mature and scale, carbon markets need access to risk management tools that can help businesses hedge exposure to this kind of uncertainty. Derivatives can be part of the solution.

The ASX already offers a number of commodity derivative contracts that enable price discovery and hedging across the electricity, gas and agricultural sectors, some of which help businesses to manage the renewable energy transition.

To further support Australia and New Zealand’s decarbonisation efforts, ASX plans to launch a suite of Environmental Futures contracts1 covering ACCU, LGC (Large Generation Certificates) and NZU (New Zealand Unit) markets. Contracts will initially be listed on an annual basis out to five years, providing a transparent forward curve for the market to price and hedge exposure.

These contracts can help the market manage the uncertainty of the energy transition.

Source: RepuTex EnergyIQ Platform (as of 12/03/2024)

Liquid forward pricing opens up access to capital

Currently, a lack of transparency in the spot and forward carbon and renewable energy markets is a major challenge to securing financing for carbon abatement and clean energy projects, both of which require significant time and capital.

Data limitations and inconsistencies make it difficult to know where the price of carbon or renewable energy is trading and how much volume is available in the secondary market. Without a robust daily price signal, growth in supplier financing is limited.

Liquid derivative markets provide clarity on projected short and long-term price trends, while also providing a mechanism to mitigate risk. These considerations, so important from an investor perspective, may improve the investment profile and attractiveness of decarbonisation projects, resulting in more capital flowing to initiatives that support the energy transition. Futures contracts,

in particular, are a tool that can support market confidence and transparency. In the case of ACCU Futures, this potentially means more money flowing into a range of carbon abatement projects that can make a real difference to Australia's decarbonisation efforts.

Market standardisation and credit intermediation leads to growth

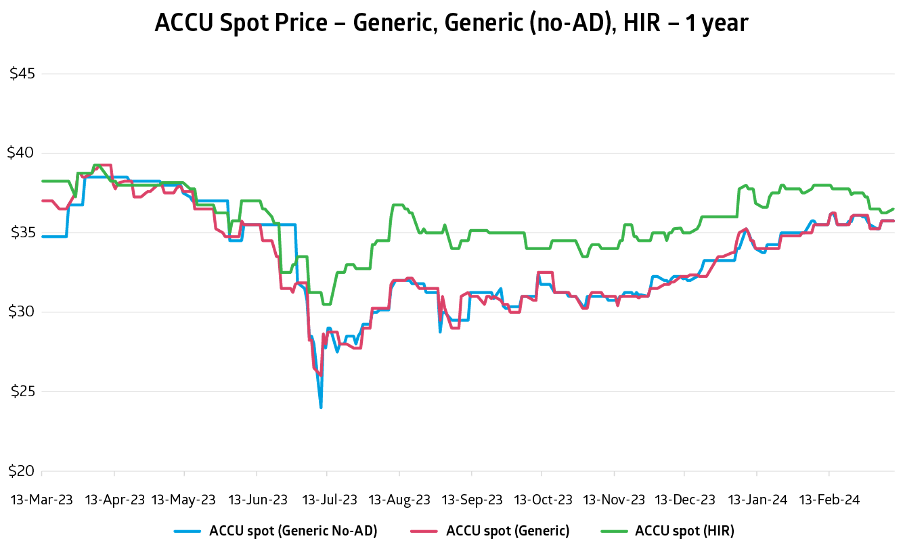

A key differentiating factor between futures and OTC derivatives is standardisation. In futures markets, terms and conditions are the same for all participants. In OTC markets, transactions can be tailored to meet individual requirements. This is clear in the ACCU OTC market where there is an established level of price stratification among various ACCU methods and co-benefits (see Figure 2). ASX ACCU Futures will be designed to be generic in nature, with one ACCU representing one tonne of CO2-e stored or avoided by a project.

While the OTC market provides increased flexibility for those seeking specific terms or co-benefits, the futures market can support more liquidity and participation due to the standardised nature of trading, and the reduced credit risk.

In futures markets, the Clearing House acts as the intermediary for all buy and sell transactions, effectively guaranteeing each side of a trade. Centralising credit exposure with the Clearing House opens up access to a diverse range of market participants and liquidity that is not available in the OTC market.

A standardised ACCU Futures market hosted by ASX will complement, rather than replace, the existing OTC market. The futures market will provide a generic price point around which liquidity can concentrate, and ACCU stratification and co-benefits can then be priced in the OTC market as a differential or basis to the futures.

Source: RepuTex EnergyIQ Platform (as of 12/03/2024)

Support for compliance buyers

Until recently, non-Commonwealth participation in the ACCU market was driven by companies looking to reduce their net emissions to support voluntary commitments, and by speculative investors hoping to benefit from price trends. However, the ACCU market is currently in a state of transition, with the reformed Safeguard Mechanism expected to drive demand for ACCUs going forward.

An increase in the number of compliance buyers under the reformed Safeguard Mechanism may change demand for various ACCU methods. The changing dynamic presents an opportunity for the futures and OTC markets to work in parallel to meet the needs of compliance and voluntary buyers in the secondary market.

ASX’s ACCU Futures will be physically delivered at the maturity of the contract. Customers holding a position at maturity will be required to either transfer or receive physical ACCUs via the ANREU registry. As a standardised futures contract, all ACCU methods eligible for surrender with the government will be accepted by ASX for delivery.

For buyers, there will be two ways to trade physically delivered futures:

- Buy the futures and hold a position to maturity, receiving physical ACCUs acceptable for surrender via the ANREU registry; or

- Use the futures to hedge forward price exposure out to five years and then close the position out (by trading the opposite side in the contract) before it reaches maturity. This effectively nets the futures position to zero, allowing the buyer to avoid ASX delivery.

Where a buyer prefers specific ACCU methods or co-benefits for surrender, the futures offer a way to hedge forward price risk without having to go to physical delivery. Buyers can close out their futures position before maturity and then use the OTC market to source preferred ACCU methods prior to surrender.

With a history of successful futures contracts and access to sophisticated risk management tools, ASX believes it can play a crucial role in scaling Australia and New Zealand’s carbon markets. If capital investment is the most efficient way to achieve emission reduction targets, then a liquid, robust and transparent carbon derivatives market can play a significant role in facilitating Australia and New Zealand’s decarbonisation efforts.

This article was originally published as a chapter in the Australian Carbon Market Institute’s 2024 CMI-Westpac Carbon Market Report.

1. Subject to final internal and regulatory approval

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.