Investor types in the SME markets

Written by Dr. Ishak Demir, Research Economist at the WFE

Small and Medium Enterprises (SMEs) play a pivotal role in the economy of many countries, contributing significantly to growth, job creation, innovation, international trade, and regional development. In this dynamic ecosystem, capital markets, especially equity markets, emerge as indispensable allies for SMEs at various growth stages. They not only provide the necessary financial support but also act as catalysts for SME growth by offering access to a diverse investor base. The symbiotic relationship between SMEs and capital markets fosters innovation, encourages value creation, and fuels sustained growth.

One interesting question is, across jurisdictions, what is the share of retail and institutional investment in the SMEs markets and how the balance may be evolving? This is important because a healthy market requires both retail and institutional investment. While institutional investment may bring stability through long-term holdings, retail investors are a source of liquidity. In the present note, which is part of an upcoming WFE Research Report on SMEs, we offer two insights into this question. The analysis was based on a survey of WFE members.

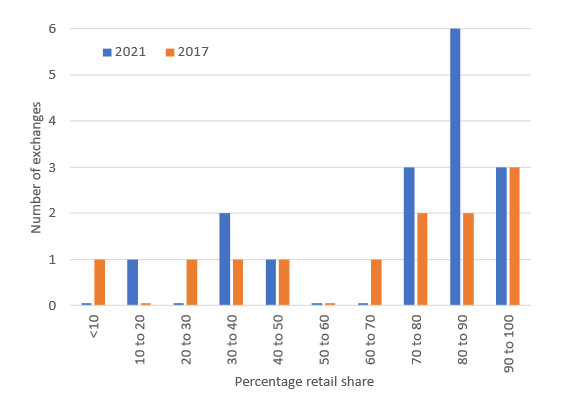

We can first consider how retail investment on SMEs may differ from retail participation in the main markets. Figure 1 summarizes the distribution of retail share (percentage trade volumes) in 16 SME markets across developed, emerging, and frontier markets. Although some markets show high levels of institutional participation, the majority of respondents (75%) reported retail accounting for over 70% of overall volumes in SME markets. This seems to be in contrast with how retail participation is distributed when considering the whole markets (SME and main boards); for example, the results of a survey conducted in a previous WFE Report (see Gurrola-Perez et al., 2022) showed half of the respondents (53%) reporting that retail accounted less than 50% of their overall volumes in the whole market. These results suggest that it is often the case that retail share in the SME markets is higher than in the main markets. In addition, if we compare with the corresponding distribution observed in 2017, it also appears that the number of SME markets with high share of retail participation has increased.

|

Figure 1. Distribution of retail share (percentage of trade volumes) in SME markets |

|

|

|

Source: WFE Survey. The survey was conducted between July 2022 and January 2023 and collected 29 responses from exchange groups across developed, emerging, and frontier economies. The plot displays data for the 16 exchanges that replied to the question about investor types, spanning from 2017 to 2021. |

However, observing more SME markets with a higher share of retail participation does not necessarily mean that there has been a decrease in institutional participation. In fact, looking at absolute institutional trading volume reveals a more nuanced perspective. Traditionally, institutional investors have been cautious about SMEs due to concerns related to liquidity and size. Nevertheless, a growing number of exchanges (10 out of 12 SME markets for which we have comparable data for the period) have witnessed an increase in institutional participation over the past five years. This hints at potential shifts in market dynamics in some jurisdictions. The growing involvement of institutional investors, known for providing stability through long-term holdings and risk management expertise, can complement the liquidity provided by retail investors. In fact, 80% of 24 surveyed exchanges cited increasing institutional participation as one of the factors in boosting liquidity and creating a more favourable listing environment within SME markets.

In conclusion, understanding the dynamic landscape of SME markets is important for exchanges to tailor their policies and incentives effectively. While some exchanges exhibit a rise in institutional participation, retail investors continue to play a predominant role in other SME markets. In each individual case, identifying the specific balance that could maximize liquidity and support the diverse needs of SMEs will contribute to unlocking the full potential of SMEs and fostering sustainable economic growth.

This note is part of the ongoing WFE Research project on the development of SME markets. If you have any questions or comments, please contact Ishak Demir ([email protected]).

References:

- Gurrola-Perez, P., Lin, K., Speth, B. (2022). Retail trading: an analysis of global trends and drivers. WFE Research Report, September 2022. https://www.world-exchanges.org/our-work/articles/retail-trading-analysis-current-trends-and-drivers

Footnotes:

[1] The complete report will be accessible on the WFE website: https://www.world-exchanges.org/our-work/research/archive/smes, where previous WFE reports on SMEs can also be found.