Scaling Climate Risk Disclosures for Investors While Addressing Interoperability Risks

According to the World Economic Forum, the world keeps breaking temperature records in 2023, with the hottest ever October, September, August and July all taking place during the year.1 Humanity’s burning of fossil fuels has emitted enough greenhouse gases (GHGs) to significantly alter the composition of the atmosphere, and the average world temperature has risen by between 1.1°C and 1.2°C. Research has shown that though we have a narrowing window of opportunity to limit global warming to 1.5°C, it is still technically feasible2; providing the optimism and sense of urgency that we need.

Finance, in particular, is providing powerful means for tackling the climate crisis. However, tracked financial flows remain up to six times less than the levels needed to achieve climate mitigation goals across all sectors and regions; and up to 10 times less in the case of adaptation finance3.

To define actionable targets to reduce GHG emissions and achievable climate risk stress tests and scenarios, the industry needs more homogenous climate risk reporting metrics, and associated disclosure frameworks and regulations.

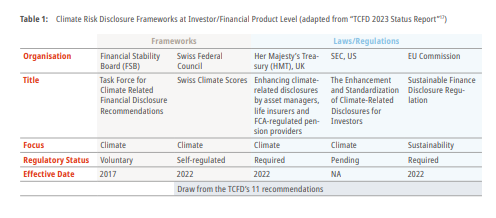

The pluralism of these frameworks4, which currently co-exist in all parts of the value chain and across markets and segments, has created a complex jungle of normative and regulatory climate risk requirements for issuers, investors and banks and hence has led to an “aggregate confusion” among providers and users of information in relation to the material areas of scope, focus and metrics in use.

Additionally, most of the existing climate risk disclosure frameworks since the announcement of the Kyoto Protocol, which operationalises the United Nations Framework Convention on Climate Change (1997), the Paris Agreement (2015-2016) and the Task Force on Climate-Related Financial Disclosures (TCFD) framework in 2017 have focused predominantly on issuer, i.e., company-related, reporting.

SIX conducted a brief analysis of the interoperability of key investor-focused climate risk disclosure frameworks. A dedicated white paper was published and issued during COP28 in Dubai in December 2023.

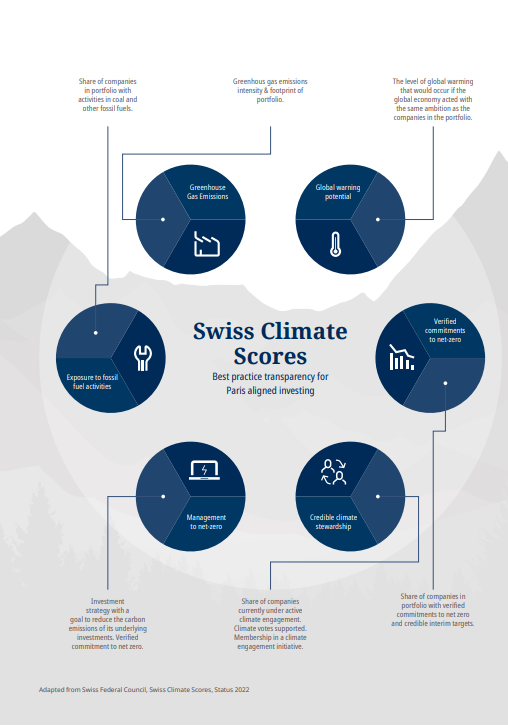

The white paper highlights that many key climate risk investor-related disclosure frameworks are a derived framework with links to the TCFD, but increasingly frameworks such the EU Sustainable Finance Disclosure Regulation (EU SFDR), or Switzerland’s new Swiss Climate Scores (SCS),5 have built and added their own metrics and parameters.

When looking specifically at the SCS, there has been an applaudable focus on “climate action” in the form of criteria asking for the verification of “net zero pledges” and credible “climate stewardship” activities, and also in the form of science-based assessments in line with “global warming” and increased temperature rising factors.

Moreover, Switzerland’s Federal Council is working in close collaboration with other international bodies such as the G20, the Organisation for Economic Co-operation and Development (OECD) and the International Platform for Sustainable Finance (IPSF), as well as in bilateral financial dialogues to ensure that the SCS indicators enjoy a high degree of international interoperability, compatibility and consistency with existing climate risk disclosure frameworks in accordance with the Paris Agreement.

The Confederation is also working with open-data facilities such as the Net-Zero Data Public Utility (NZDPU) to address the inconsistencies and paywalls for corporate (GHG) emissions and emission reduction targets related to Swiss and global entities, especially with regard to small and medium enterprises (SME). The NZDPU is an open, free, and centralised data repository initiative that allows a broad range of stakeholders such as companies, investors and banks to easily access key climate transition-related data, and to track their climate commitments versus actions.

To address the layers of complexity linked to the pluralism of frameworks and initiatives, SIX, which is a member of the Future of Sustainable Data Alliance (FoSDA)6, has been calling in its engagements at and around COP28 for:

Promoting effective reporting: to highlight the importance of comparable, consistent, high-quality and decision-useful sustainability and climate-risk disclosures. The ongoing transition to mandatory ESG disclosures is gaining momentum, and hence there is a growing recognition of the need for standardised and comprehensive reporting and relevant and reliable ESG data.

Interoperability of ESG regulations: as the landscape of ESG regulations continues to evolve, it is essential to ensure and promote interoperability and avoid fragmentation. Harmonising and aligning global ESG and climate risk management frameworks would facilitate smoother global operations and simplify compliance.

Clarity on definitions: to advance sustainability and climate risk management practices and policies effectively, it is important to understand the definitions of ESG and climate risk ratings, scores and data products. Diverse interpretations of ESG ratings, scores and data products across jurisdictions pose challenges for both market participants and regulators, potentially leading to market confusion and compliance challenges.

SIX recognises the importance of initiatives that move from climate pledges and commitments to actions, and the need for transition-led activities with forward-looking trajectories to better assess and predict climate risks in line with the Paris Agreement and the Representative Concentration (RCP)7 pathways.

1. World Economic Forum, Is 2023 Going to be the Hottest Year on Record? 14 November 2023, link: Is 2023 going to be the hottest year on record? | World Economic Forum (weforum.org) 2. Systems Change Lab, 21 November 2023, State of Climate Action 2023 (licdn.com) 3. 4. ESGBook reports that there are now more than 1,255 ESG policy interventions that have been introduced worldwide since 2011, compared to just 493 regulations published between 2001 and 20105, and many of them focusing on climate risk regulations. 5. To note: The voluntary SCS use a set of six mandatory and optional criteria underlying indicators for calculation that reflect the current (“actual”) situation of global companies in the financial products or portfolios and how these companies are positioned in relation to global climate goals with a net zero target by 2050 (“proxy”). The intention is to regularly update these scores to reflect the dynamic nature of the climate landscape, starting in 2023. 6. FoSDA is the proactive voice of the sustainable data ecosystem which aims to enable the power of financial markets to tackle global environmental and social challenges through comprehensive and high-quality data and products. 7. To note: a Representative Concentration Pathway (RCP) is a greenhouse gas concentration (not emissions) trajectory adopted by the IPCC. Four pathways were initially used for climate modeling and research for the IPCC Fifth Assessment Report (AR5) in 2014. The pathways describe different climate change scenarios, all of which are considered possible depending on the amount of greenhouse gases (GHG) emitted in the years to come.

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.