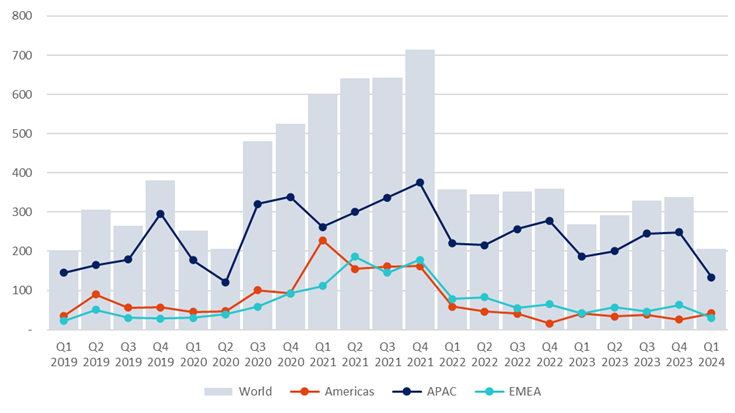

IPO trends

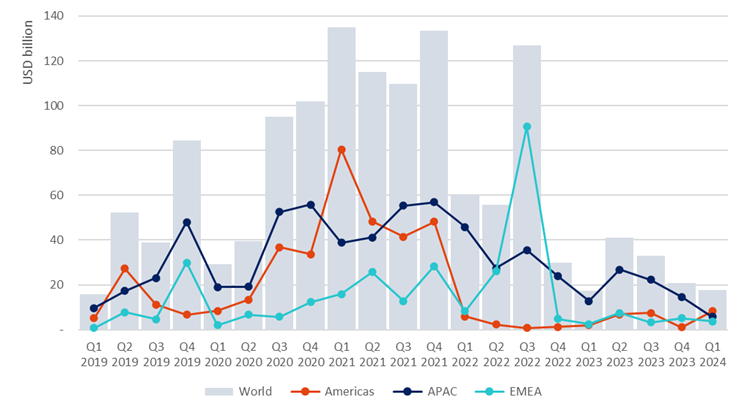

In the first quarter of 2024, the market saw 206 initial public offerings (IPOs). These IPOs collectively amassed 17.84 billion USD, indicating substantial investor interest and confidence in these newly listed entities. However, this figure represents a decline compared to the preceding quarter. Specifically, the number of IPOs experienced a 39.1% decrease compared to the fourth quarter of 2023, while the capital raised saw a 14.1% reduction during the same period.

Sectors of activity in which most of these IPOs operate are industrials, information technology, services, healthcare and financial services. Some of the largest IPOs in Q1 2024 were Galderma Group AG (a healthcare company) hosted by SIX Swiss Exchange, raising 2.51 billion USD, Douglas AG (a retail company) which went public on Deutsche Boerse for 960.04 million USD and Athens International Airport hosted by Athens Stock Exchange, raising 809.41 million USD among others.

As Figure 1 and Figure 2 show, regionally, while APAC welcomed most IPOs (134), markets in the Americas region raised most of the capital (8.27 billion USD). This means that IPOs hosted by the Americas tended to be larger (reaching to 196.9 million USD/IPO), whereas the average size of an IPO in EMEA was 125.58 million USD/IPO and in the APAC region 43.29 million USD/IPO.

The Americas was the only region which witnessed an increase in number of IPOs in Q1 2024 compared to Q4 2023 (recording a double digit increase of 61.5%) and increased capital raised (witnessing a surge of 665.2%), while APAC and EMEA regions registered double digit declines on both metrics.

We observed a pronounced negative trend in capital raised QoQ results in the last two years, with the exception of Q3 2022 and Q2 2023, Q2 2023 being the only quarter when proceeds in every region went up.

This decline was observed at a time when interest rates increased and liquidity was reduced. Some large economies experiencing political instability (upcoming UK and USA elections) might be another contributing factor.

Regarding the number of IPOs, every region witnessed a decline in every quarter in 2022 and 2023 compared to the year before, with the exception of the Americas region, which went up in Q4 2023. The YoY increase in the number of IPOs in the Americas region continued in Q1 2024.

With regards to capital raised, after five quarters of double digit declines, Q1 2024 is the first quarter to record a slight YoY increase (+3.3%). This increase coincides with global inflation falling and Central Banks thinking whether to reduce interest rates.

Figure 1: Number of new listings through IPO

Figure 2: Capital raised through IPO

The data used for this note is available on the WFE Statistics Portal and indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team at [email protected]