Exchanges maturing in ESG leadership - new WFE sustainability survey

The WFE has published its fourth annual Environment, Social and Governance (ESG) survey of member exchanges, which shows nearly 90% are embracing sustainability initiatives.

The WFE survey captured the nature and engagement with ESG issues by member exchanges in both developed and emerging markets.

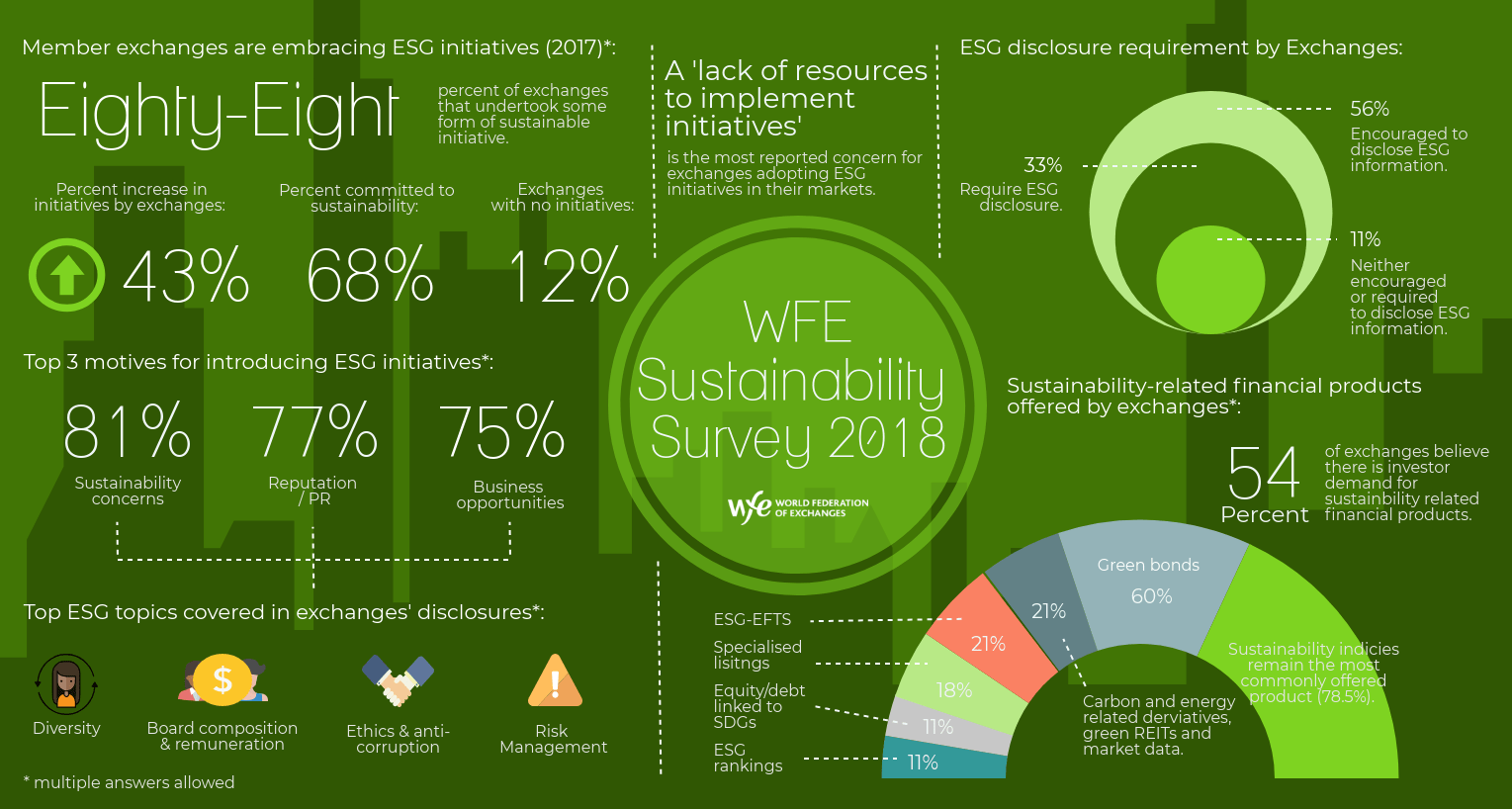

Overall, member exchanges continue to leverage their position to adopt more sustainability initiatives in their respective markets. Exchanges are prioritising the long-term sustainability of the financial system to educate more market participants, proactively drive ESG disclosures, and increase the number of sustainability products offered in their markets. Some exchanges said a lack of resources has hindered the adoption of ESG initiatives, as has insufficient demand, and there are reservations about the potential impact of these initiatives.

The survey also highlights the continued divergence of investor demand between emerging and developed markets in adopting and supporting sustainability initiatives. Despite lower investor appetite for ESG-related initiatives, many exchanges across emerging markets are gearing-up their efforts to incorporate sustainability-related financial products.

Perceived investor demand for ESG disclosure increased from last year, while the demand for sustainability products has remained broadly the same as 2016.

You can download the full survey here. Key highlights from the report include:

- Overall, 88% of member exchanges embrace some form of ESG initiative, and 43% of exchanges have increased the number of initiatives (that took part in last year’s survey).

- 73% of ESG disclosures for listed companies were driven by the exchange, rather than the market regulator, in each market.

- Seven exchanges have adopted the Task Force on Climate-Related Financial Disclosures (TCFD) Recommendations, while a further 11 are planning to incorporate these recommendations soon.

- Exchanges are leading by example with 57% incorporating ESG factors into their own reporting, up from 48% in 2016.

- Investor demand for ESG disclosure has increased to 70% in 2017 from 64% last year, and 54% of exchanges believe there is demand for sustainability-related products.

- 70% of exchanges that reported no investor demand are either from emerging or smaller exchanges within the EMEA region. And;

- The number of exchanges offering green or climate bonds has increased to 15 from eight last year, while sustainability indices remain the most commonly offered product.

Nandini Sukumar, CEO, WFE said: “Exchanges are using their position within the financial system to transition the global economy towards more sustainable development. This survey reveals an increasing maturity through proactive engagement with market participants, more transparency for listed-companies, and a reorientation of investment towards a more sustainable financial system.”

Siobhan Cleary, Head of Research & Public Policy, WFE, added: “More exchanges offering more ESG products, for example sustainable indices and green bonds, and encouraging more ESG disclosure of listed-companies, is creating a favourable market for sustainability.”

The survey was conducted in 2018 by the WFE and covers the 2017 period, focusing on three key themes: exchanges and their sustainability initiatives, transparency and reporting, and sustainability products and investor demand. The results were compiled from questionnaire responses supplied by exchanges and their clearinghouses.