An introduction to tokenization by ConsenSys

What actually is a blockchain-based ‘token’? It can be tricky to wrap one’s mind around concepts such as the tokenization of financial assets, token fractionalization, and how smart contracts behave in certain scenarios, even for seasoned DeFi industry practitioners. Chances are, you haven’t been interrogated on blockchain concepts by a crypto-obsessed six-year-old, but as Albert Einstein once said, “if you can’t explain it to a six-year-old, you probably don’t understand it yourself”. With that in mind, we at ConsenSys Codefi have taken a stab at explaining the tokenization process by using an analogy to something all six-year-olds know: marbles.

So let’s start with a token:

A token digitally represents the ownership of something in a secure way, using cryptographic methods. “Something” can actually be anything: a crypto asset, yes, but also a company share, a fund share, a syndicated loan, a corporate bond, a derivative, a real estate asset, a piece of art or a luxury good.

The properties and requirements of a certain token differ depending on the use case. Choosing the right token from among the numerous options depends on the given use case.

Discover a real-world tokenization case study

French real estate fund management company, Mata Capital, looked to blockchain technology to modernize and optimize the processes of maintaining its investor registry and distributing fund shares. In partnership with ConsenSys Codefi, Mata Capital issued security tokens for three separate funds worth a combined total of €350m.

Download the Mata Capital Case Study

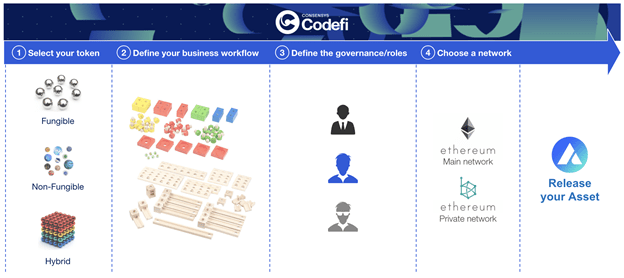

Step 1: Selecting a Token Category

Despite the diversity of tokens, most of them can be generalized into 3 main categories, as defined in the Token Taxonomy Framework.

The first category is fungible tokens:

Fungible tokens are all identical and cannot be distinguished from each other. Each individual token is essentially interchangeable, like US dollars, company shares, or ounces of gold. This is probably the simplest and most common category of tokens, and basic use cases for fungible tokens are quite straightforward -- the most common one being cryptocurrencies (such as Bitcoin or Ether).

The second category is non-fungible tokens:

Non-fungible tokens are like a collection of different, unique marbles: they represent something unique or finite and therefore are not mutually interchangeable. Non-fungible tokens (NFTs) are used to create verifiable digital scarcity, as well as representing asset ownership of things like real estate, luxury goods, works of art, or collectible objects in video games (CryptoKitties is an early example). Essentially, NFTs are used for items which require a unique digital fingerprint. NFTs make possible a whole new variety of powerful opportunities for using blockchain technology.

The third category is hybrid tokens:

Hybrid tokens are a mix of both, and therefore are a bit more complex. Each token belongs to a class (sometimes also called category/partition/tranche). Inside a given class, all tokens are the same: they are fungible. But tokens from different classes can be distinguished from each other: they are non-fungible. Using the marble analogy, hybrid tokens are like groups of different coloured marbles, identical to all and only those marbles of the same colour group. Hybrid token classes can for instance represent a fund share, a container on a ship, etc.

For any token -- fungible, non-fungible, or hybrid -- there are a set of pre-defined axioms or ‘rules’ dictating its behavior in certain scenarios. For more common uses of tokens, such as financial asset tokens, a set of generalized Ethereum token standards have been built in order to ensure more seamless interoperability and integration with existing platforms and decentralized applications.

Next steps include:

-

Step 2: Define the Business Workflow + Appropriate Behaviours

-

Step 3: Configuring the Governance and Roles

-

Step 4: Choosing a Blockchain Network: Public or Private-Permissioned

To read the full article, visit the ConsenSys Codefi blog.

Do you want to play with marbles?

If you’re interested in learning more about tokenized assets as a possible solution for your business, we’d love to help. ConsenSys’s commerce and finance operating system, ConsenSys Codefi, provides the building blocks to create, issue, and manage the lifecycle of digital assets, associated markets, and digital financial instruments on public or permissioned blockchain networks. We can help simplify and customize the design, issuance, and distribution of digital assets and securities.

Are you ready to build the next evolution of digital finance? Get started today.

Contact ConsenSys Codefi or [email protected]