Sustainability bonds

In this article, we look at the trend in exchange-traded sustainability bonds in the past year. The data is available on the WFE Statistics Portal, while the indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team at [email protected]

Sustainability bonds are fixed income securities issued by corporations or governments to raise funds for new and existing projects with positive social or environmental outcomes. According to the WFE Annual Sustainability Survey 2023[1] sustainability bonds are the most offered ESG products by exchanges.

The number of sustainability bonds listed in the world markets in Q1 2024 reached 1,163, which represents a 16% increase on Q1 2023 as seen in Figure 1. While the Americas and EMEA went up 32.3% and 25.6%, respectively, APAC region went down 4.2%.

Most sustainability bonds are listed in the EMEA region (69.2%), followed by APAC (27.3%), while the Americas region accounts only for 3.5%.

Figure 1: Number of sustainability bonds listed by region between May 2021 and May 2024

Figure 1 shows the steady increase in the number of listings.

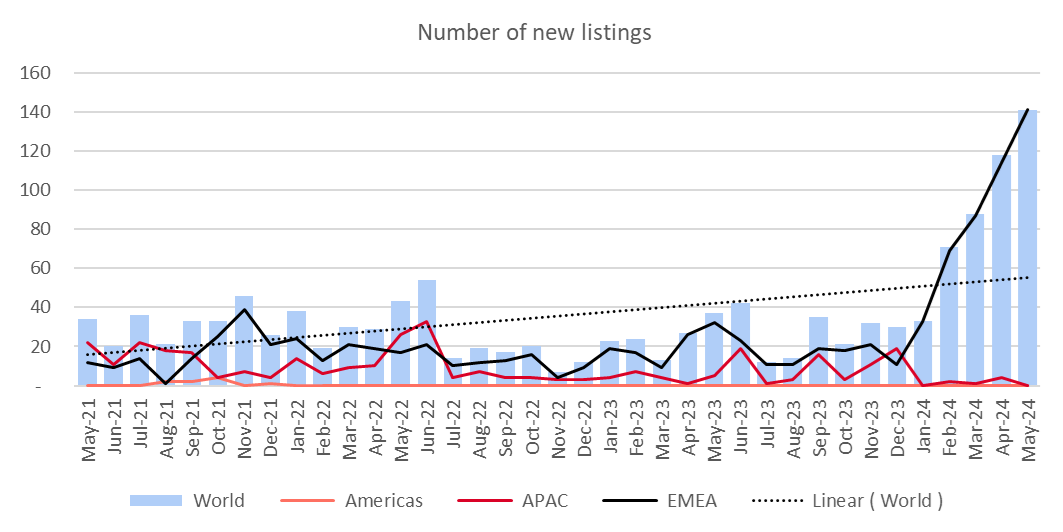

With regards to sustainability bonds new listings, these amounted to 192 in Q1 2024, registering a 220% surge compared to Q1 2023. New listings in EMEA increased 320%, while in APAC region they declined 80%.

Most of the sustainability bonds new listings took place in EMEA (98.4%), while the rest took place in APAC region (Figure 2).

Figure 2: Sustainability bonds new listings between May 2021 and May 2024

In Figure 2 we notice that EMEA markets surged in 2024; this result is driven mostly by the Luxembourg Stock Exchange.

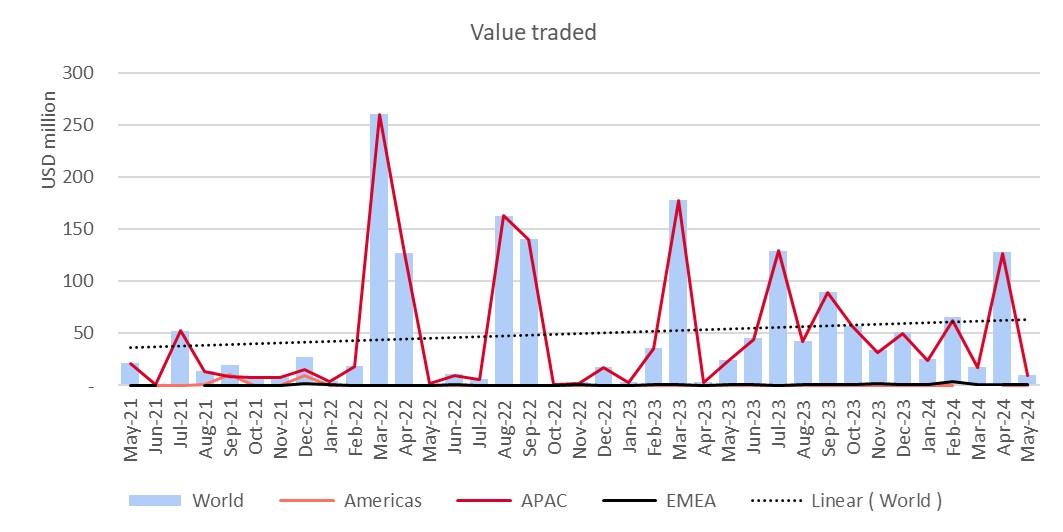

Regarding sustainability bonds value traded, it amounted to 108.1 million USD in Q1 2024, representing a 50.1% decline due to APAC falling 52.1%, while EMEA region rose 194.4%.

It is worth noting that the traded value is dominated by the APAC region, which has 95.1% of the value traded, while the EMEA region accounts for 4.9%. It is also a very volatile indicator, with months of high value followed by months of almost zero value traded (Figure 3).

Figure 3: Sustainability bonds value traded by region between May 2021 and May 2024

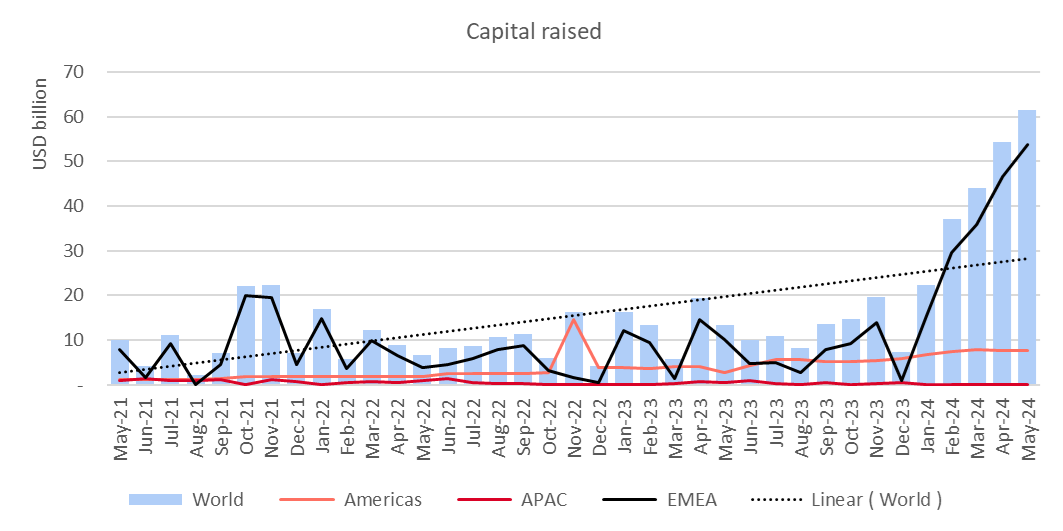

With regards to capital raised, this amounted to 103.3 billion USD in Q1 2024, representing a 192% increase compared to the previous year. This outcome was possible due to the Americas (87.6% up) and EMEA regions (249.9% up), while APAC decreased (75.4%).

Regionally, 21.3% of the capital was raised in markets in the Americas region, 78.5% on EMEA markets, while APAC accounted only for 0.1% (as shown in Figure 4).

Figure 4: Capital raised with sustainability bonds between May 2021 and May 2024

The surge in EMEA markets in 2024 is due mostly to the Luxembourg Stock Exchange.

In the three years period showed in the charts we observe a positive trend in every indicator analysed: the number of sustainability bonds listed, the number of new listings, the value traded and the capital raised, suggesting more funds are being directed towards the improvement of social and environmental issues.

For more WFE statistical reports, please click here.

For our research papers on emerging markets, SMEs, sustainability, technology etc, please click here.

For our regulatory affairs papers on clearing, cross-border, market integrity, market structure, risk or technology, please click here.

[1] The full WFE 10th Annual Sustainability Survey is available on our website https://www.world-exchanges.org/our-work/articles/wfe-10th-annual-sustainability-survey