No longer an afterthought: Post-trade is ripe for innovation

Following his electric participation on the Market Infrastructures, Post Trade and Fintech – Finding the Valuepanel at the recent WFE & Imperial College Technology Conference, Arjun Jayaram, CEO, Baton Systems tells us why the post-trade space is ready for innovation.

When it comes to post-trade systems, there has been a noticeable lack of innovation for as long as I can remember, especially in payments and reporting.

However, the degree of regulatory and capital pressure upon financial institutions has had significant impact on the level of investments in technology enhancements. The good news is that we are now seeing a rise in new investment, particularly in trading systems, front-office systems, and in regulatory and compliance.

So where are the opportunities to make a sizeable difference for the industry? Today, trading desks and the front office can be viewed as event-based systems. These events – an order, a price tick, a news item, fulfilment, a confirmation, etc. – happen at a very fast pace. Systems that can take advantage of these low-latency, high-throughput systems give firms a competitive advantage in areas such as HFT and predictive analytics for risks.

However, the paradigm shift to event-based systems and the response to low latency have not trickled down to middle- and back-office systems. They have traditionally been batch systems, including payments. So, while the volumes have increased, the systems to clear, settle and report to the regulators have not kept pace. This has in turn created pressures in other parts of the business. Consider the requirement for pre-funding: hundreds of billions of dollars globally, just to meet payment obligations, pay increased settlement costs or cover delayed settlements.

This is where companies like Baton will make a difference – by building a platform for the post-trade space that brings event-based systems to the middle- and back-office. A major opportunity to make this happen in the real-world is in the payment, clearing and settlement, and liquidity prediction areas – where some of the greatest pain points are.

Driving the Payments Lifecycle Forward

In Pre-Payments, there is a pressing need to compute counterparty exposures and obligations in real-time. This gives the liquidity and treasury teams visibility into the upcoming payments by asset type and by counterparty. While Baton is probably the only platform that provides this in real-time, we are also using many of the same data innovations that have powered companies like Google, Facebook, Twitter, Uber, etc. We are simply bringing them to the capital markets.

But these insights also need to be actionable, and firms need to be able to make payments on demand – clearing and settling multiple assets on demand with settlement finality. Unlike all the pure blockchain providers, Baton moves real assets in real bank accounts with settlement finality. We connect across ledgers of banks and with the CSDs and central banks to move the assets. Baton is the only company that can provide this efficiency without converting the assets to a digital currency or cryptocurrency. You can call us the “non-blockchain blockchain.”

Once the payments are made, there is still the need for reconciliation of the data between multiple parties. This is where the power of a DLT ledger comes into play. We built a ledger capable of handling the throughput needed by capital markets. We took the core constructs of the blockchain, like immutability and tamper resistance, and added features like end-to-end auditability, replay capability, and self-healing in case of tamper at an end point. One of our patents is on fast multi-party reconciliation and document comparison down to an individual field level. Counterparties will be able to generate regulatory reports off the ledger and tie this to the payments.

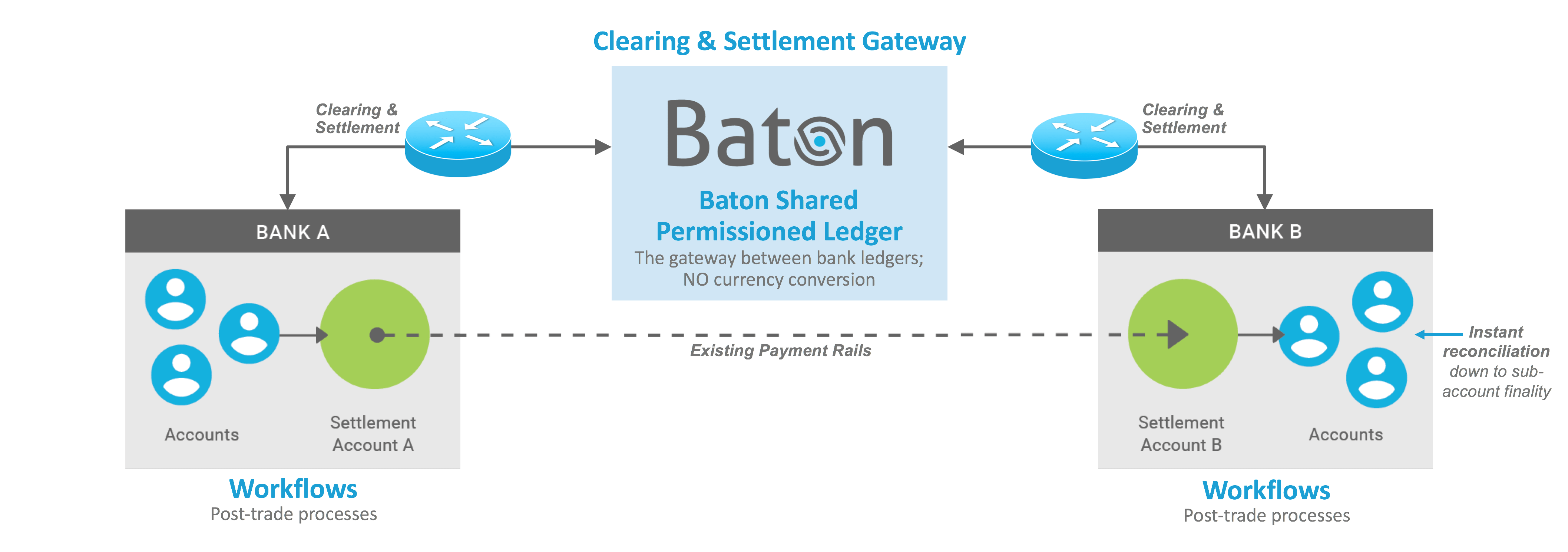

Baton technology accelerates post-trade clearing and settlement, down to the sub-account level, by connecting disparate bank ledgers to the Baton shared, permissioned ledger. Payments in any currency – with no conversion required and with full transparency – are processed on-demand through the firms’ existing payment rails.

Eliminating the Payments Bottleneck

Payments are handled by many intermediaries during their lifecycle, sometimes taking days to settle. Today, some people in the blockchain space are trying to disintermediate the central banks, depositories or the custody banks without understanding where the payments are actually slow. It is not at the settlement venues but fundamentally, it is because of the different ledgers at the banks.

Back in the 1990’s, investment banks struggled with the integrating disparate systems that talked in different languages. The solution widely adopted was asynchronous messaging middleware to integrate those systems and improve STP throughout each firm’s internal infrastructure. Jump to today’s post-trade community and we see a similar issue – a vast number of firms using different ledgers that speak different languages. All this makes the payments process opaque and synchronization and movement of assets between them supremely difficult. Blockchain-based attempts to solve this problem actually add complexity by introducing a new ledger, new accounts and new digital assets.

Baton’s approach brings messaging middleware into the 21st century. By securing our platform at the heart of the post-trade world, with a hub-and-spoke approach that connects to the ledgers of all the banks, irrespective of language message formats or APIs, Baton orchestrates the movement of assets between accounts across banks with settlement finality. When Baton moves money, it is real money from real accounts in real banks, without the need for digital or cryptocurrency conversion.