Commodity derivatives in 2023

Ahead of WFEClear, the WFE’s Clearing and Derivatives Conference, taking place in March 2024, this note provides some insights into the performance of commodity derivatives in 2023.

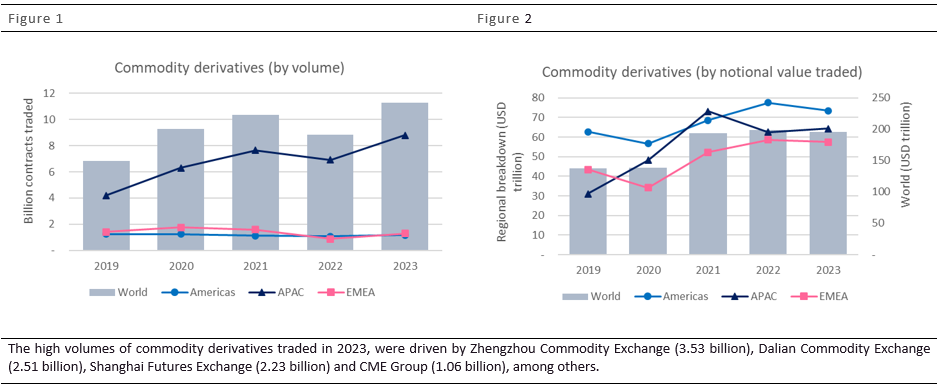

Overall, compared with 2022, in 2023 saw a substantial increase in trading activity in derivatives across all regions. The number of contracts traded increased globally (by 27%) and across regions (Figure 1). However, the increase seems to be driven by trading in smaller size contracts, since the notional value traded showed a slight decrease of 1.8%, with the Americas and EMEA regions contracting 5.3% and 1.9%, respectively (Figure 2).[1]

With regards to the type of contracts traded, volumes of futures contracts (which account for 86% of the commodity derivatives) rose by 18.2% while option and options rose by135.8%.

During 2023, some commodity markets experienced increased volatility due to geopolitical and climate-related events: in Africa, concerns about the weather anticipated rising prices of agricultural products, like cocoa. The war in Ukraine and the conflict in Gaza have affected energy prices; with the latter also impacting freight costs, as the maritime routes through the Suez Canal were disrupted.

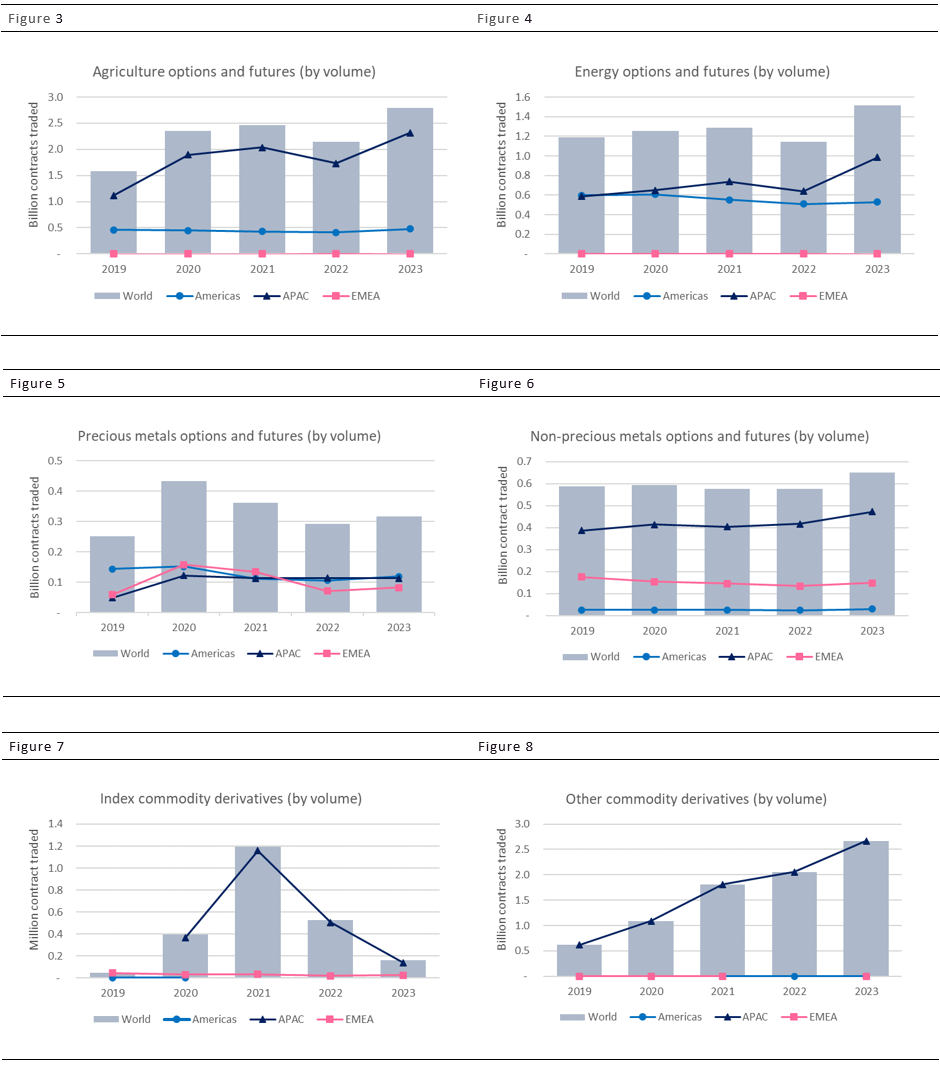

Not surprisingly perhaps is then the notable increase in 2023 of trading volumes on agricultural (Figure 3) and energy contracts (Figure 4). In both cases, the increase was driven mostly by the APAC markets. Activity in precious and non-precious metals also increased but by smaller amounts (Figures 5 and 6).

An interesting case is that of commodity indexes (Figure 7). These contracts are mainly traded in APAC and reached a peak in volumes in 2021. Since then, volumes have significantly decreased, including in 2023.

Finally, we saw a large increase in other type of commodity contracts (Figure 8), which include freight derivatives. However, this increase does not appear to be exclusively driven by the events of 2023, but it is the continuation of a longer trend starting at least since 2019.

The data used for this note is available on the WFE Statistics Portal and indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team at [email protected]

[1] As with other products, there is a large variation in contract sizes across markets.