Bursa Malaysia Develops Web-Based Game to Teach Children Stock Investment Concepts

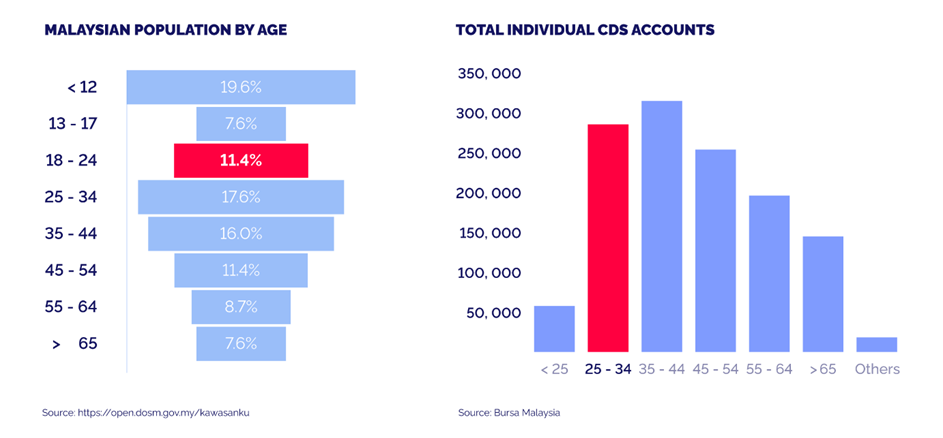

If we are to ask a room of Malaysian youths “What is a stock market?”, many would be hard pressed to provide an answer, let alone a correct one. There is an air of complexity to the stock market that causes the youth to shy away from investing and trading in stocks. While 65% of them are aware of stocks (according to a survey by the Securities Commission), only 4.4% of Central Depository System (CDS) accounts are opened by youths when this age group makes up 11.4% of the Malaysian population. Bursa Malaysia wishes to demystify the stock market with their brand new game titled Burmon Trader.

The Burmon Trader game is part of our overarching campaign ‘Bursa Beginnings’ to educate the youth. The game helps to provide a foundational level of knowledge to children aged between 8-14 years old.

Through the game, we are helping to plant early seeds of financial literacy at a young age, so that they can build their interest and knowledge over time. It is envisioned that by the time they reach 18 years old, the young adults will be equipped with the knowledge and understanding of the market, and thus be able to contribute to a larger portion of this demographic age group participating in investing and trading, to grow their wealth.

In addition, the programme considers the concept of “pester power” to result in actual trading from parents. The premise is that if the child is interested in the stock market, both the interest of the child and the parents in investing will be elevated. Seeing the parents investing in the market will also instil confidence in the stock market for the child.

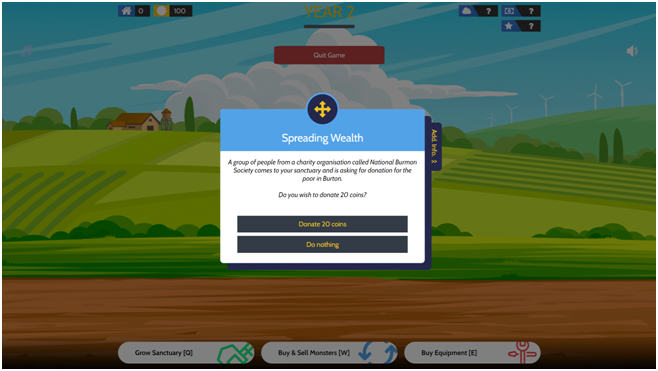

The game also aims to educate prospective investors and show that the stock market is not complicated. It achieves this by removing the intimidating and confusing terminologies in the stock market and replacing it with more approachable concepts. This helps the players to indirectly learn the concepts of investing, rather than feeling overwhelmed when market jargon is used.

In Burmon Trader, the Burmons are essentially the “stocks” that a trader buys and sells to generate capital gains. All Burmons gathered in one’s sanctuary is considered one’s “portfolio.” The prices of the Burmon are affected by factors like weather, local wealth, and magical surge in the area. To accurately predict the price movement of each Burmon, a player needs to perform their research and consider how the factors affect their Burmon prices. And in every step, the interactive app encourages its players to perform research in every action. From making a trading decision to reacting to random events, the need to perform their own research is heavily encouraged. This will help the player build their financial literacy and knowledge. It also creates awareness against financial scams that are becoming more prevalent these days.

As the players generate profit, they will have to decide whether to reinvest or use it to grow their sanctuary. Similar to real life, a person needs to learn how to balance their spending. Players would learn to balance expenditure and investment so that they do not come short in either category.

In the end, the game or platform generates a report so that the player can reflect and learn from their trading performance. Players can see their trade statistics, their random event performance, and a list of their trades. They can use this to identify any weaknesses they can improve on in future game sessions. And since the game is short, this encourages them to put the new information they have learned into use immediately.

Burmon Trader was launched on Aug. 5, 2023, at the Bursa Marketplace Fair which was officiated by the Malaysian Deputy Minister of Finance 1, the Honourable Datuk Seri Ahmad Maslan. It was well received from retail investors and brokers, and over 500 games were played during the first few days of its launch.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.