The Relationship Between Stock Market Development and Economic Growth

Written by Dr. Ishak Demir

The health and dynamism of an economy are intrinsically linked to the performance of its financial markets and, in particular, to its capital markets.

This note provides some insights about the connection between the stock markets and economic growth.

We know that the direct and indirect contributions of the stock market to economic growth flow through various channels, including facilitating the efficient allocation and mobilization of capital, reducing the cost of investment, and allowing investors to diversify their risk. [1]

But, looking at the data, how does market growth correlates with economic growth?

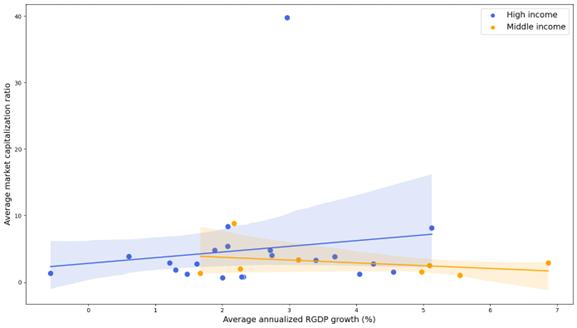

Figure 1 illustrates the relationship between market capitalization and real GDP growth for high- and mid-income countries between 2003 and 2022. The figure indicates a positive correlation between stock market capitalization and economic growth in high-income countries, whereas middle-income countries show a weaker correlation.

Figure 1. Market capitalization to GDP ratio vs. real GDP growth 2003-2022

Note: Country classification by income data obtained from the World Bank's World Development Indicators.

Source: Market capitalization data is from WFE Statistics Portal, and real GDP data is from IMF.

However, we all know that correlation does not imply causation.

When we conducted causality analysis for a sample 36 countries over the period 2003-2022 to test the causal relationship between stock market capitalization and economic growth, we found a nuanced dynamic. High-income countries experience a bidirectional short-term causality between stock market capitalization and economic output. This indicates that not only does economic growth spur stock market development, but an active stock market also stimulates economic activity. In these economies, mature financial systems likely facilitate this two-way interaction, as businesses and investors are better integrated into the financial market ecosystem.

On the other hand, in middle-income countries, the effect is unidirectional, with stock market developments influencing economic growth in the short term but not vice versa. This suggests that in these economies, stock markets play a more foundational role in economic development. However, the feedback loop from economic growth to stock market development is weaker, possibly due to less sophisticated financial markets and lower levels of investor participation.

These findings underscore the critical role of stock markets in economic development and the importance for policymakers, especially in developing economies, to focus on strengthening stock market infrastructure and creating an environment conducive to capital formation and investment.

This note is part of the ongoing WFE Research project on the role of exchanges in economic growth. If you have any questions or comments, please contact Ishak Demir ([email protected]).

References:

Greenwood, J. and Smith, B. D. (1997). Financial markets in development, and the development of financial markets. Journal of Economic Dynamics and Control, 21(1):145–181.

Grossman, S. (1976). On the efficiency of competitive stock markets where trades have diverse information. The Journal of Finance, 31(2):573–585.

Fulghieri, P. and Rovelli, R. (1998). Capital markets, financial intermediaries, and liquidity supply. Journal of Banking & Finance, 22(9):1157–1180.

Levine, R. (1991). Stock markets, growth, and tax policy. Journal of Finance, 46(4):1445–1465.

[1] Grossman (1976), Levine (1991), Greenwood and Smith (1997), Fulghieri and Rovelli (1998) for discussions of individual channels.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.