Exchange ESG initiatives and Environmental Performance

Exchange ESG initiatives and Environmental Performance

Written by Dr. Kaitao Lin, Senior Financial Economist at the WFE

In an era where environmental sustainability and responsible corporate governance have become pivotal global concerns, understanding the intricate relationship between exchanges and Environmental, Social, and Governance (ESG) initiatives is of paramount importance. This analysis delves into the connection between environmental performance and the adoption of ESG initiatives by exchanges worldwide. By examining data from diverse regions, income levels, and specific ESG initiatives, this article aims to elucidate how exchanges contribute to, and are influenced by, the pursuit of sustainability and the enhancement of environmental performance. The findings highlight the role of exchanges in promoting ESG principles and underscore their potential to drive positive change in the environmental performance of their respective jurisdictions.

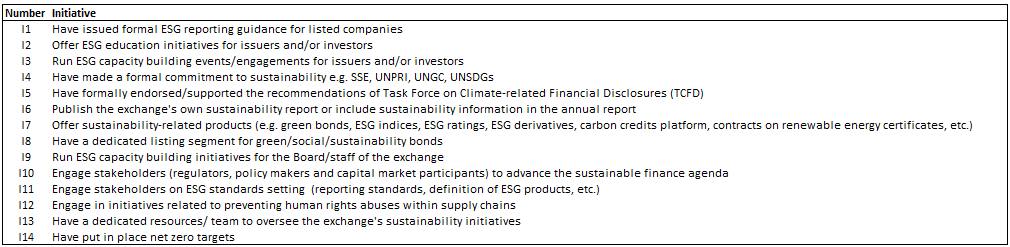

This analysis draws data from various sources. To begin, we obtained the Environmental Performance Index (EPI) for the year 2022, developed by Wolf et al. (2022) and sourced from the Yale Center for Environmental Law & Policy. The EPI assesses the environmental performance of each country by evaluating three key objectives: climate change, environmental health, and ecosystem vitality.[1] Additionally, our study makes use of the 9th Annual Sustainability Survey for 2023 conducted by the World Federation of Exchanges (WFE), which provides valuable insights into the sustainable initiatives of exchanges.[2] A detailed list of these initiatives is presented in Table 1. We match these two datasets based on the geographic locations of the exchanges. To facilitate our analysis, we categorize jurisdictions according to the World Bank's region and income group classifications. For the purpose of this article, we focus exclusively on jurisdictions with at least one WFE member.

Table 1. List of exchange ESG initiatives

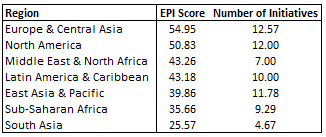

Table 2 provides insights into the average Environmental Performance Index (EPI) scores and the number of ESG initiatives implemented per exchange within each region. Notably, there is a discernible pattern wherein regions with higher EPI scores tend to exhibit a greater commitment to ESG initiatives. For instance, both Europe & Central Asia and North America boast EPI scores surpassing the 50-point mark, and coincidentally, they lead in the implementation of ESG initiatives with averages of 12.6 and 12, respectively. Conversely, South Asia reports the lowest EPI score among the regions, and correspondingly, the exchanges in this region exhibit a comparatively lower level of engagement in ESG initiatives.

Table 2. Exchange ESG initiatives by region

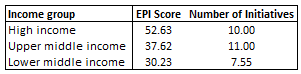

Table 3 categorizes our sample based on the income levels of the respective jurisdictions, namely, high income, upper middle income, and lower middle income. It presents the average EPI scores and the number of ESG initiatives per exchange for each category. The findings reveal a clear correlation between income level and commitment to ESG initiatives, with higher income jurisdictions demonstrating stronger engagement and achieving higher EPI scores. For instance, high income jurisdictions exhibit EPI scores exceeding 50 points on average, with exchanges in this category boasting an average of 10 ESG initiatives.

Table 3. Exchange ESG initiative by income group

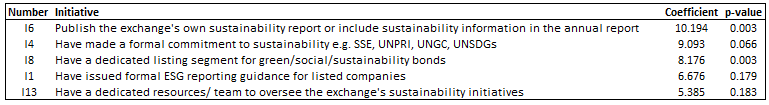

In our quest to delve deeper into the nature of ESG initiatives adopted by exchanges and their connection with the EPI score, we conducted a regression analysis. The variable EPI Score represents the environmental performance score of the exchange's jurisdiction, while Initiative consists of a set of binary variables indicating the presence or absence of specific ESG initiatives within the exchange. Additionally, we accounted for the income level of the respective jurisdictions in our analysis as a control variable.

Table 4 displays the estimated coefficients and their corresponding p-values for the top five ESG initiatives, ranked by the magnitude of the coefficient. The initiative that stands out as the most influential is the one related to "Publishing the exchange's own sustainability report or including sustainability information in the annual report." Notably, this initiative is statistically significant at a 99% confidence level, suggesting that exchanges committed to this practice are associated with a substantial 10-point increase in the environmental performance score of their respective jurisdictions. Following closely, the initiatives "Having made a formal commitment to sustainability" and "Maintaining a dedicated listing segment for green/social/sustainability bonds" demonstrate similar coefficients of 9.09 (with a p-value below 0.1) and 8.18 (with a p-value below 0.01), respectively, indicating their significant impact on environmental performance. In the third and fourth positions, we find the initiatives "Issuing formal ESG reporting guidance for listed companies" and "Establishing a dedicated resources/team to oversee exchange sustainability initiatives." While these initiatives do not reach statistical significance, they still possess considerable economic significance, with coefficients of 6.68 and 5.38, respectively.

Table 4. Top ESG initiatives

The analysis explores how exchanges and their involvement in Environmental, Social, and Governance (ESG) initiatives can impact a region's environmental performance. Key findings revealed that exchanges in regions with higher Environmental Performance Index (EPI) scores are more likely to engage in ESG initiatives. High-income jurisdictions show a strong commitment to ESG practices and tend to achieve higher EPI scores. The most influential ESG initiative is the publication of sustainability reports, associated with a significant increase in environmental performance. While not all ESG initiatives show statistical significance, the overall takeaway is that exchanges play a crucial role in promoting sustainability and environmental responsibility in their regions.

This report is part of the ongoing WFE Research project on the role of exchanges on ESG development. If you have any question or comment, please contact Kaitao Lin ([email protected]).

Reference:

Wolf, M. J., Emerson, J. W., Esty, D. C., de Sherbinin, A., Wendling, Z. A., et al. (2022). 2022 Environmental Performance Index. New Haven, CT: Yale Center for Environmental Law & Policy. epi.yale.edu

[1] For more information, see https://epi.yale.edu/downloads/epi2022technicalappendix.pdf

[2] To read the full report, see https://www.world-exchanges.org/our-work/articles/the-wfes-9th-sustainability-survey