The Importance of Central Counterparty Clearing in the Growth and Development of Emerging Markets

A common challenge faced by emerging market economies is their ability to attract greater foreign capital investment. Foreign investors seek out investment opportunities in emerging markets as part of a portfolio diversification strategy while achieving higher investment returns compared to investments in developed economies. Emerging markets often experience faster economic growth and higher investment returns; however, this may come with greater investment risks including political instability, lack of dependable and transparent information, currency fluctuations, lower liquidity and investment volatility.

Emerging markets generally do not have the sophisticated financial markets and regulatory frameworks found in developed jurisdictions. As emerging markets grow and develop, their integration with the global economy deepens, resulting in increased trade volumes in local debt and equity markets and more foreign direct investment. Global standards in domestic financial market infrastructure and regulatory policies are essential foundations on which to service this increase in local and foreign trade activity. As a result, emerging markets may adopt the regulatory frameworks and policies of the developed markets that are their primary or largest trading partners, to minimise investment friction.

Demand for CCP Clearing in Emerging Markets

Following the 2008 financial crisis - where CCP clearing had proven its resilience by minimising the contagion impact of the Lehman Brothers default - regulators of developed markets moved to mandate CCP clearing for standardised over-the-counter (OTC) derivative contracts. Regulators also imposed margining (collateral) requirements and higher regulatory capital charges on banks for all non-centrally cleared derivative contracts, as a further incentive for CCP clearing. While these regulations were initially targeted primarily at OTC derivatives, CCP clearing for listed derivatives and cash/securities markets had seen widespread global adoption, and most especially in the developed markets.

CCP adoption in developed markets has applied significant pressure on emerging markets to implement CCP clearing to maintain and grow trading activities with developed markets’ investors. In emerging markets where CCP clearing has not yet been mandated or where CCP market infrastructure is not readily available, clearing mandates on foreign trading counterparties often result in adverse operational burdens and costs for domestic trading participants. For example, domestic banks in countries without mandatory clearing requirements or a domestic CCP clearing service, may be indirectly forced by their foreign counterparties to clear at a foreign CCP at a higher cost and increased operational overhead. This challenge is quite common in emerging markets where the majority of local denominated OTC derivatives may be traded outside of the home economy. Domestic banks in emerging economies often trade with foreign banks to offset risk exposures assumed from their trading activity with domestic non-bank financial institutions i.e. buy-side and corporate clients. These foreign banks are usually global systemically important financial institutions (G-SIFIs) that are subject to supervision in jurisdictions where central clearing has already been mandated e.g. the U.K., the EU and the U.S.

Even if trades are not required to be cleared, foreign counterparties are likely to encourage clearing to avoid punitive regulatory capital costs on their reported trade exposures, and the operational complexities of posting and managing margins and collateral on non-cleared transactions.

Indirect foreign clearing may not be feasible from an economic and risk management perspective. Local banks in emerging markets may face challenges in accessing foreign CCPs as a direct clearing member due to the large upfront capital investment required, with system setup and integration costs, membership compliance including a large capital reserve or bank guarantee, default fund capital, and the necessary business and IT operational support teams.

Foreign CCPs may allow only banks with a certain sovereign credit rating level to be eligible for direct clearing membership. This could pose a challenge for emerging market banks if their sovereign credit rating is below the foreign CCPs’ thresholds, or is sub-investment grade.

The alternative to becoming a direct clearing member of a foreign CCP is to opt for client clearing through a general clearing member of the CCP, often provided by large foreign banks. While this option may require less upfront capital and may have less operational complexities than direct clearing, it does come with its own set of challenges. Client clearing may create a high dependency on large foreign clearing member banks, increasing systemic concerns of concentrating risk at these banks and thus increasing their systemic importance. Clearing indirectly through an existing clearing member of a foreign CCP may also come at a high price, depending on the volume and exposures being cleared.

Competition issues may also arise if only a few banks can offer access to the foreign CCP, although global CCPs usually have many members. The implications of CCPs’ access rules could result in higher costs for indirect clearing and also limit the ability of dealers that clear indirectly to compete in other market activities. Furthermore, if the market for clearing services is insufficiently competitive, a dealer whose access is controlled by a clearing bank may see their access constrained at the discretion of that bank.

Clearing Rates Increase Substantially for Emerging Markets

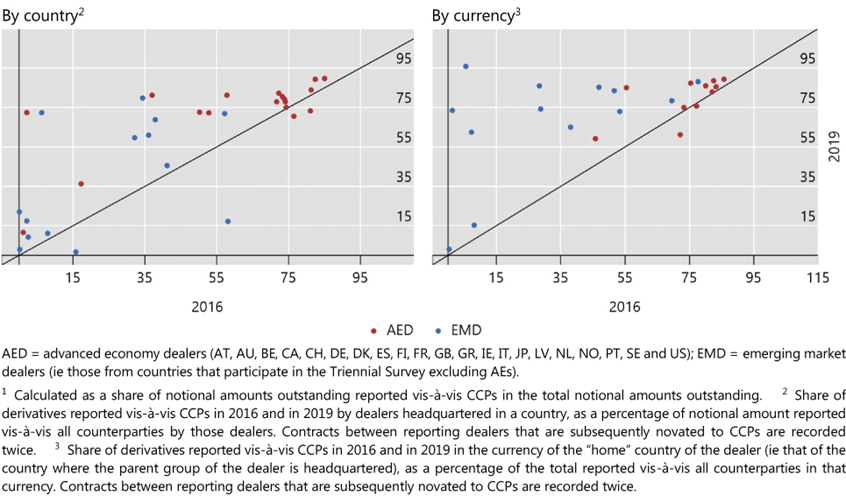

The clearing rates of emerging market economies’ (EME) dealers caught up with those of advanced economies’ (AE) dealers over the past three years. AE dealers generally reported higher rates than those from EMEs and were approaching full clearing, while rates increased substantially for EME dealers (Graph - left-hand panel). AE currencies had higher clearing rates, while EME ones exhibited more substantial growth in central clearing (right-hand panel).

Interest rate derivatives at June 2019, %

Source: Aramoto, S. and Huang, W. (2019): “OTC derivatives: euro exposures rise and central clearing advances,” BIS Quarterly Review - December 2019.

Benefits of Domestic CCP Clearing in Emerging Markets

Emerging markets stand to realise several benefits from having a domestically located, and internationally equivalent, CCP in place. These extend beyond the foundational benefits of improved counterparty credit risk, transparency and robustness that CCPs provide, and include benefits relating to market attractiveness, growth and regulatory credibility.

The introduction of CCP clearing has been found to contribute positively to market liquidity through the reduction of counterparty risk and the associated risk-based costs of trading. Low liquidity in financial markets can be a major obstacle to economic growth and development in emerging economies because it can lead to inefficient pricing, high transaction costs and a lack of access to capital. A 2018 ISDA report (“How clearing houses improve trade liquidity”) estimated that the central clearing of OTC derivatives has increased trade liquidity in both developed markets (by 20% - 40%) and emerging markets (by 10% – 20%). A domestic CCP that has international recognition can reduce regulatory compliance barriers and punitive capital costs for foreign banks that are subject to supervision in jurisdictions where central clearing has already been mandated, removing friction for these banks to gain direct access to domestic markets.

For local market participants, clearing through a domestic CCP can provide several cost efficiencies. More efficient asset utilisation is realisable because local cash and securities are used for collateral, rather than hard currency and the foreign securities required by foreign CCPs. The offshoring of margin capital and bifurcation of collateral liquidity pools to foreign CCPs can be minimised, and participants are not hampered by domestic exchange control restrictions that would otherwise be applied to margins paid in foreign currencies to foreign CCPs. Clearing fees and memberships are charged and paid in domestic currency, thereby avoiding unfavourable exchange rates and currency risk. Domestic CCPs are also able to provide a clearable product range that best services the specific needs of the domestic market. Clearing membership requirements may also be proportionate to the market.

A domestic CCP provides an opportunity for domestic market participants and clearing banks to have far stronger influence and input into the strategic direction of the CCP and the markets it clears. Reliance on foreign authorities to take actions that benefit national financial stability is reduced. Local regulators have the benefit of greater market oversight and control over trading activities and risk exposures in the domestic market and are empowered to place the highest priority on the protection of domestic entities and on the recovery and resolution of the CCP if required. The impacts of global shocks that may be otherwise transmissible through participation in default funds at foreign CCPs are reduced through a dedicated default fund for the domestic market.

Challenges of Domestic CCP Clearing in Emerging Markets

Notwithstanding the multiple, and foundational, benefits that developing a domestic CCP provides, there are a few challenges that must be addressed.

The size of the domestic clearable market needs to be sufficiently large to allow for a sound business case for developing a domestic CCP, given its high setup costs and capitalisation requirements. In smaller jurisdictions where trade volumes and the number of market participants are low, the CCP costs can only be distributed among fewer counterparties and trades. As a result, either the price of clearing, or the risk management framework of the CCP - or both – may suffer.

There is a risk of bifurcation of trade positions i.e. breaking up trade netting sets, and the resultant increase in margin requirements that could be avoided if cleared through a single CCP. This challenge could arise in the case where a local market-making bank trades with a local client and clears that trade at the domestic CCP, while their hedge trade is done with foreign counterparty and cleared at a foreign CCP. In this case the position offset of the two trades done by the local bank is not recognised by either CCP, requiring them to place margin capital at both CCPs.

A highly concentrated and interconnected financial system of smaller countries could pose a challenge to a domestic CCP to be a true firewall in stopping contagion in the event of a member default. A default of a large local bank could place a high burden on the few surviving clearing members to help the local CCP in hedging and liquidating the positions of the defaulter and to help maintain the operations of the CCP. Larger default funds at offshore CCPs could benefit local clearing members in terms of default loss absorption.

Conclusion

The introduction of a domestic CCP contributes positively to the growth and development of emerging markets and their integration with the broader global economy. CCPs are critical financial market infrastructures that can increase the attractiveness and liquidity of an emerging market and help to ensure that emerging markets are able to take advantage of the opportunities presented by the global economy. A domestically operated and internationally equivalent CCP reinforces the overall credibility of the regulatory, legal and governance frameworks on which the domestic market is based, and positively impacts the reputation and credibility of the country as a whole – these are key foundations of market development.

For further information on WFEClear: The WFE’s Clearing and Derivatives Conference 2023, see https://wfeclear.wfecm.com/

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.