Post-trade reforms in India: Enhancing customer protection

While managing systemic risk is the utmost priority for a CCP, customer protection is a key policy objective for the CCPs as well.

In the traditional collateral management mechanism at CCPs, there are two threats to customer assets:

- Misuse of customer assets towards proprietary or fellow customer losses; and

- Lengthy procedures for a return of collateral to the customers in the traditional bankruptcy/insolvency process in the event of default of clearing members.

The threat of misutilisation has been manifested many times, notably in cases of defaults like MF Global and other similar cases. Traditionally, CCPs mandatorily segregate proprietary and customer collateral. Few customers may opt for an additional level of safety through individual collateral segregation. While the more common omnibus segregation protects customer assets from proprietary default, it does not provide protection against fellow customer default. Further, the risk of fraud remains: for instance, if the collateral deposits are not independently verified; customer collateral can be masqueraded as proprietary collateral.

In case of default of a clearing member, the non-defaulting customers’ assets should either be transferred along with the positions to another non-defaulting member or returned to such customers. Achieving the portability has its own challenges. The return of collateral through the traditional insolvency/bankruptcy process is generally time-consuming and there is a need to speed up the default management process and provide greater certainty regarding return of collateral of non-defaulting customers.

Through landmark reforms outlined by the Securities and Exchange Board of India (SEBI), regarding identification and segregation of customer collateral, and recognition of claim of customers in the default management process, Indian CCPs have improved their capability to protect customers in case of the insolvency of member firms, through the use of technology and preventive controls to limit exposures. This is done in a manner that achieves maintenance of systemic risk and the risks faced by the CCPs at current levels.

In India, it is mandatory to identify each customer with a separate unique ID at the time of order entry. Accordingly, CCPs are able to maintain positions and margins for each customer in a fully segregated manner.

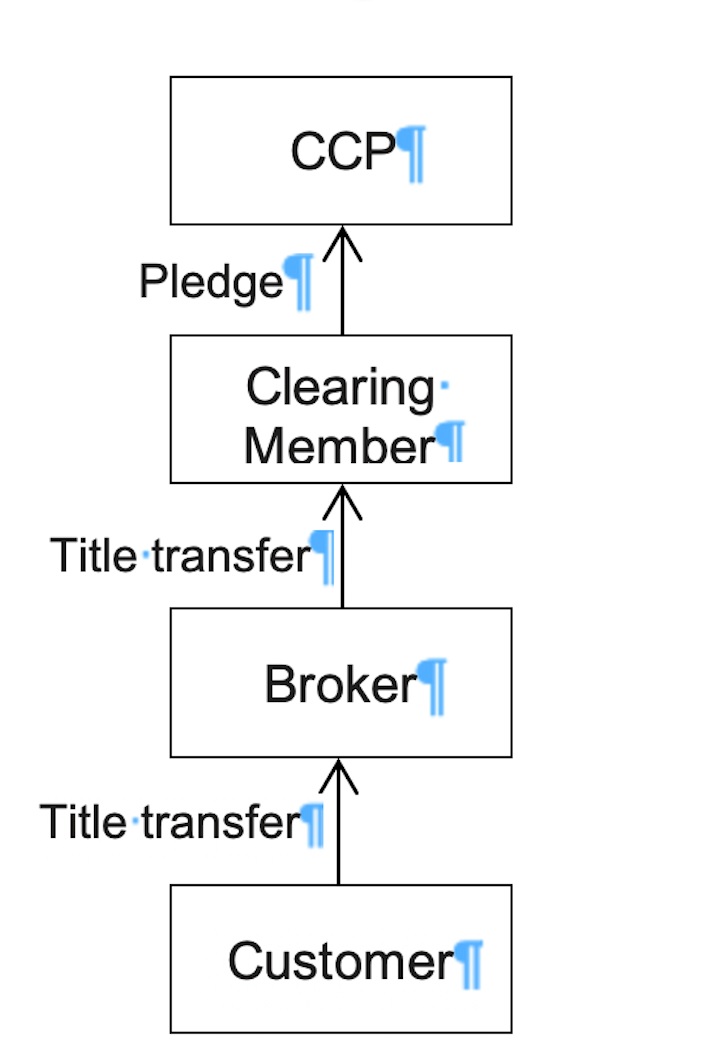

Prior to the new regulations, securities provided as collateral were transferred by the customers by way of title transfers. The clearing members would pledge the securities in favour of the CCPs.

Hence, while the CCPs could identify the beneficial ownership of each trade and position to the end beneficiary customer, and therefore calculate margins at customer level, the beneficial owner of the collateral was not identifiable.

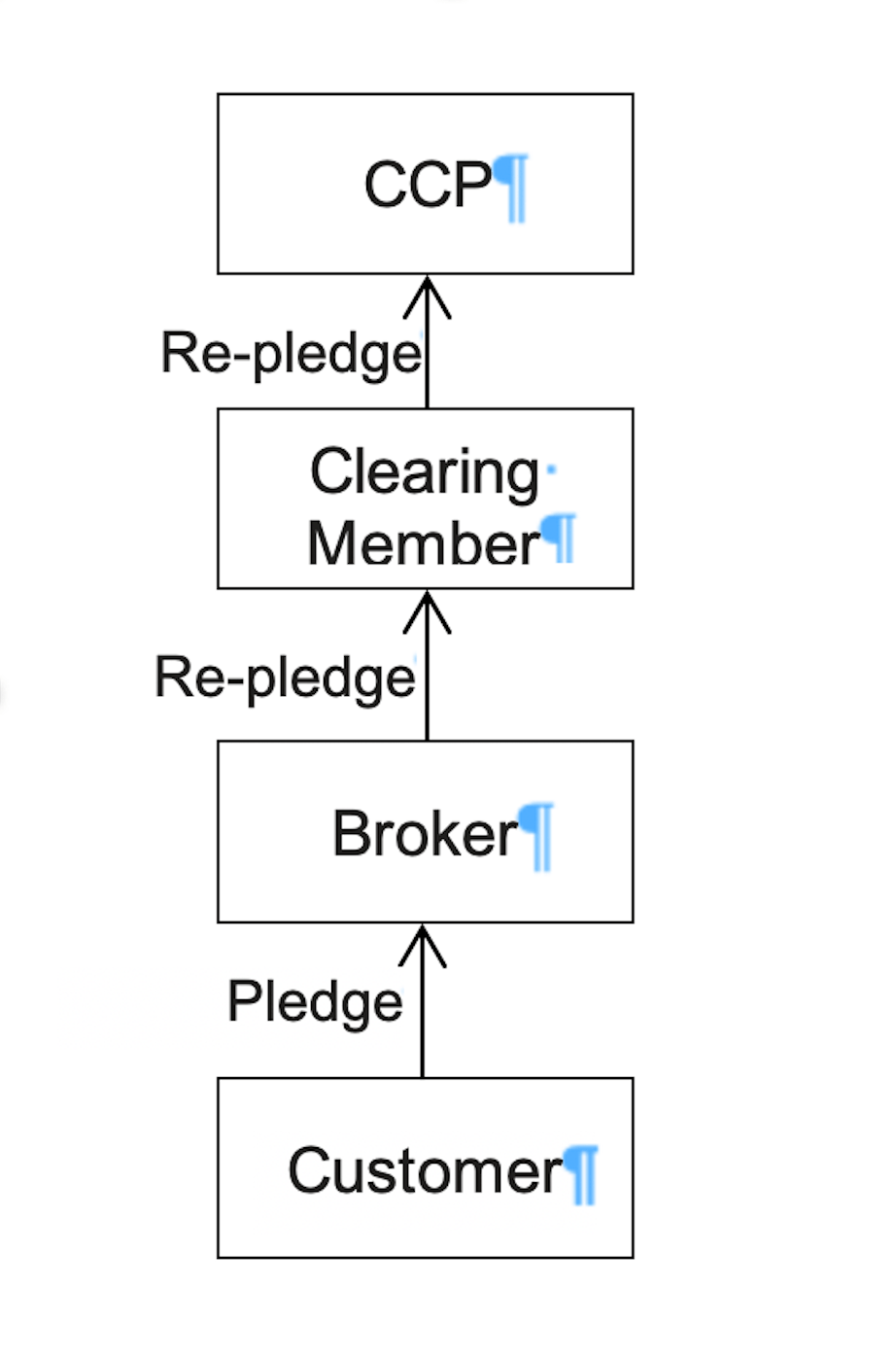

The reform in accepting securities collateral was enabled by the margin pledge mechanism provided by the CSDs in India. The CCPs built upon this mechanism to identify, isolate and protect customer collateral.

Under the margin pledge mechanism, instead of requiring customers to transfer the securities to brokers and onward to clearing members, the customers could pledge the securities in favour of brokers; who could re-pledge the same securities in favour of clearing members, who could in turn re-pledge the securities in favour of the CCPs.

This margin pledge mechanism ensured that the CCPs could have the trail of beneficial ownership of the securities provided by them from the depositories up to the end customer.

CCPs in India have an upfront margining regime and real-time computation of margins. Under this, the clearing members are required to deposit margins upfront with the CCPs, who calculate margins on a real-time basis immediately upon execution of trades.

CCPs used the information regarding beneficial ownership of collateral and enhanced their online real-time risk management systems. In brief, the CCPs did the following:

- Upon trade execution, use clearing member collateral towards the margin requirements.

- Ascertain the availability of customer collateral.

- If customer collateral is available, utilise this instead of the clearing member collateral towards margin.

With the use of advanced technology, even for complex margin models and millions of customers, the above process could be achieved in few seconds. Thus the CCPs could ensure segregation of customer collateral and ensure that customer collateral is used only towards the obligation of the respective customer. The CCPs could then amend their default process to enshrine the protection of customer assets in a much superior manner. The CCPs could now identify the positions, obligations as well as collateral of customers and would therefore be able to make sure that not only will customer collateral not be utilised towards proprietary default or fellow customer default, but also that the CCPs would be able to quickly return the collateral in the event of default or insolvency of the clearing member.

New technologies and enhanced computing power have the potential to bring about disruptive changes to the market structure and traditional operating models. However, we must not lose sight of opportunities that these can bring about within the traditional operating models to enhance the fulfilment of most fundamental objectives of market infrastructure design.