How Readable are Market Manipulation Definitions?

Written by Dr. Kaitao Lin, Senior Financial Economist at the WFE

Education on investment-related regulations is essential for retail investors, as it helps them understand the rules of investing and fosters informed investment decisions. This is especially true for market manipulation regulations, as violating such rules can result in severe penalties, including exclusion from future investments, fines, and, in some cases, prison sentences. Awareness of manipulation also supports market integrity, maintains investor confidence, and contributes to a more equitable financial system. However, a primary hurdle regarding financial literacy is the ability of retail investors to understand the legal texts and definitions of market manipulation.

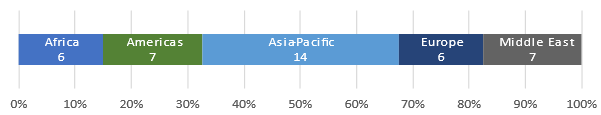

Therefore, in this note, we analyze the readability of market manipulation legal definitions, as the accessibility of legal texts contributes to financial literacy. Specially, we collect the legal definitions of market manipulation from 40 jurisdictions across the world.[1] Figure 1 reports the distribution of these jurisdictions.

[1] If the original text of the definition is not in English, we obtain the English translation of the definition from the exchanges or the financial market regulators.

Figure 1. Sample

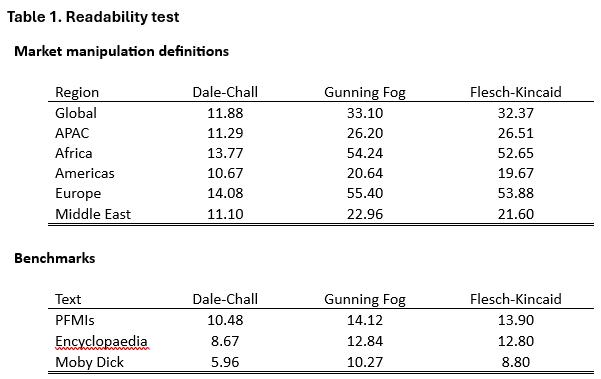

In our methodology, we applied the Dale-Chall readability test (Dale & Chall, 1948), the Gunning Fog index (Gunning, 1952), and the Flesch-Kincaid grade level (Kincaid, 1975), all of which are standard tools for assessing text readability. These tests evaluate readability based on factors such as sentence length, word complexity, and grammatical structure. The Dale-Chall test measures text difficulty by comparing the percentage of words that do not appear on a list of familiar words typically known to U.S. fourth-grade students. The Gunning Fog index estimates the years of formal education needed to understand a text, based on average sentence length and the proportion of complex words. The Flesch-Kincaid grade level provides a readability score that corresponds to a U.S. school grade level, considering the average number of syllables per word and words per sentence. To ensure a balanced comparison, we also analyzed readability benchmarks, including (1) the Principles for Financial Market Infrastructures (PFMI)’s definition of financial market infrastructure, (2) the Encyclopaedia Britannica's description of the financial market, and (3) Herman Melville's 1851 novel Moby-Dick. The readability results are presented in Table 1.

On average, definitions of market manipulation tend to be difficult to read and understand. According to the Gunning Fog index and the Flesch-Kincaid grade level, a high level of educational attainment—often more than 30 years—is typically needed to fully grasp these definitions. When considering regional differences, the Middle East and the Americas offer the most accessible definitions, with readability scores suggesting about 20 years of education are required (as indicated by the Gunning Fog index). The Asia-Pacific region is next, with an average score equivalent to roughly 26 years of education. In contrast, the definitions from Africa and Europe are the hardest to read, with average readability scores indicating that around 55 years of education would be necessary for comprehension.

In terms of the benchmarks, the definition of financial market infrastructure in the PFMIs and the financial market description in the Encyclopaedia Britannica are accessible to individuals with approximately 14 years and 12 years of education, respectively. Herman Melville's novel Moby-dick is even more readable, requiring about eight years of education for comprehension. In contrast, definitions of market manipulation are significantly more difficult to understand when compared to these benchmarks.

This note is part of the ongoing WFE Research project on market manipulation. If you have any questions or comments, please contact Kaitao Lin ([email protected]).

Reference

Dale, E., & Chall, J. S. (1948). A formula for predicting readability: Instructions. Educational research bulletin, 37-54.

Gunning, R. (1952). Technique of clear writing. McGraw Hill.

Kincaid, J. P. (1975). Derivation of new readability formulas (automated readability index, fog count and flesch reading ease formula) for navy enlisted personnel. Naval Technical Training Command Millington TN Research Branch.