Promoting Access and Inclusivity in Financial Literacy

Two and a half years after the start of the pandemic, investors and non-investors alike continue to be confronted with a challenging landscape – uneven economic recovery, a difficult market environment, inflationary pressures and, for some, uncertain job prospects.

The evolving dynamics in financial markets call for greater support for individuals to help them understand the risks and opportunities of investing and to make sound financial decisions for long-term financial resiliency. Empowering the retail community with financial knowledge to make basic investments is paramount, particularly in a high inflation environment where uninvested savings are losing value.

With the acceleration of digitalisation and the democratisation of data, retail investors are increasingly exposed to and inundated with information which may or may not be relevant. It is therefore crucial that investors are properly educated and have access to high-quality market intelligence to make informed investment decisions.

The recent cryptocurrency market crash was a painful lesson as there were many who speculated on cryptocurrencies with little knowledge and suffered heavy losses as a result. In the Asia Pacific region, a rising problem with the use of technology has also been online fraud. A recent survey by Experian found that a quarter of consumers across the Asia Pacific have been victims of online fraud such as banking, e-commerce and investment scams.

In a 2021 survey of Singapore residents, it was discovered that four in 10 respondents did not understand financial concepts such as ‘risk diversification’ and ‘simple and compound interest’. Slightly more than half of the respondents also had not developed a plan for retirement savings. Clearly, more needs to be done to equip the man-in-the-street with knowledge and concrete steps to plan their finances and retirement.

Empowering the retail community

When it comes to making investing decisions, retail investors rely heavily on educational resources from financial institutions.

SGX Group is one of the few exchanges in Asia that has dedicated investor education and professional training programmes. We started SGX Academy back in 2008 to drive financial literacy and address the growing need to empower the retail community to make important and educated financial decisions.

Our programmes – delivered across multiple online and offline platforms – are curated for investors with varying proficiency levels, from professionals and seasoned investors to people in the early stages of their investment journey. We want to ensure that we first help investors build a good foundation in the fundamentals of investing, before moving on to deeper training on the diverse investment instruments available.

Broadening access and inclusivity

We recognise that financial education should be accessible and inclusive. In order to extend our reach across different segments of society, SGX Academy partners with government agencies as well as institutions and organisations across a range of sectors.

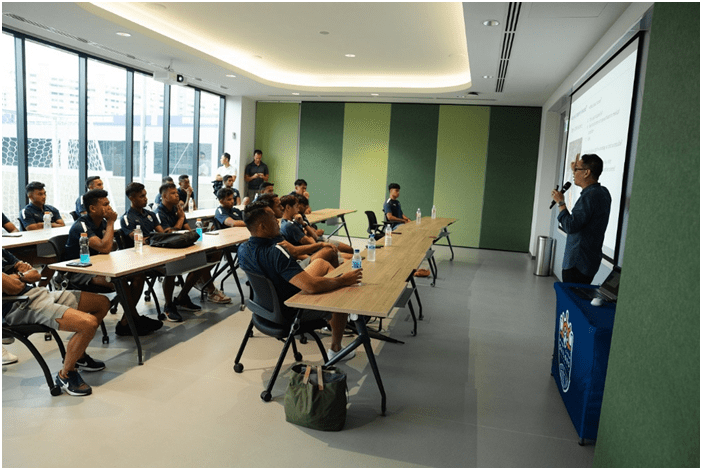

One such partnership is with a Singapore professional football club – Lion City Sailors Football Club, or the Sailors. As part of SGX Group’s corporate social responsibility programme, SGX Cares, where financial literacy is one of the key pillars, we launched a series of financial literacy workshops to equip the Sailors’ professional footballers with knowledge that will assist them in managing their personal finances and investments, during their football careers and beyond.

The collaboration was also aligned to the Sailors’ continuous efforts in building all-rounded competencies amongst its professional footballers. Professional footballers may have a limited career on the football pitch and our goal is to empower them to take charge of their future.

Sailors and Singapore captain Hariss Harun, who attended the workshop, said, “It’s important for players to prepare ourselves for what comes after we hang up our boots. Some of us have already started to plan for that – whether it’s going to school, setting up a business, or coaching – and financial literacy is definitely a tool that will help us better manage our post-football finances.”

Our partnership with the Sailors builds upon an earlier collaboration with the Singapore Sports Institute (SSI) that first started in 2020. During the pandemic, Team Singapore athletes had to adapt their training at home and explore different ways to learn new skills to maintain their competitive edge and readiness. As part of continuous learning for the athletes to build broader competencies, SGX Academy and SSI put together a Financial Literacy Webinar Series – a five-module online programme, run twice yearly, that focuses on the theme of regular investing through discipline and perseverance.

Beyond the sporting fraternity, SGX Academy recently partnered with a brokerage firm and grassroot constituencies to promote basic financial knowledge to the general public, with a focus on low-income families and the elderly. We also work closely with MoneySense, a national education programme to make financial knowledge more accessible. Through these partnerships and initiatives, we hope to create a network effect among the broader community and use it as an example for similar collaborations with other organisations.

The role of financial exchanges to promote financial literacy and investor education goes hand in hand with our business of helping investors risk-manage and invest for growth. Financial education is key to capital markets development. In this regard, the annual efforts by The World Federation of Stock Exchanges to raise awareness on investor education and protection are much needed and appreciated by the industry. SGX Group is proud to be participating in World Investor Week, and will continue exploring new ways to extend the reach of investor education.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.