Futures for the Electric Vehicle Future

Electric vehicles (EVs) are one of the big stories of the energy transition, and the growing EV fleet is having an outsize effect on commodity markets. Established products like aluminium and copper are feeling the effects of increased demand, and smaller markets like cobalt and lithium are experiencing exponential growth. These developments are leading to price volatility and the need for predictable commodity sourcing and pricing. CME Group is seeing significant take-up of its metals futures markets from EV hedgers and has rolled out new contracts to support the EV revolution.

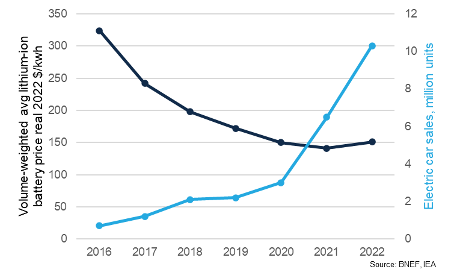

Technological breakthroughs in battery technology and economies of scale in the production of batteries have drastically improved the cost competitiveness of EVs versus internal combustion engine (ICE) vehicles. While China is ahead of other regions in terms of market penetration, it is truly a global trend towards higher EV adoption.

Chart 1 - Lower costs for batteries and higher adoption rates

In light of this EV market growth and wider decarbonisation efforts in the global economy, which metals stand to benefit the most? Copper and aluminium are old stalwarts of the global metals landscape – widely used across industries and applications and with a rich history of being traded on commodity exchanges. The energy transition is adding a new angle to that story – copper, in particular, will be in high demand because it is so versatile and used in energy storage, EV charging infrastructure and related applications. For instance, the International Energy Agency estimates that “clean energy technology” may account for more than 40% of total copper demand1. Due to its low weight, aluminium can be helpful in offsetting the weight of EV batteries, and thereby increasing vehicle range. Aluminium is also required to construct solar panels. In total, BloombergNEF estimates that 30%-40% of global aluminium demand will be tied to the energy transition2.

If copper and aluminium are old stalwarts, that makes cobalt and lithium the new kids on the block of the metal trading universe. Ten or 20 years ago, these metals were used in niche applications, such as superalloys or magnets (in the case of cobalt) or the production of ceramics and glasses (lithium). Because volumes were small, and the universe of participants limited, trading was often done using fixed-price long-term contracts. The introduction of lithium-ion batteries, first for consumer electronics and then progressively in EV batteries, has dramatically changed this once tranquil landscape. Market analysts forecast that overall demand for lithium-ion batteries may grow by 30% year-on-year over the coming decade3. Expectations are that EVs will dominate demand and account for 90% or more of the total consumption of lithium and cobalt4. The industry has had to adapt to this new environment by changing long-established practices. For instance, lithium procurement is now often tied to spot prices, or formula indices that reflect current market pricing.

The required ramp-up in supply required to meet this demand surge may pose challenges to the mining industry. In the case of cobalt, supply is heavily concentrated in the Democratic Republic of Congo, and cobalt is often extracted as a by-product of copper and nickel production – meaning, what happens with these metals can influence how much cobalt will be produced. In the case of lithium, supply is more evenly distributed with mining in Australia, the South American “lithium triangle” (Argentina-Bolivia-Chile) and other regions. But lithium faces other challenges – it does not store well, meaning that stocking excess production to clear the market is, at best, an imperfect solution. With industry growth rates of around 20%-40% annually, small shifts in the supply/demand balance can have a huge impact on prices – something witnessed over the past 36 months. Over that time, lithium went into a wild ride with spot prices growing by a factor of 6x, before coming back down to earth.

Chart 2 – lithium spot prices - back to earth

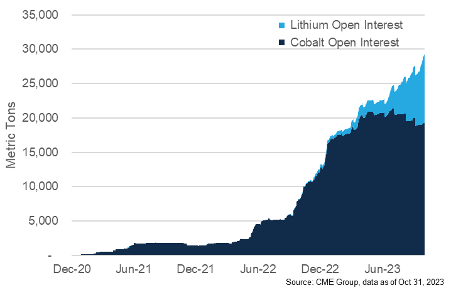

The chart above would most likely send a shudder down the spine of any corporate treasury risk manager. Fortunately, financial derivatives are quickly evolving to help manage that cobalt and lithium price risk. In the case of cobalt, CME Group entered the fray back in 2020. The Cobalt Metal futures contract, which tracks the price of metal stored in Rotterdam warehouses – conveniently located between America and Asia – has quickly found adoption by industry participants as documented by a steady rise in open interest to around 20,000 tons (or about 10% of annual world production). In quick succession, CME Group also launched a Lithium Hydroxide futures contract, which tracks the import price of battery-grade lithium hydroxide into North Asia, the main hub for battery manufacturing. Over the past year, the contract quickly grew to around 10,000 tons open interest, versus an overall annual production of around 800,000 tons5 in 2023.

Chart 3 – Open Interest on the rise

Growing awareness of hedging activity in these markets has led to demand for more products tailored to the battery supply chain. These new contracts offer even more granular hedging of risk: participants are now able to directly trade and hedge cobalt hydroxide (the material that typically finds its way into batteries via chemical refining) and lithium carbonate (a lithium product similar to hydroxide, but best suited for different types of batteries). While the derivatives market for battery metals is still in its infancy, growth rates and contract adoption are progressing swiftly, reflecting the ramp-up in activity and volumes moved in the “real world”.

In summary, the electric vehicle revolution is having a deep impact on the metal markets used to produce the necessary batteries and the accompanying infrastructure. The effect will be felt across well-established, traditional markets such as copper and aluminium, as well as in smaller markets such as cobalt and lithium. To manage price gyrations in these metals, derivatives markets are emerging. CME Group is at the forefront of this development with an active market in both cobalt and lithium futures and a suite of products designed to cover a variety of price risk exposures across the EV supply chain.

2 https://www.bloomberg.com/professional/blog/how-to-benchmark-energy-transition-trends-in-2023/

4 footnote 1

5 https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/metals/122222-lithium-prices-likely-to-see-support-in-2023-from-tight-supply-bullish-ev-demand

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.