Social bonds

In this article, we analyse the trends in exchange-traded social bonds observed in the last year. The data is available on the WFE Statistics Portal, while the indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team at [email protected]

Social bonds are fixed income securities issued by corporations or governments to raise funds for new and existing projects with positive social outcomes. According to the WFE Annual Sustainability Survey 2022, social bonds are the second most offered ESG products by exchanges.

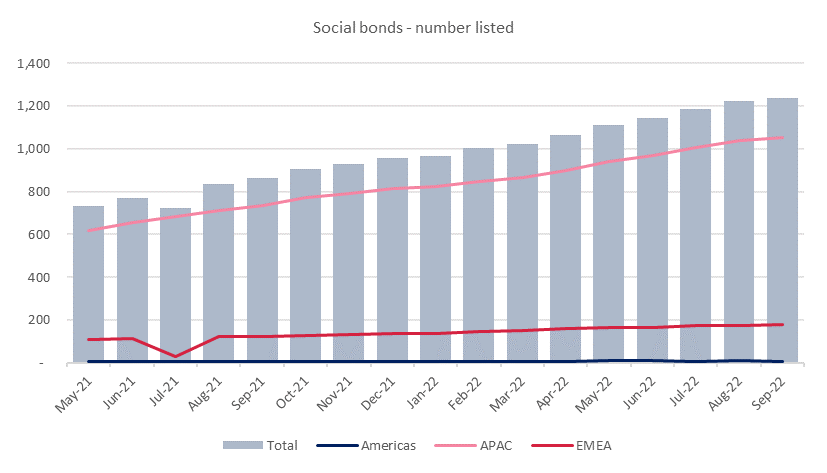

Overall, we observe a positive trend in the number of social bonds listed, suggesting more funds are being channelled to improve social issues.

The number of social bonds listed on the world markets in Q3 2022 reached 1,239, which represents a 8.4% increase on Q2 2022 (QoQ) and 43.2% increase on Q3 2021 (YoY) as seen in Figure 1.

Most social bonds are listed in the APAC region (85.1%), followed by EMEA (14.5%), while the Americas region accounts only for 0.4%.

QoQ: APAC and EMEA regions listed more social bonds by 8.9% and 8.4%, respectively, while the Americas declined 44.4%.

YoY: the number of listed social bonds increased in APAC (43%) and the EMEA region (47.5%), while in the Americas fell 16.7%.

Figure 1: Number of social bonds listed by region between May 2021 and September 2022

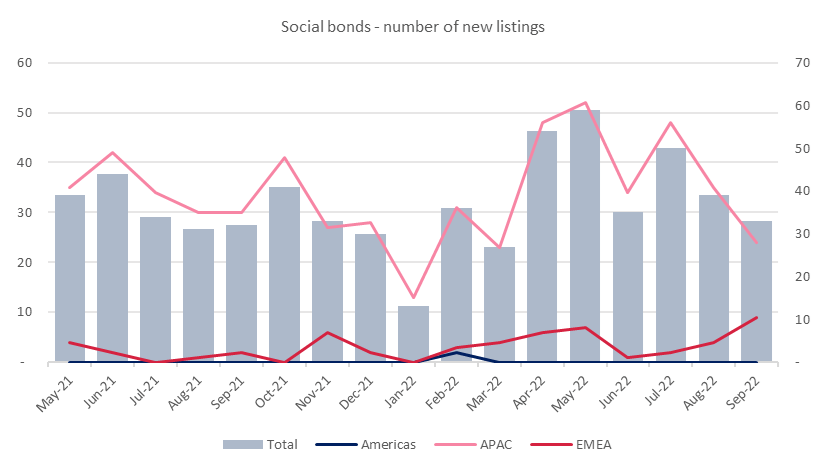

With regards to social bonds new listings, Q3 2022 recorded a 17.6% decline compared to the previous quarter, amounting to 122, with APAC going down 20.1%, while EMEA region went up 7.1%. There were no new listings in the Americas region in Q2 and Q3 2022.

Most of the social bonds new listings took place in APAC (87.7%), with EMEA accounting for the rest (12.3%) (Figure 3).

YoY: the increase was 25.8% due to APAC and EMEA regions increasing 13.8% and 400%, respectively.

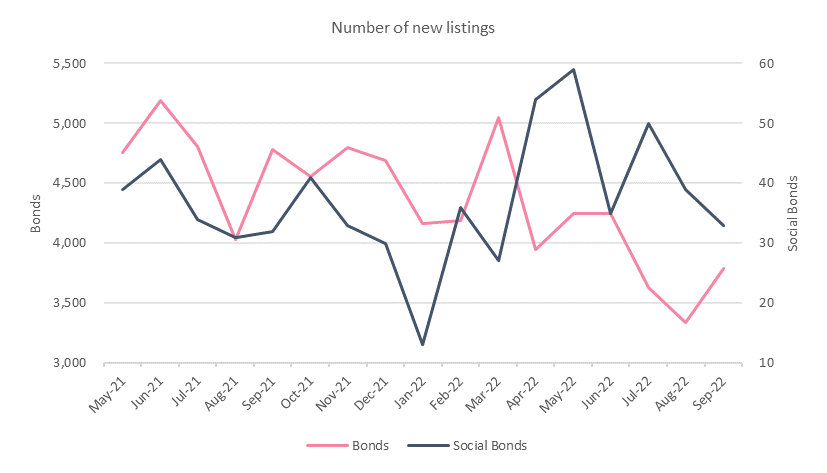

It is worth noting that the number of bond new listings declined in Q3 2022 when compared to the previous quarter (13.6%) and YoY (21%). The Americas is the only region which registered an increase of 29.3% YoY, amounting to 159 bond new listings.

Figure 2: Bonds and social bonds new listings between May 2021 and September 2022

Figure 3: Social bonds new listings by region between May 2021 and September 2022

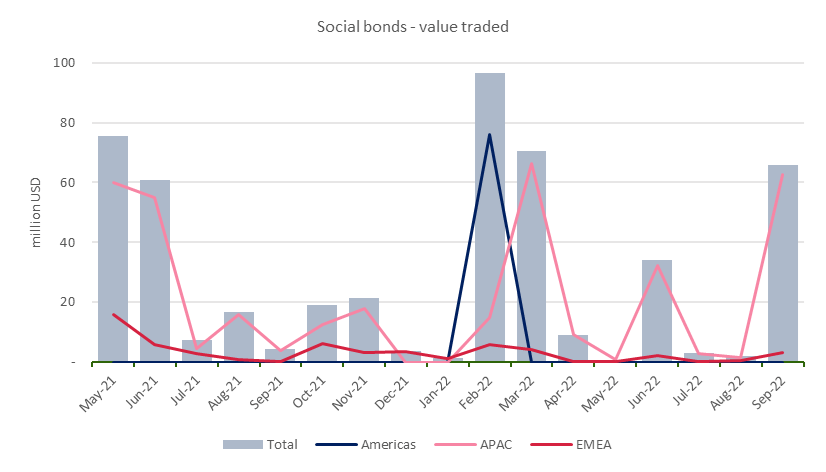

Regarding social bonds value traded, this reached 70.76 million USD in Q3 2022, representing a 60.6% increase QoQ, result due to APAC and EMEA regions, which grew 59.9% and 73.7%, respectively. There was no social bond trading in the Americas region in Q2 and Q3 2022.

94.7% of the value is traded on APAC markets, while EMEA accounts for 5.3% (Figure 4).

YoY: we notice a 152.8% rise due to both APAC and EMEA regions increasing 175.9% and 1.6%, respectively.

Figure 4: Social bonds value traded by region between May 2021 and September 2022

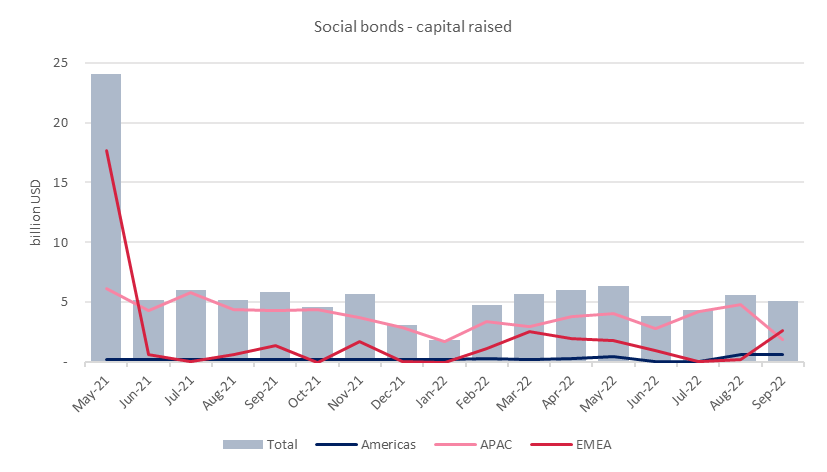

Capital raised by social bonds decreased 7.3% in Q3 2022 compared to the previous quarter, amounting to 15.04 billion USD, due to the EMEA declining 40%, while the Americas and APAC regions rose 54.4% and 2.6%, respectively.

72.6% of the capital is raised on APAC markets, 18.9% on markets in EMEA and 8.4% on markets in the Americas region (as shown in Figure 5).

YoY: the capital raised registered a 12% decline, due to APAC region (24.6%), while the Americas and EMEA regions went up 113.5% and 42.5%, respectively.

Figure 5: Social bonds capital raised by region between May 2021 and September 2022

The peak in EMEA in May 2021 is due mostly to Luxemburg Stock Exchange.