Small Financial Transaction Taxes Create Big Economic Impacts

This U.S. stock market has significantly outperformed global markets in the past decade. It remains a leading venue for IPOs and capital formation. That’s been great for U.S. investors and pensions.

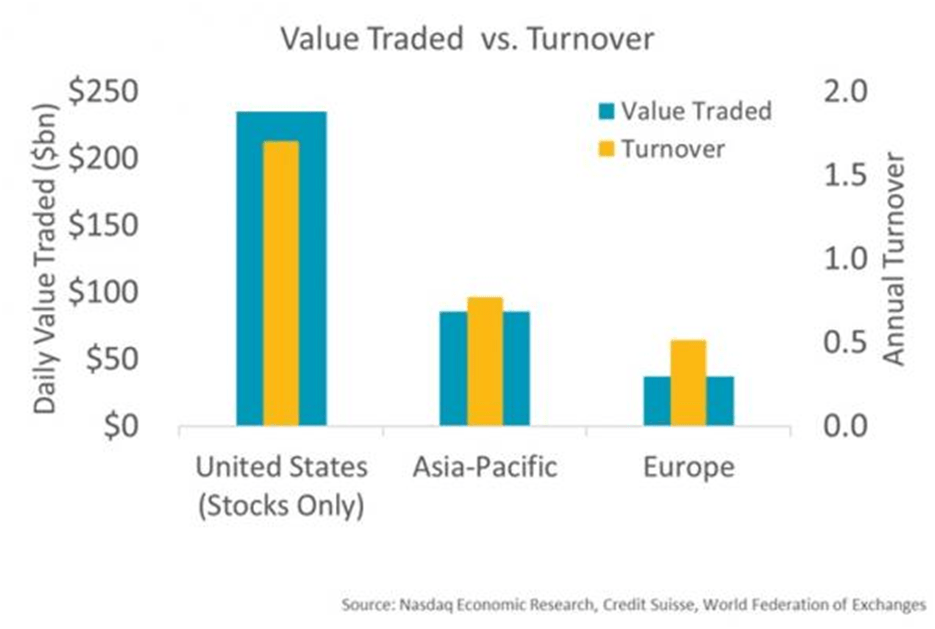

It helps that the U.S. market is also the most liquid (Chart 1) and least expensive market in the world. In fact, looking at turnover, U.S. stocks are more than twice as liquid as stocks in other regions.

Chart 1: The U.S. has the deepest, most liquid market in the world

Other data shows that deeper liquidity and smaller spreads are shown to reduce costs of capital, and increase valuations, for companies. They find that even small cost savings can have a big impact.

What makes US markets different?

There are a number of reasons the U.S. market has lower costs, from economies of scale, to a stable currency and a moderate and consistent environment.

But one thing the U.S. doesn’t have, that many countries in Europe and Asia-Pacific do have, is a Financial Transaction Tax (FTT).

Data suggests that even if these taxes are small, data suggests they can hurt a country's market liquidity and international competitiveness.

Research finds Transaction Taxes are harmful to the economy

This debate isn’t theoretical. There is a lot of data and case studies that support these findings.

Over two dozen (mostly emerging) countries have FTTs and at least a dozen more (mostly developed) countries have repealed FTTs. An IMF Summary of FTT studies concluded that FTTs consistently:

- reduced company valuations

- raised the cost of capital for issuers

- increased bid-ask spreads

- reduced order book depth

- reduced trading volume

- slowed price discovery

FTTs hurt liquidity

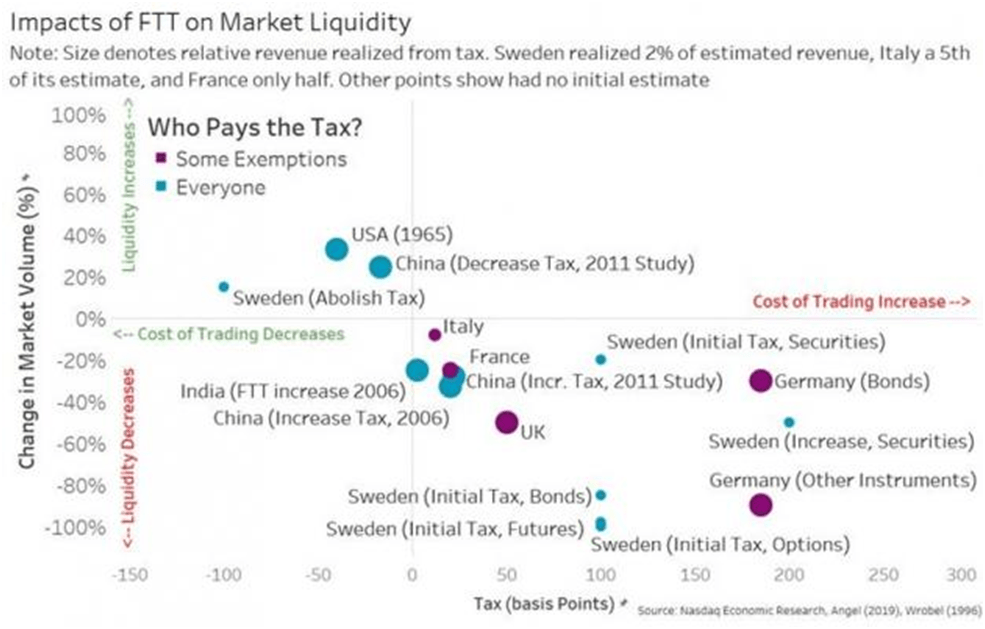

There are also a number of specific studies of FTTs. Nasdaq combined the results from many of these studies, (including by Angel, Two Sigma, Tax Foundation, IMF, Wrobel) in Chart 2 and 3 below. They found a consistent downward sloping diagonal of the data that shows taxes harm markets when they are added, and markets recover when they are reduced or removed. They diagonal nature of the dots in the chart shows that

- Larger cost changes cause a larger changes in liquidity, and when costs go up, liquidity goes down. That also ultimately reduces tax revenues collected

- When taxes are removed or reduced, the opposite happens, and market quality and competitiveness improves

Chart 2: Comparing the impact on liquidity of trading cost changes

There are useful case studies to consider too.

For example, when Sweden implemented its FTT, 50% of share volume moved to London almost immediately. Futures volumes fell 98%, bond trading fell 85% and the options market shuttered. As a result of activity moving to lower cost countries, the tax collected was a mere 3% of estimates. Sadly, even after the tax was removed, it’s considered by some that Swedish markets never recovered their previous status in Europe.

Some markets exempt market makers in an effort to retain market efficiency and liquidity. This impacts volumes less, but it also limits taxes collected.

For example, recent EU FTTs in France raised less than one-half of its expected revenue, and in Italy less than one-fifth.

In the U.K., the stamp duty taxes only apply to around 30% of trading. That’s partly because the industry has engineered a contract for difference (CFD) market to help investors minimize trading costs. Its possible that CFDs, by deferring actual cashflows for trades, added to European systemic risks, including helping to hide multi-billion-dollar ETF losses at SocGen and UBS.

Based on the data in chart 2, a relatively small increase in costs leads to a significant reduction of volumes, and therefore taxes collected.

Trading costs also hurt valuations

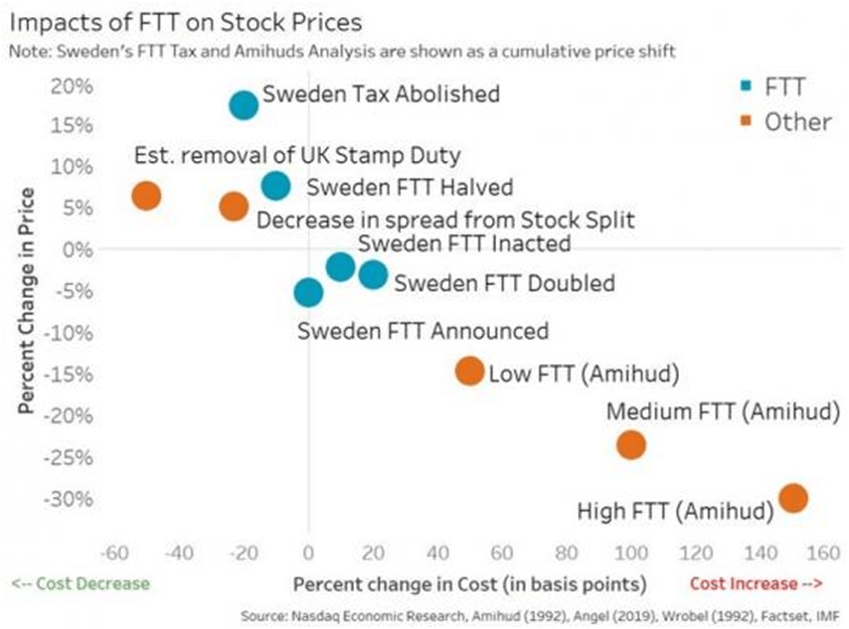

Research by Nasdaq, Amihud, and Brugler show lower costs help stock valuations, and Lin, Angel, IMF, Wrobel show higher costs hurt.

That is because trading costs affect the “after trade” returns of stocks, and stocks with lower returns are given lower valuations.

Summarizing the results of multiple studies in Chart 3 again shows that the larger the additional costs, the more stock valuation falls (diagonal slope). That reduces pension funding for all individuals and states. In a related study, Vanguard estimates that a 10-basis-points tax translates to 19% of capital gains over 20 years.

Importantly for governments considering FTTs, falling valuations also reduces capital gains tax collections. That’s one reason why the CBO estimated the first-year impact of a U.S.-wide FTT would be negative.

Chart 3: Valuations are also affected by trading costs

Increasing trading costs hurts the economy

Lower valuations also increase the cost of capital for companies, which in turn has been shown to cause companies to invest less ultimately reducing GDP. In fact, economists for the European Union estimated a proposed 0.10% transaction tax would lower GDP by 1.76% while raising revenue of only 0.08% of GDP. In other words, the cost to the economy is far greater than the revenue raised.

That’s consistent with U.S. Congressional Budget Office estimates that found a decrease of 1% in the cost of capital leads to a 0.7% increase in investment.

Recent US proposal highlights how low trading costs are

In response to the fiscal deficits caused by Covid, a U.S. state, New Jersey, proposed an FTT in 2020.

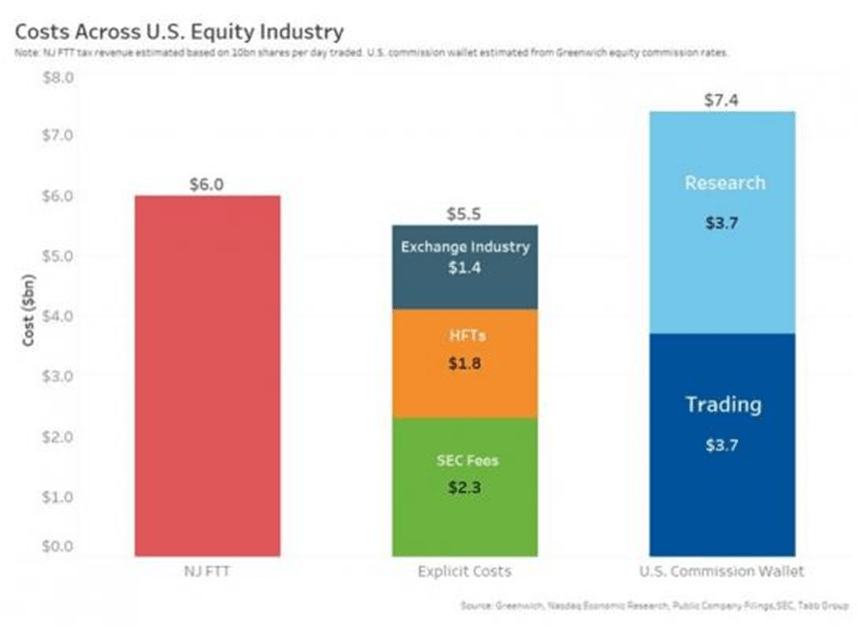

With U.S. equities trading around $100 trillion each year, regulators claimed claim their proposal could raise around $6 billion each year.

However, Nasdaq estimated an FTT of that size could potentially double the explicit costs of trading in the U.S. equity markets.

At $6 billion, the tax would cost investors more than estimates of the combined U.S. exchange revenues plus market makers’ profits plus the fees charged to run the U.S. securities regulator, the SEC.

Looked at another way, at $6 billion, the state tax would cost roughly the same as the total amount asset managers spend on research and trading each year.

And yet, $6 billion represented a fraction of the deficits incurred during Covid.

One thing this highlights is just how low explicit equity trading costs really are.

Chart 4: Comparing the proposed FTT to market frictions

A big miscalculation by New Jersey

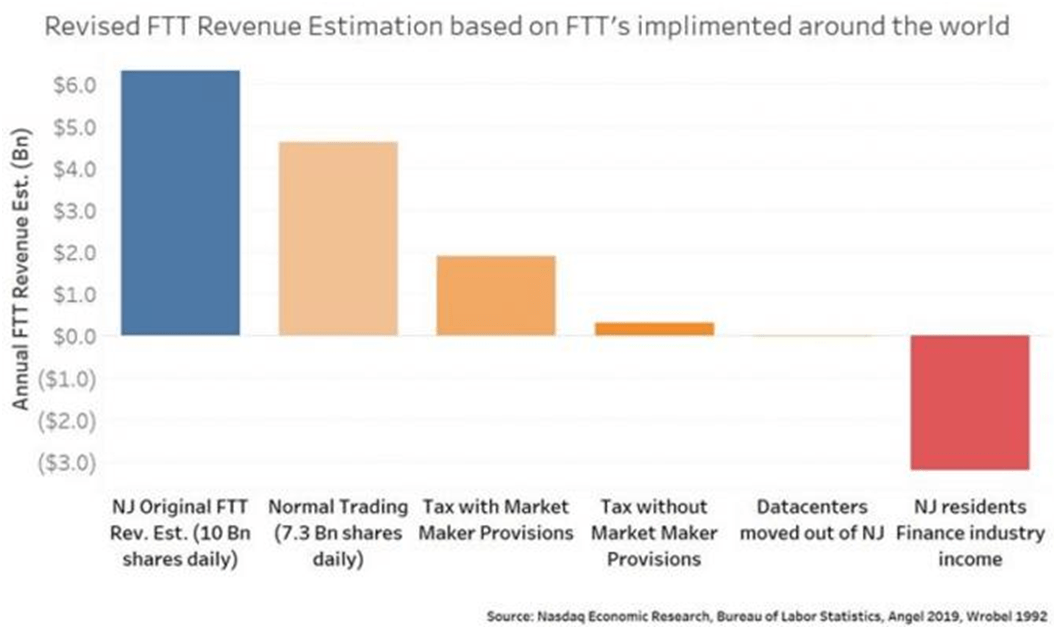

Moreover, the studies above suggest that revenues raised would almost certainly be lower than expected.

First, based on the reaction to FTT around the world, a more-than-doubling of transaction costs would likely cause trading to fall. Data in Chart 3 suggests trading could fall around 50%, reducing expected revenues to less than $3 billion.

More importantly, U.S. Investors can trade in any other state. In fact, most of the industry already has backup facilities in Illinois, where almost all futures and many options markets are also based. If the whole industry consolidated in Chicago, New Jersey FTT revenues could have been closer to zero.

New Jersey could have done much more damage to its economy. Over time, some of the over 30,000 finance industry jobs in New Jersey would also likely leave the state. It wouldn’t be the first time a financial center moved states for good.

That, in turn, will reduce spending, property valuations and income tax receipts.

Chart 5: After adding all this research together, it’s likely the costs of the tax would outweigh the revenues

A negative Cost Benefit

It’s pretty easy to see that the costs of an FTT can quickly outweigh the revenues raised.

It’s also important to realize who would pay the taxes. Venues and Market Makers could not trade for losses. Instead, they would factor new taxes into margins. That would result in increased spreads and less efficient prices.

Investors would pay to cross wider spreads, and trade at prices that factor in tax costs, as well as incur the drop in the valuations that researchers have found higher costs create.

Looking at the evidence, the costs of FTTs seem to far outweigh the benefits. Especially when the people paying the tax end up being the same investors the tax is meant to be helping.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.