JPX Publishes Survey of TCFD Disclosure in Japan

In January 2023, Japan Exchange Group, Inc. (JPX) published the Survey of TCFD Disclosure in Japan (FY2022), covering the constituent companies of the JPX-Nikkei Index 400.

About the survey

Japan's Corporate Governance Code, which was revised in 2021, asks listed companies (on a comply-or-explain basis) to address sustainability issues, including climate change and other global environmental issues, positively and proactively. Alongside this, it states that companies listed on the Prime Market in particular should collect and analyse the necessary data on the impact of climate change-related risks and earnings opportunities on their business activities and profits, and enhance the quality and quantity of their disclosures, based on the TCFD recommendations or an equivalent framework.

In November 2021, JPX published the Survey of TCFD Disclosure in Japan, the results of a survey of the 259 listed companies that had declared support for TCFD as of the end of March 2021. This aimed to shed light on the situation around Japanese companies' climate change-related information disclosure based on the TCFD Recommendations and provide listed companies with helpful reference information for preparing their own climate-related disclosures.

Tokyo Stock Exchange has launched its new market segments since the first survey was published, and it can be expected that many more listed companies have been working to improve the quality and quantity of their TCFD-based disclosures. This year's survey covers a bigger range of companies, namely the constituents of the JPX-Nikkei Index 400, to better reflect the current situation around Japanese companies' climate-related disclosures.

We hope that this survey can be of help to listed companies preparing their climate-related disclosures.

Key findings

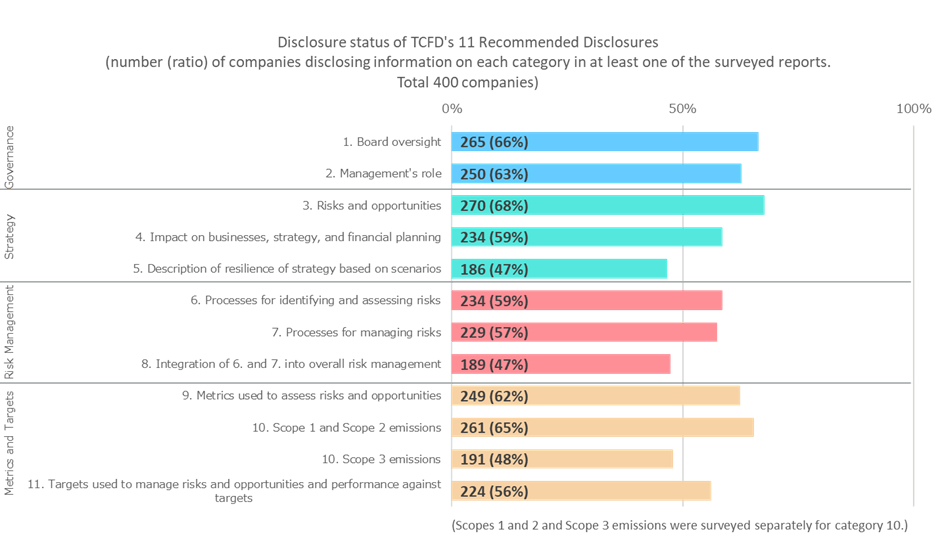

- Looking at each of TCFD’s 11 recommended disclosures, disclosure was most common on three. Risks and opportunities (270 companies, 68%), followed by 1. Board oversight (265, 66%) and 10. Scope 1 and Scope 2 emissions (261, 65%).

- The categories with the lowest level of disclosure were 5. Description of resilience of strategy based on scenarios (186, 47%) and 8. Integration of 6. and 7. into overall risk management (189, 47%).

- 191 companies (48%) disclosed information relating to Scope 3 emissions.

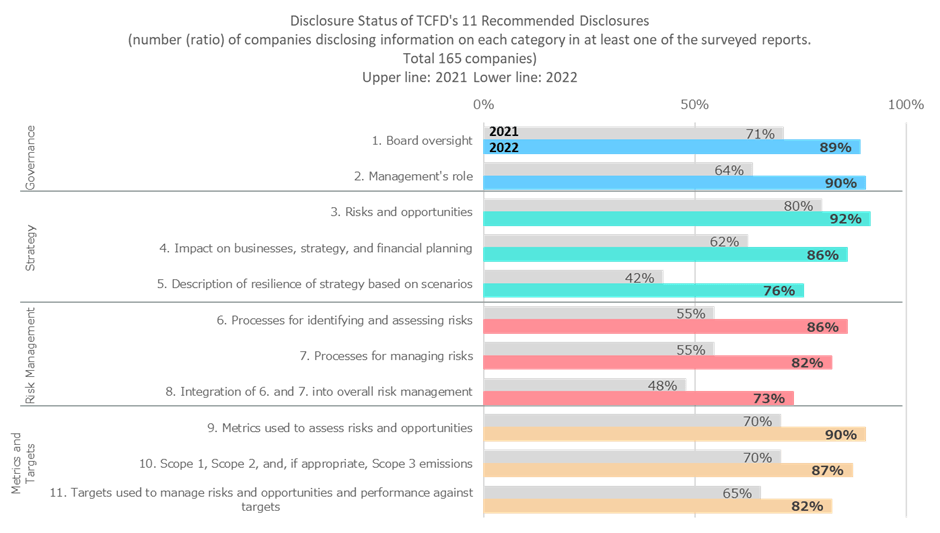

- Looking at the 165 companies that were included in both this survey and the previous one (published in November 2021, covering the 259 listed companies that had declared support for TCFD as of March 31, 2021), disclosure rates have increased in all categories.

- The biggest increases came in 5. Description of resilience of strategy based on scenarios (a 34-point increase) and 6. Processes for identifying and addressing risks (31 points).

More findings can be viewed here:

Conclusions

This survey attempted to shed light on the status of disclosure of the 11 TCFD recommended disclosures among constituent companies of the JPX-Nikkei Index 400, by category and company attributes (size and sector).

By disclosure category, the categories where disclosure was highest (3. Risks and opportunities, 1. Board oversight, and 10. Scope 1 and Scope 2 emissions) and those where it was lowest (5. Description of resilience of strategy based on scenarios and 8. Integration of 6. and 7. into overall risk management) were along the same trends as the previous survey (published November 2021). There was no notable difference between the disclosure rates of Governance and Risk Management categories, for which TCFD recommends disclosure from all companies, and Strategy and Metrics and Targets categories, which should be based on materiality (apart from Scope 1 and Scope 2 emissions, disclosure of which is recommended regardless of materiality).

Among the companies that were also included in the previous survey, disclosure increased in all categories, and the category with the lowest rate of disclosure – 5. Description of resilience of strategy based on scenarios – had the highest rate of increase. This suggests an improvement in the availability of information that companies can use when engaging with shareholders and other stakeholders. While a company’s material issues and the kinds of information it can most easily gather and disclose depend on its attributes (size, sector, etc.) and external environment, the survey results suggest that companies are starting from wherever their circumstances allow and gradually expanding their activities and information disclosure from there.

It is important to note that this survey specifically covered four types of reports, including the Annual Securities Report, based on the TCFD’s recommendation that disclosure should be included in a company’s annual financial filings (or, in some cases, other official company reports published once a year). However, many companies publish related information on their websites to supplement these reports.

The world of sustainability-related disclosure is heading for some big changes. In November 2022, the Japan Financial Services Agency proposed an amendment to the Cabinet Office Order on Disclosure of Corporate Affairs, which would add a new section on approaches and responses to sustainability to the Annual Securities Report and require disclosure of detailed sustainability-related information, including responses to climate change, under this section if deemed material (this would apply to Securities Reports covering fiscal years ending on or after March 31, 2023). Internationally, in March 2022 the International Sustainability Standards Board (ISSB), established under the IFRS Foundation, published two exposure drafts: S1, which sets out general requirements for sustainability-related information, and S2, which is specifically for climate-related information. The ISSB is continuing discussions with the aim of finalising the requirements in early 2023.

We hope to see companies improving the quality and quantity of disclosure in a voluntary way based on the TCFD recommendations, as well as statutory disclosure based on these regulatory changes and information provision to supplement this, leading to more active dialogue with shareholders and other stakeholders. This should then contribute to improvements in sustainable growth and mid- to long-term corporate value, leading in turn to a more attractive Japanese market.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.