Client clearing in commodity derivative markets

Dr Pedro Gurrola-Perez, Head of Research, WFE

Client clearing was one of the topics discussed at WFEClear 2024, the WFE’s Clearing and Derivatives Conference, which took place in Madrid at the end of March and was hosted by BME (Bolsas y Mercados Españoles) and SIX Group. To mark this occasion, in this edition of Monthly Insights I will provide some insights around client clearing in the commodity derivative markets.

To set the context, we should mention that, in recent years, trading volumes in commodity derivatives have been through some volatile times. In the last three years, we have observed annual trading volumes increase by 11.5% in 2021, decrease by 14.5% in 2022, and increase again by 28% in 2023. In 2023, an increase in volumes was observed across all types of underlying assets, except for index commodity derivatives (Figure 1). Among the top exchanges by volume traded were (across different commodity products) Dalian Commodity Exchange, CME Group, Zhengzhou Commodity Exchange, London Metal Exchange (LME), the Multicommodity Exchange of India, Borsa Istanbul, Deutsche Börse AG, and ICE Futures US.[1]

When it comes to clearing commodity derivatives, one interesting question exists regarding the amount of risk that clients bring to the CCP, in comparison to the amount brought by clearing members. In general, clients tend to have more directional portfolios and members more balanced portfolios, because clients use derivatives to either hedge risks (such as crops being lost) or to take risky positions, while members act as intermediaries, and therefore seek to keep a hedged portfolio. Therefore, one would expect the level of aggregated risk arising from client portfolios to be higher than that of members. But there are other factors at play: for example, the characteristics of the market, the number of clients, or the membership structure of the CCP.

Let’s start with the membership structure. Different membership arrangements exist which govern access to clearing services. In a typical arrangement, a “general” clearing member is allowed to clear proprietary transactions and also client transactions on behalf of its clients (the end-users). The former are registered in a “House” account and the latter in “Client” accounts. “Direct” clearing members, on the other hand, do not have clients, they only have their House account at the CCP and are often themselves the end-users.

Commodity markets involve both financial participants (banks, brokers) and non-financial ones (commodities producers, commodity consumers, commodity traders, utility companies). Many end-users access the CCP via clearing members, but, in contrast with other markets, it is not unusual to find some larger non-financial end-users participating as direct clearing members. These clearing members clear on their House account and can be expected to have directional portfolios.

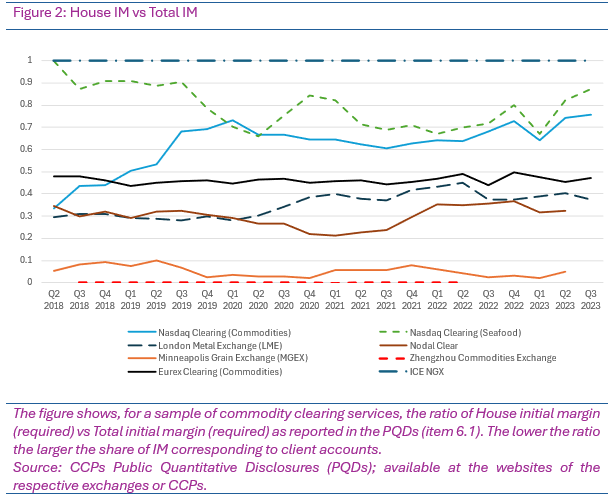

CCPs call initial margin (IM) from their clearing members, both for the clearing members’ own (proprietary) portfolios and for the portfolios of clearing members’ clients. Since IM is calibrated to mitigate the potential future exposure of the portfolio, one way of comparing the levels of risk between clients’ and members’ portfolios is to look at the share of initial margin contributed by the members with respect to that of clients. This information is available as part of the Public Quantitative Disclosures (PQDs) that CCPs publish quarterly.[2] We can look at a sample of CCPs and estimate, for every quarter, the ratio of House IM to Total IM (Figure 2).

Looking at the different House/Total ratios, there are some interesting observations. First, the substantial differences in the share of IM corresponding to house accounts reflect a diversity of clearing access structures. ICE NGX, for example, which clears natural gas, electricity, and environmental markets; operates a non-mutualized, direct clearing operation, whereby all market participants clear directly without the mediation of a third-party clearing member.[3] In other cases, like that of the Minneapolis Grain Exchange (MGEX), it is client IM that predominates, with a share of more than 90% of total IM. The Zhengzhou Commodities Exchange reported around 0.002% of House IM, which suggests a model where almost all the risk managed by the CCP originates from intermediated end-user trades.

The differences do not seem to be correlated to the type of product cleared. While for Nasdaq Clearing there is a difference between the ratio reported for the seafood market (around 87% in Q3 2023) and for their commodities market (around 74% in Q3, 2023), the difference in ratios between Nodal Clear and ICE NGX is much larger, even though they both focus on power and gas products.

Finally, we notice that, while in most cases the House/Total ratios tend to be rather stable, some non-constant trends are observable. For example, in the last five years, the share of House IM for Nasdaq Clearing in the commodities market (which includes metals, grains, energy, and soft commodities) has increased from 34% to 74%.

If you have any questions or comments, please contact Pedro Gurrola-Perez at [email protected]

[1] See WFE FY 2023 Market Highlights Report.

[2] According to the CPMI-IOSCO Public disclosure standards for central counterparties, under item 6.1, CCPs report "for each clearing service, total initial margin required, split by house and client (or combined total if not segregated)". This is done on a quarterly basis.

[3] See https://www.ice.com/ngx/clearing-settlement