Investment flows

In this article, we analyse the trends in capital raised in 2021 compared to 2020. The capital raised is the sum of the capital raised through IPOs and the capital raised through already listed companies.

The data is available on the WFE Statistics Portal, while the indicators are defined in our Definitions Manual. For questions or feedback about this article, please contact the WFE Statistics Team on [email protected]

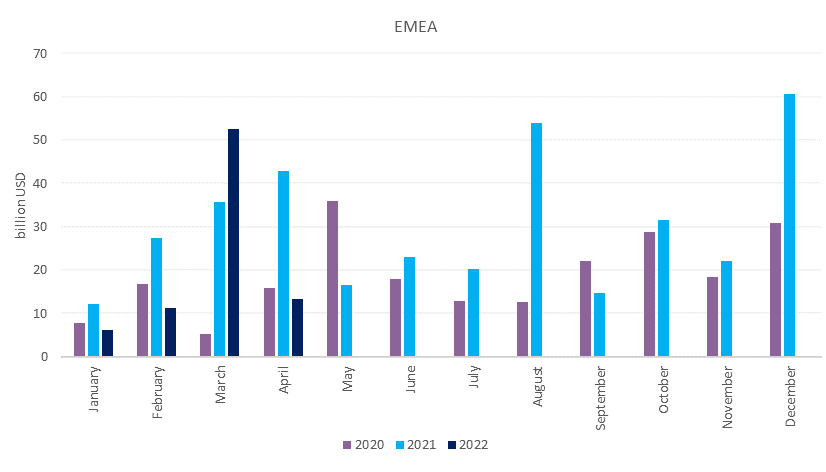

In 2021 there was 1.35 trillion USD capital raised across the world, which represented a 145.1% increase on 2020. This result was due to all regions experiencing increased activity: the Americas 185.8%, APAC 117.9% and EMEA 160.2%. Across different regions, most of the capital was raised in the APAC region (41%), followed by the Americas (32%) and EMEA (27%).

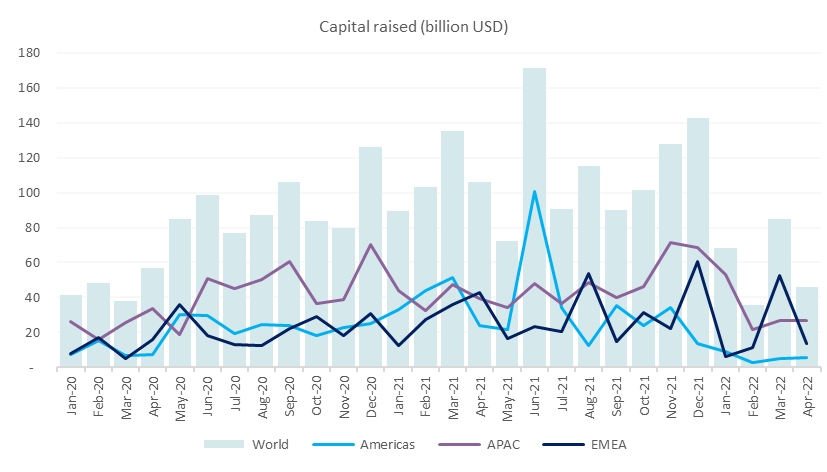

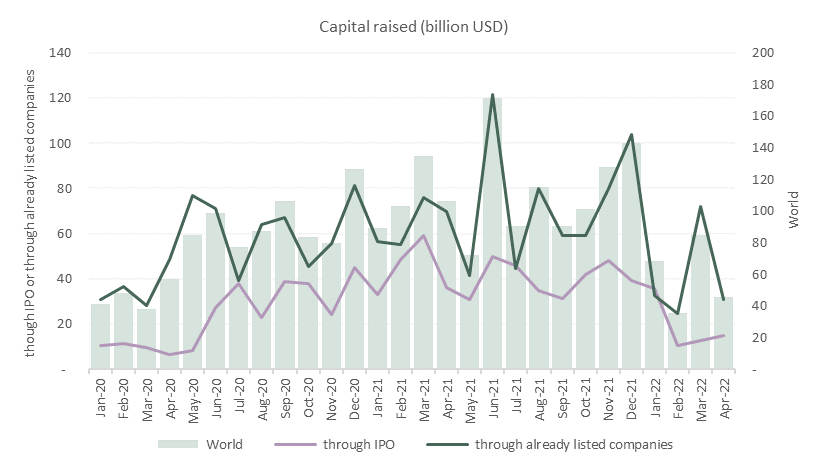

Figure 1: Capital raised between Jan 2020 – Apr 2022

From Figure 1 we notice that the Americas region recorded the highest investment flows in Jun-2021, while APAC peaked in Nov-2021 and EMEA in Dec-2021.

In Q1 2022, the amount of capital raised declined 49.3% compared to the previous quarter, amounting to 188.6 billion USD. All regions experienced a drop: the Americas by 76.1%, APAC by 45.5% and EMEA region by 38.7%.

Q4 2021 is the quarter with the highest capital raised in the last two years reaching 372.1 billion USD.

The exchanges that raised most capital year-to-date (Jan-Apr 2022) were: Shanghai Stock Exchange (48.47 billion USD), Shenzhen Stock Exchange (28.49 billion USD), Korea Exchange (11.02 billion USD), Hong Kong Exchanges and Clearing (10.8 billion USD), TMX Group (9.04 billion USD) etc.

When comparing Q1 2022 with Q1 2021, the decline is less pronounced (42.5%), all regions recording a fall: the Americas by 86.7%, APAC by 18% and EMEA region by 7.2%.

The capital raised by region is illustrated in Figures 2-4.

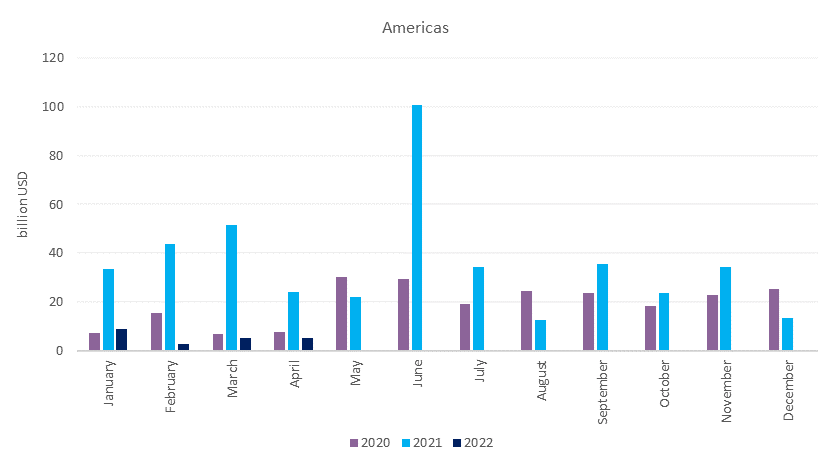

Figure 2: Capital raised between Jan 2020 – Apr 2022 in the Americas region

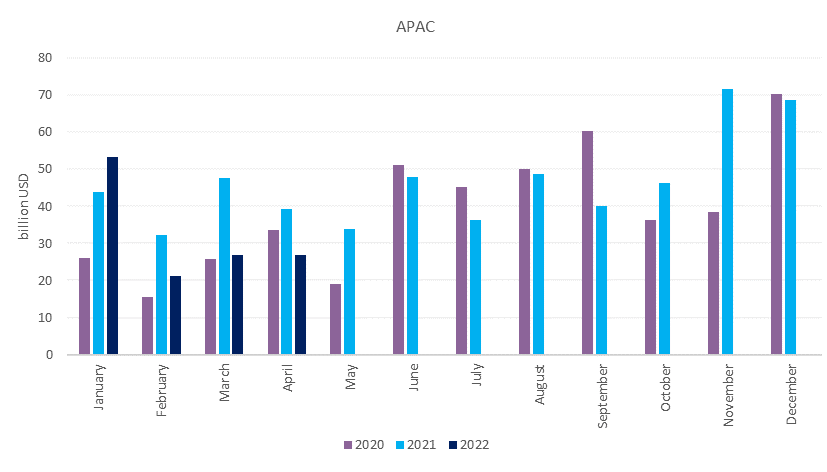

Figure 3: Capital raised between Jan 2020 – Apr 2022 in the APAC region

Figure 4: Capital raised between Jan 2020 – Apr 2022 in the EMEA region

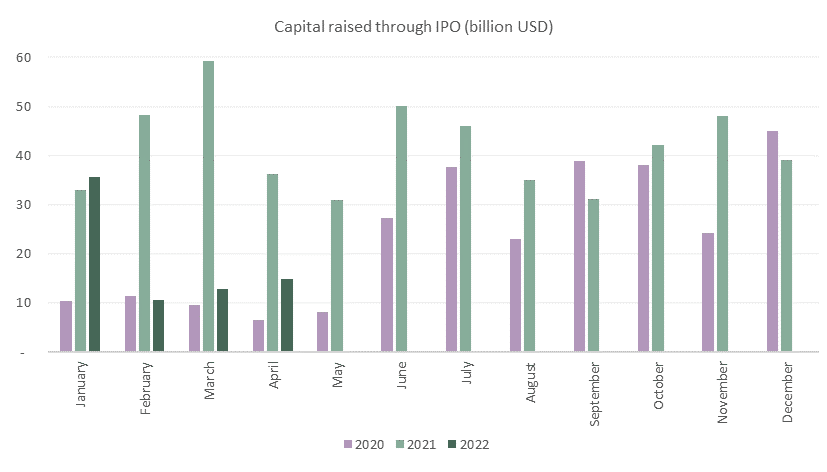

Figures 5 - 7 present the capital raised through IPOs and through listed companies between Jan 2020 – Apr 2022.

Fig. 5 Capital raised through IPOs and through already listed companies between Jan 2020 – Apr 2022

Figure 5 shows that the capital raised through IPOs peaked in Mar 2021, while the capital raised through already listed companies was at its highest in Jun 2021.

Fig. 6 Capital raised through IPO between Jan 2020 – Apr 2022

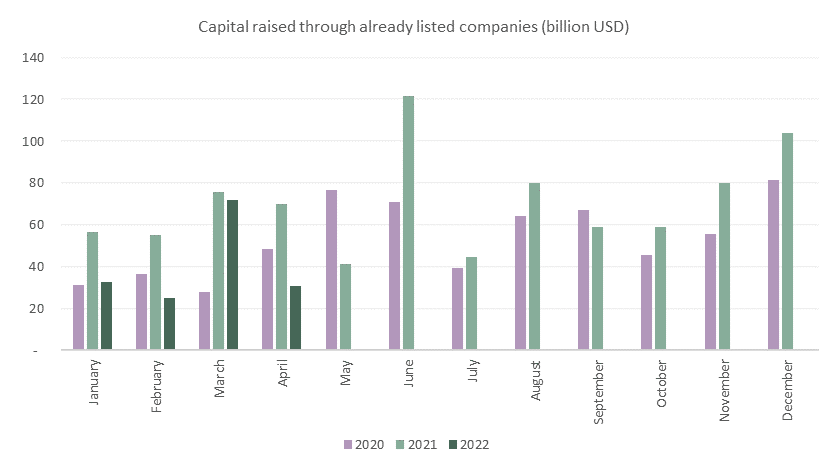

Fig. 7 Capital raised through already listed companies between Jan 2020 – Apr 2022