WFE Creates First Qualification on Market Infrastructure for Next Generation of Leaders

The World Federation of Exchanges Market Infrastructure Certificate (MIC) programme, the only one of its kind, is a new qualification that we created to help anyone who needs to engage with and understand the functioning and role of the organisations that underpin public markets.

The MIC is aimed at educating the next generation of financial services leaders worldwide and we expect that it will serve the learning needs of all senior managers and mid-career professionals at central banks, buy-side and sell-side firms, exchanges, clearing houses and regulatory bodies.

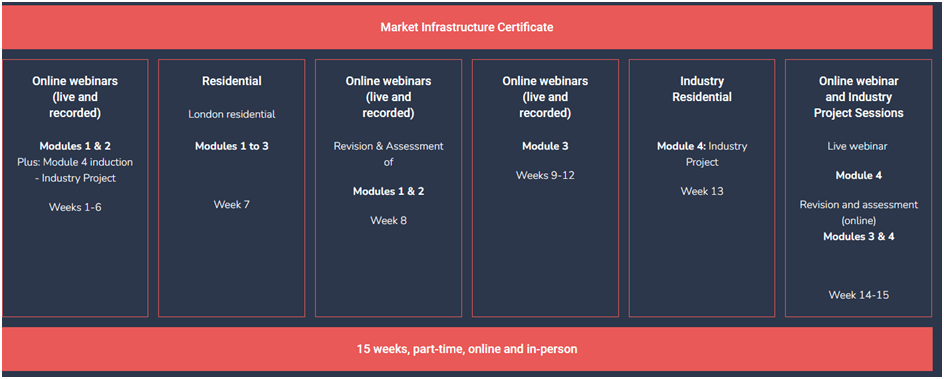

The programme focuses equally on both the theoretical and on the practical aspects of market infrastructures (MIs). It features two components: an online and a residential component.

The WFE chose Bayes Business School (formerly Cass) as the university educational partner for the programme. Bayes Business School is a leading global business school in the City of London, with state-of-the-art facilities on the executive education campus where the London residential week of the MIC programme will be held. Bayes are known for their world-class business education, excellent research reputation, and their deep engagement with practice. Bayes are part of City, University of London.

The residential component consists of a residential academic week in London and an industry residential week which this year will be hosted by the Chicago Board of Options Exchange (Cboe).o. Founded in 1973, Cboe has played a pivotal role in shaping the options market and is located in the heart of Chicago’s financial district.

On successful completion of the programme, participants will have:

Developed a broader and deeper knowledge of how market infrastructures operate, their interrelations, their regulatory environment, and their role in achieving financial stability and supporting sustainable and inclusive economic growth.

Updated knowledge of the current best practices in MIs.

Gained a deeper understanding of how different risks are managed by each market infrastructure.

Assessed the implications of recent financial and technological innovations.

Studied the role of ESG and ethics in the working of modern MIs.

Entry requirements & Selection Process

To qualify for the MIC, applicants must have at least four years of full-time relevant work experience or a graduate degree (BSc, BA, BEng, or equivalent). In cases where participants do not possess a graduate degree in a quantitative field such as Economics, Finance, Mathematics, or Engineering, it is essential they feel comfortable accessing algebraic expressions in order to engage effectively with the programme content.

The selection process will be conducted by the World Federation of Exchanges and aims to identify candidates who exhibit not only a strong academic background or relevant work experience, but also leadership potential and motivation to drive positive change in their home countries.

Certification

Participants who successfully complete the programme will be awarded a postgraduate certificate, the Market Infrastructure Certificate, and receive 60 credits from Bayes Business School, City University of London.

The postgraduate certificate is at the same level as an MSc (i.e., Higher Education Level 7 in the UK), but is shorter and does not require the completion of a research project or dissertation. These qualifications are useful for those looking to improve their skills and develop their CV.

Assessment

To complete the programme, attendants will have to obtain at least a 50% mark in the assessment of each of the modules. Forms of assessment will include coursework, group projects, presentations, multiple-choice question online tests and class participation.

Syllabus

The programme draws from the following topics:

Exchanges and market microstructure

Asset classes

Listings

Contract design

Trading organisation

Market microstructure

Determinants and measures of liquidity

Electronification of trading and its impact on the markets

Market infrastructures

Central clearing (CCPs)

Risk management, margining practices and models

Central Securities Depositories (CSDs) and Securities Settlement Systems (SSSs)

Payment systems

Trade repositories (TRs)

Differences between Developed and Emerging & Frontier markets. Sequencing

MIs and national development

Regulation and governance

Regulation of MIs: International approaches and challenges

Evolution of MIs governance

Managing conflict of interests

Role of international organizations

ESG

Incorporating ESG into the exchanges’ value chain

Shareholder and investor engagement

ESG data and ratings

The role of the exchange industry in advancing the sustainability agenda

Technological innovation

Crypto-currencies and DLT

Central bank digital currencies (CBDC)

Cloud solutions

Key issues with emerging technologies, ranging from security to scale to cyber risk and financial stability

Ethics in market infrastructures

The significance of ethics within financial institutions.

Frameworks in moral philosophy to guide decision making.

Adopting ethical frameworks to the setting of market infrastructures.

Ethical issues facing market infrastructures.

Programme structure

The MIC will operate a blended learning approach, with both online and faceto-face elements, including two residential weeks: one at Bayes Business School in London with teaching by faculty and the other at Cboe for a direct interaction with industry experts and regulators.

The academic programme will consist of online webinars covering the theory of the core principles, case-based examples, and in-person academic led sessions. The online component will include recorded sessions which participants can access at a time that suits them and a series of live webinars which will be highly interactive.

- Module 1: Payments and market infrastructures (CCPs, CSDs, SSSs, TRs)

- Module 2: Exchanges (cash, derivatives and commodities) and market micro-structure

- Module 3: Regulation, ESG and ethics

- Module 4: Industry project on market infrastructures

All four modules are designed and taught by leading Bayes academics, and participants will also have access to online tutors who will give day-to-day academic support. The online component of the programme is delivered through Bayes’ virtual learning platform so that everything needed is online and in one place. Modules are broken down into topics. Within each topic, online lectures and presentations are supplemented by core readings and other resources to prepare for weekly live lectures.

Industry residential week

The industry residential week will consist of a series of lectures, panel sessions, and mentoring hosted by Cboe Global Markets. Industry experts and senior regulators will lead the discussions, which will focus on the practical aspects of the industry. These will be drawn from:

- Markets and product design

- Listings

- Market data

- Risk management in clearing (margining practices and models)

- Operational risk (e.g., transition to the cloud)

- Current regulatory challenges

- The impact of new technologies (crypto platforms, AI, cloud solutions)

- Differences between developed and emerging & frontier markets. Sequencing

- Managing conflict of interests: the role of governance

- MIs and national development

- The role of MIs in advancing the sustainability agenda

- Role of international organizations.

Fireside chats with leaders and experts in the finance industry will also be part of the industry residential week. These intimate sessions will allow participants to engage in open and candid discussions, gaining insider perspectives on market infrastructures. Together with the panels and lectures, they will provide a unique opportunity for participants to ask questions, exchange ideas, and learn from other markets' experiences.

Industry project

The Industry Project is the final component of the Market Infrastructure Certificate, taking place after the taught modules have been completed and with work on it being conducted during and after the industry residential week. By considering problems based on MI experiences, the module is designed to help participants integrate learning from across the programme and to join the dots between theory and practice.

Programme details and fees

The programme dates are 6 September 2023 - 15 December 2023. All practical details including fees, can be found here under the section titled Programme details and fees

WFE Members get a 10% discount.

The residential week courses are delivered in-person at each specified location. The London residential week consists of five full days of lectures which will be delivered at Bayes Business School, in the City of London.

The industry residential week consists of five full days of activities (including team work on the industry project). This year it will be delivered at the Chicago Board of Options Exchange (Cboe).

For the virtual sessions, delegates will be given access to the course materials before the live sessions and will have access to those for the duration of the programme. During this time, participants will have the option to keep working through the course materials at their own pace. Live sessions will be delivered at 13:00 hrs London time.

Application

To apply to the MIC, please send the following documentation to [email protected]

- A motivation letter stating why you are interested in the programme, what you will contribute to it, and how you expect to benefit from it.

- An up-to-date CV

Places are limited to 25. Applications will be considered for the selection process on a first come, first served basis.

The deadline for submitting applications is the 10 August, 2023.

Confirmation of acceptance and the registration form will be sent by email to the applicants in the next 10 calendar days after their application is received.

To secure a place, a 15% deposit (non-refundable) should be received within the next 10 calendar days after the confirmation of acceptance. An invoice will be sent with the balance due, payable before the start of the programme

Disclaimer:

The views, thoughts and opinions contained in this Focus article belong solely to the author and do not necessarily reflect the WFE’s policy position on the issue, or the WFE’s views or opinions.