Interest rate derivatives trends

In this article, we analyse the trends in interest rate derivatives (both options and futures) volumes (measured by the number of traded contracts) observed in the last year. The data is available on the WFE Statistics Portal, while the indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team at [email protected].

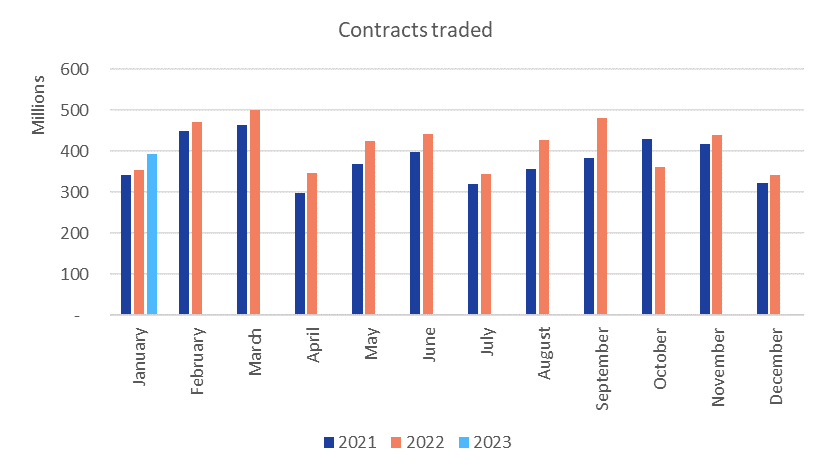

The number of interest rate derivatives contracts traded in Q4 2022 was 1.14 billion, which was a 8.9% decline on Q3 2022 and a 2.4% fall on Q4 2021.

Interest rate derivatives represent 5.8% of all derivatives contracts traded. Most of them are traded in the Americas region (72.7%), while 22.6% are traded in the EMEA and the rest 4.8% in APAC.

Interest rate futures accounted for 82.5% of the interest rate derivatives, while options only for 17.5%.

Figure 1: Number of interest rate derivatives contracts traded between Jan 2021 - Jan 2023

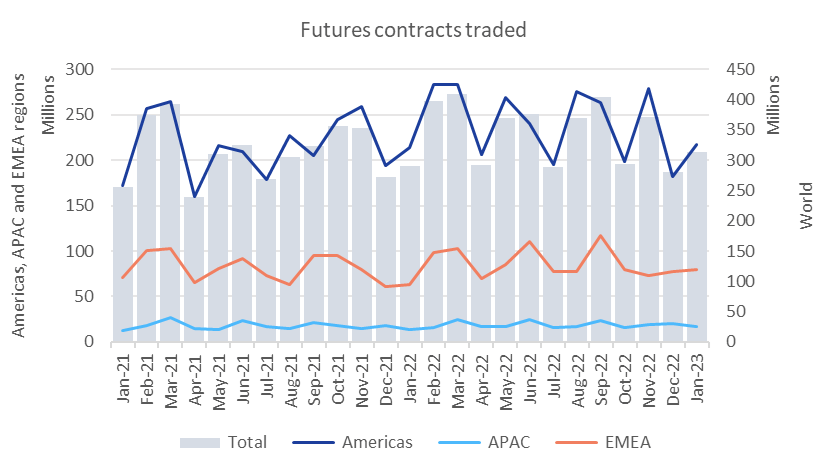

Figure 2: Number of interest rate futures contracts traded between Jan 2021 - Jan 2023

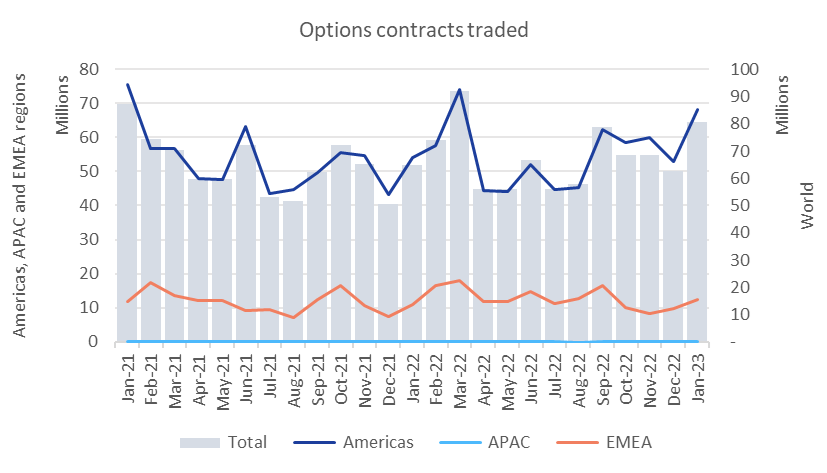

Figure 3: Number of interest rate options contracts traded between Jan 2021 - Jan 2023

Quarter-on-quarter, in Q4 2022 futures volumes fell 11.1%, caused by a decline across all regions: the Americas 10.1%, APAC 3.8% and EMEA 15.3%, while the options increased 3.4%, due to the Americas and APAC regions going up 12.5% and 27.8%, respectively, while the EMEA region declined 30.8%.

In H2 2022 the volumes of interest rate derivatives declined 5.8%, with both options and futures recording decreases of 4.3% (amounting to 392.5 million) and 6.1% (2 billion), respectively, when compared to H1 2022. This result was due to all regions witnessing falling volumes.

In 2022 more contracts were traded (by 8.5%) compared to 2021, due to both options and futures going up 3.1% (to 802.7 million) and 9.6% (to 4.1 billion).

The increase in number of futures contracts traded in 2022 was due to increases in every region: the Americas 11.6%, APAC 5.2% and EMEA region 5.3%.

Exchanges with an excellent performance were: CME Group which went up 17.7%, and Eurex (up 20.4%).

The year-on-year increase in the volume of options in 2022 was due to the Americas and EMEA regions going up 1.8% and 9.2%, respectively. Exchanges that had a good year were: CME Group (up 15%), ICE Futures Europe (3.2%) and Eurex (18.8%).

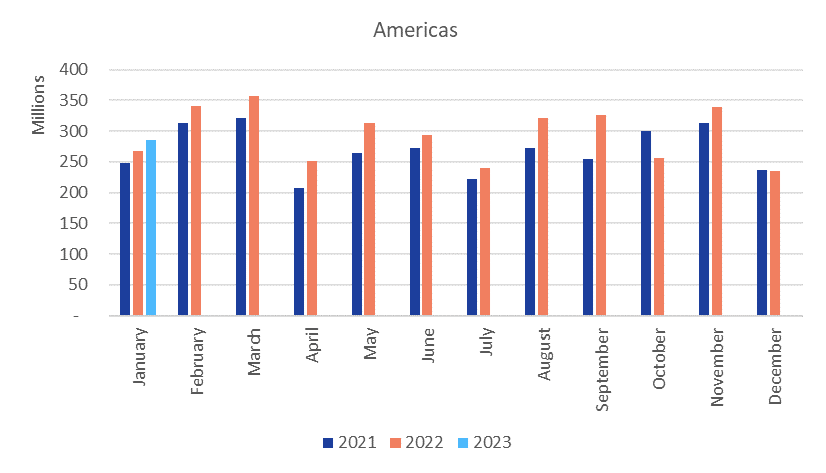

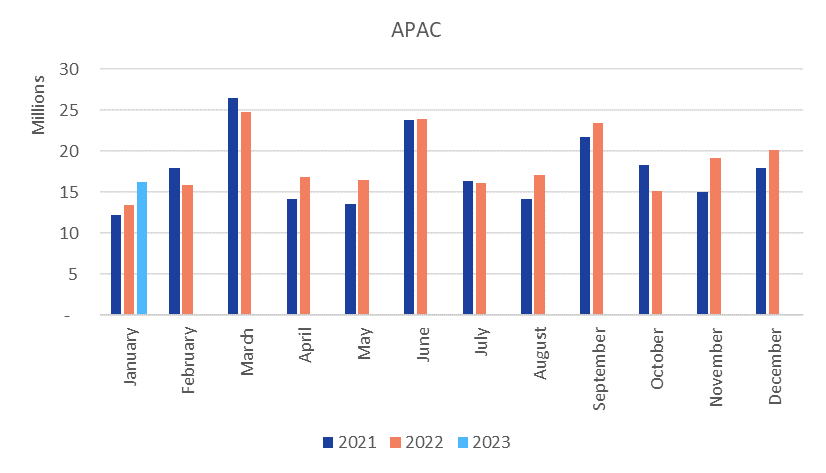

The number of interest rate derivatives traded in each region is illustrated in Figures 4-6.

Figure 4: Number of interest rate derivatives contracts traded in the Americas region between Jan 2021 - Jan 2023

Figure 5: Number of interest rate derivatives contracts traded in APAC region between Jan 2021 - Jan 2023

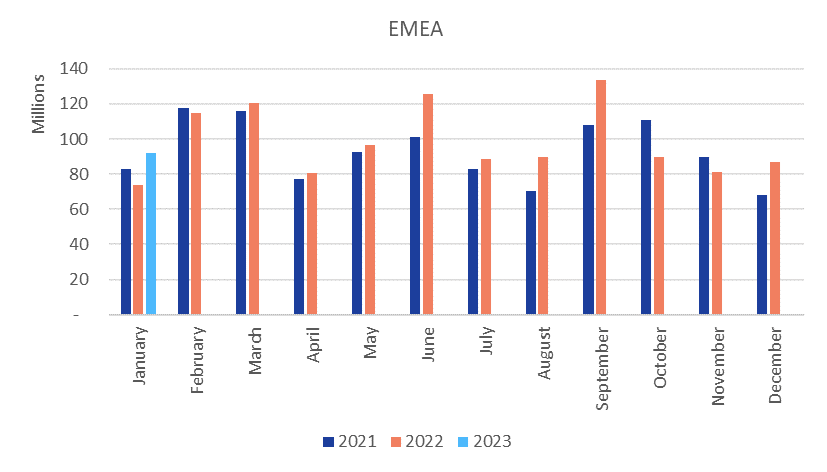

Figure 6: Number of interest rate derivatives contracts traded in EMEA region between Jan 2021 - Jan 2023