Green Bonds Trends

In this article, we analyse the trends in exchange-traded green bonds in the past year. The data is available on the WFE Statistics Portal, while the indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team at [email protected]

Green bonds are fixed income securities issued by corporations or governments to raise funds for new and existing projects with positive environmental outcomes. According to the WFE Annual Sustainability Survey 2023[1] green bonds are the most offered ESG products by exchanges.

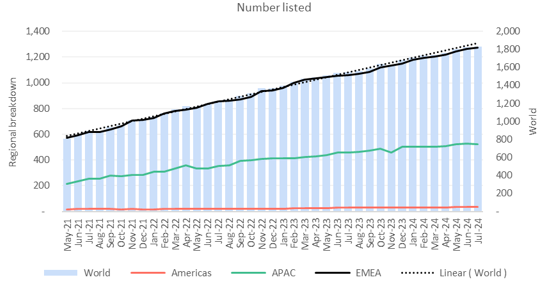

The number of green bonds listed in the world markets in H1 2024 reached 1,823, which represents a 18.3% increase on H1 2023 as seen in Figure 1.

Most green bonds are listed in the EMEA region (69.3%), followed by APAC (28.8%), while the Americas region accounts only for 1.9%.

Figure 1: Number of green bonds listed by region between May 2021 and July 2024

Figure 1 shows the steady increase in the number of listings.

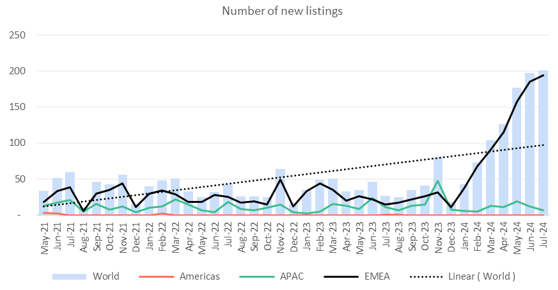

With regards to green bonds new listings, H1 2024 recorded a 189.2% rise compared to H1 2023, amounting to 720, a result due entirely to EMEA, which surged 263.3%, while APAC region declined 4.3%. There haven’t been new listings in the Americas region in H1 2024.

Most of the green bonds new listings took place in EMEA (90.8%), with APAC accounting for the rest (9.2%) (Figure 2).

Figure 2: Green bonds new listings between May 2021 and July 2024

In Figure 2 we notice that EMEA markets surged in 2024; this result is driven mostly by the Luxembourg Stock Exchange.

Regarding green bonds value traded, it amounted to 1.79 billion USD in H1 2024, representing a 15.7% decline on H1 2023, driven by a 20.2% fall in APAC region, while the Americas and EMEA regions surged 404.6% and 313%, respectively.

It is worth noting that the traded value is dominated by the APAC region, which has 93.5% of the value traded, while the Americas account for 1.6% and EMEA for the rest of 4.9%. It is also a very volatile indicator, with months of high value followed by months of almost zero value traded (Figure 3).

Figure 3: Green bonds value traded by region between May 2021 and July 2024

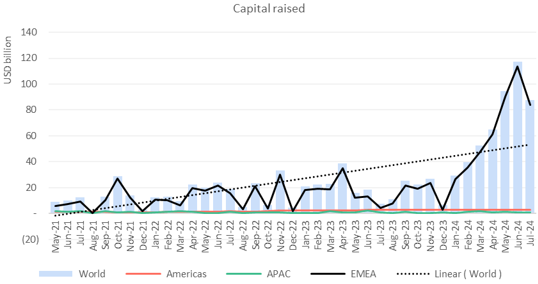

With regards to capital raised, 94.3% of the capital was generated on markets in the EMEA region, 4.2% in the Americas and the rest of 1.6% in the APAC region (as shown in Figure 4).

The capital raised increased 187%, due to the Americas and EMEA regions, which went up 13.5% and 220.6%, respectively, while APAC region declined 11.6%.

Figure 4: Capital raised with green bonds between May 2021 and July 2024

The surge in EMEA markets in 2024, due mostly to the Luxembourg Stock Exchange.

During the three years period we observe a positive trend in the number of green bonds listed, the number of new listings and the capital raised, suggesting more funds are invested towards the improvement of environmental issues.

The negative trend in the value traded suggests that these products become more affordable to investors.

For more WFE statistical reports, please click here.

For our research papers on emerging markets, SMEs, sustainability, technology etc, please click here.

For our regulatory affairs papers on clearing, cross-border, market integrity, market structure, risk or technology, please click here.

[1] The full WFE 10th Annual Sustainability Survey is available on our website https://www.world-exchanges.org/our-work/articles/wfe-10th-annual-sustainability-survey