The decrease in listings in SME markets

By Dr Pedro Gurrola-Perez, Head of Research, WFE

For many years, exchanges have implemented dedicated platforms to facilitate Small and Medium Enterprises (SMEs) obtaining finance through the public markets. These SME markets or SME Boards offer more relaxed listing requirements to cater for the specific needs and circumstances of SMEs. In some cases, an exchange may target specific activity segments (for example, a market focusing on technology companies), or have more than one dedicated SME market.

The WFE database collects information about the exchanges’ SME or alternative markets, including their market capitalization, the number of firms listed in that market, or the total capital raised. These indicators are an important source of information to understand the dynamics of SME markets globally.

In this note, we will focus on two indicators, market capitalisation and the evolution of new listings in the last eight years.

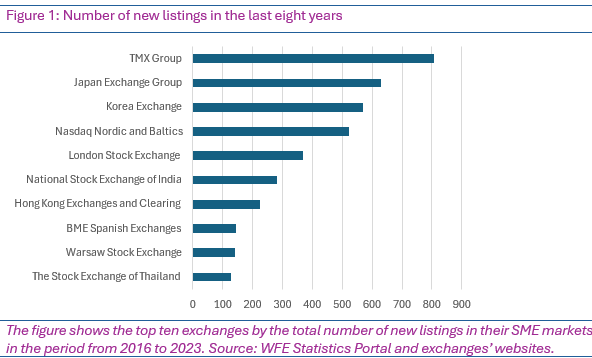

Figure 1 shows the ten exchanges whose SMEs attracted the largest number of new listings in the last eight years. At the top of the list is TMX Group, whose SME platform, the TSX Venture Exchange, attracted more than 800 new listings between 2016 and 2023. It is followed by the Japan Exchange Group, who has four SME markets: JASDAQ Standard, JASDAQ Growth, Mothers, and Growth Market. In third place we have the Korea Exchange with its Kosdaq market. It is worth noting that the Kosdaq market is also a very liquid market: in 2023, it surpassed the trading volume of the main market Kospi.

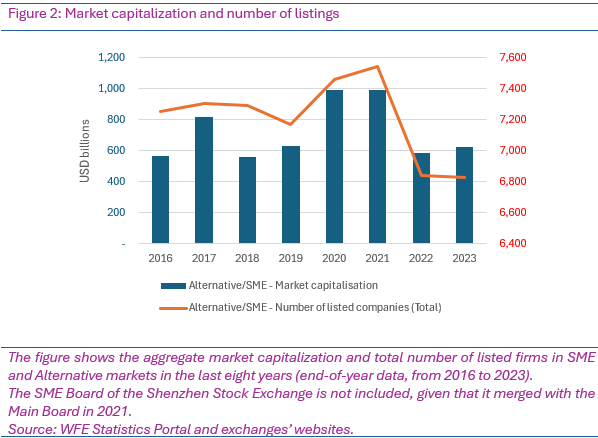

Looking at the evolution of market capitalization and of the total number of listings reported by SME markets in the period 2016 to 2023, we observe some interesting patterns (Figure 2). First, it seems clear that, after 2021, there is a sharp fall across SME markets, both in market capitalisation and in number of listings.

It is also interesting to see how in 2020 there was an increase in market cap and in number of listings and how these values remained high through 2021; a result that may appear counterintuitive, given the uncertainties the world faced in those years. But it is worth remembering that in those years we also saw unprecedented economic stimuli (low interest rates, recovery packages, loan guarantees, fiscal rules flexibility, etc.) and that for many small companies the pandemic offered new business opportunities (think of technology firms offering video-conferencing platforms, for example). At the same time, and not less important, the exchanges implemented different measures to help SMEs financing through public markets.[1]

On the other hand, looking at the data, one could argue that, if we assume that the growth observed in 2020 was exceptional, the decreasing trend in number of listings probably started as early as 2018.

Further research is needed to understand what the trends are at regional, country, and sector levels and what factors are driving them. But, in any case, a decrease in the size of SME markets is certainly not good news.

If you have any questions or comments, please contact Pedro Gurrola-Perez at [email protected]

[1] See the WFE report “Exchange issuer-related initiatives- Can responses to the pandemic encourage greater SME listing?”