pTools Announces Persistent Sanctions Screening Solution

pTools Software, the leading provider of market information AI and automation solutions for exchanges and regulated market operators, is delighted to announce the delivery of its pTools Persistent Sanctions Screening Solution, which provides an automated solution for 'persistent' sanctions screening to help organisations mitigate financial risks and maintain global security.

This underscores pTools’ commitment to providing advanced risk-mitigating solutions to clients in global financial services, including exchanges and CSDs, and assisting them in meeting global regulatory compliance.

pTools Persistent Sanctions Screening has capabilities that differentiate it from other sanctions screening solutions, including:

- Persistent Automated Sanctions Checks

- Single, Scheduled or Manual Sanctions Checks

- Multiple Accounts

- List Update Automation

- Web Corpus

- Media Searching

- Unlimited Screens

Commenting on the announcement, Keith Wood, CEO of pTools, said: “Our aim is always to make technology easy and seamless and to improve the results for our clients. Persistent services within client applications processes for sanctions screening, artificial intelligence and more, are key to the digital transformation we deliver. I am delighted to announce this new solution and to see it provided to our clients world-wide.”

Sanctions Regulation and Persistent Screening

Sanctions regulation and compliance has become more crucial than ever as it aims to strengthen AML, anti-fraud and anti-terrorism efforts by governments, ultimately resulting in robust global financial markets and the prevention of financial crime.

This has called for regular or ‘persistent’ sanctions screening by entities, rather than more traditional on-boarding or more recently off-boarding screening. Importantly, pTools Persistent Sanctions Screening is embedded in the exchange market information process, including ISIN and LEI issuance, listings, funds and ETFs, and corporate actions and announcements. This enables active oversight of sanctions risk, albeit alongside existing sanctions screening processes. In terms of process, pTools Persistent Sanctions Screening works persistently, and does not require traditional manual and often siloed sanctions processes management.

Persistent Screening has become vital for global entities as it helps them meet regulatory compliance, mitigate financial and reputational risks, prevent financial crimes, facilitate trade and investment, and protect overall business interests.

pTools Persistent Sanctions Screening Solution

pTools Persistent Sanctions Screening, our latest and most advanced sanctions screening solution, contains an extensive database consisting of risk relevant information derived from sanction lists, international watchlists, media, and more. The ability to screen as many names as necessary, as frequently as needed, allows clients to be assured that risk liability is minimised by the pTools Persistent Sanctions Screening Solution. The solution provides a constant monitoring service for individuals and entities within client data environments. The API driven software service uses all major sanctions and criminal lists, which are also updated constantly within the system.

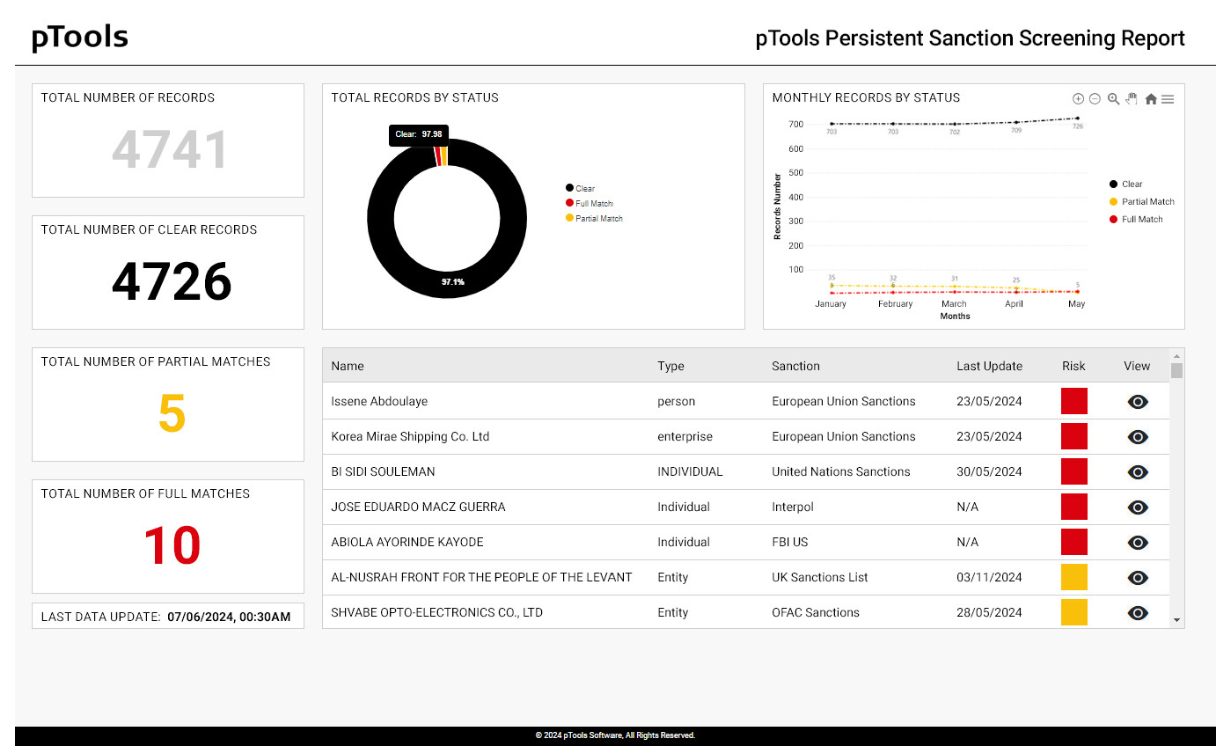

The solution uses advanced technology to give a complete view of individuals and entities and related parties, which combined with both linear sanctions checks and non-linear risk checks produces an overall risk score and ‘Dashboard’ that allows clients to quickly identify risk and take action when concerns arise.

Output is based on risk scoring against events within client information processes and this is captured in a sanctions screening risk dashboard. Key to the software service is the web-based spidering of regulated and public information relating to the named individuals and entities within the system, resulting in a corpus of data that evolves over time and augments risk scoring for sanctions screening and for all risk profiling within clients’ applications.

Risk information associated with individuals or entities is presented in a profile. These profiles consist of all the risk-relevant information relating to the individual or entity, along with any other information provided by our database of sanction lists, crime lists and international watchlists.

Key verification check lists cover major US and EU sanctions lists and UN global lists and include, but are not limited to: EASS/EU, OFAC, OFSI, SDN, UNSC, OECD, MET, FBI, Interpol as well as organisational and industry blacklist checks and greylist checks provided by clients.

pTools Persistent Sanctions Screening is provided on a per instance model with unlimited named users and unlimited checks with incremental costs for system scale and managed services infrastructure support.

Image: pTools Persistent Sanctions Screening Solution – Sample Dashboard

Persistent screening allows for the continual monitoring of lists of individuals and entities. Through pTools List Update Automation and Persistent Automated Sanctions Checks, users can always be sure of receiving the most up-to-date risk information about their clients.

Integration of Information by Adverse Media and Web Searching

Over 20 search engine results pages (SERPs) targeting both industry publications and the World Wide Web are used by the pTools Persistent Sanctions Screening Solution to search for information posted by media outlets that relate directly and indirectly to individuals and entities within client environments. Often news is made available about individuals and entities before sanctions lists and international watchlists have had a chance to update, and adverse media searching allows for further risk mitigation by alerting pTools Persistent Sanctions Screening Solution’s users of breaking news about individuals or entities.

Global Interest for pTools Persistent Sanctions Screening Solution

We are engaging with entities globally regarding the automation of sanctions screening with our Persistent Sanctions Screening solution for issuance, listing, fund management, settlement and other purposes. We understand that current market developments present significant and strict regulatory challenges to entities as they now have to comply with additional sanctions regulations introduced by countries and we are proud to assist them in addressing this challenge.

Our work for stock exchanges, NNAs, LOUs and CSDs is underpinned by risk mitigation and risk scoring for sanctions screening including AML/KYC and our experience in this area is proven in multiple deployments for some of the largest firms in the sector.

pTools is a leading provider of market information services for stock exchanges and related organisations including LOUs, NNAs, CSDs, CCPs and central banks. pTools provides packaged software, bespoke solutions, outsourced and support services for applications including Persistent Sanctions Screening, LEI and ISIN issuance, corporate actions and announcements, ESG validation, asset tokenisation and listing. With offices in Dublin, London and Bangalore, pTools’ clients include LSEG, Qatar Central Bank and Strate South Africa. pTools works across technologies with specific capability in AI and NLP, blockchain and notarisation, digital risk mitigation/sanctions risk scoring and data quality management. pTools delivers solutions on-Premise, on-Cloud and as-a-Service. pTools is a long-term partner of the World Federation of Exchanges and has additional partnerships with global technology providers IBM, AWS, Microsoft and global eLearning provider Intuition.

For more information on pTools Persistent Sanctions Screening Solution, please get in touch with: Suraj Pandey, Business Development Manager – Market Information Services – pTools Software - [email protected]

To gain insights on our solutions, please visit: https://www.ptools.com/

WFE will be hosting a webinar with pTools Software on 19th of September 2024 at 1 PM BST, where pTools will discuss how exchanges and regulated market operators can mitigate financial risks and maintain security across all aspects of business. For more details and to register for the webinar please visit: https://www.world-exchanges.org/risk-intelligence-for-exchanges

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.